With Bankman-Fried potentially facing lengthy prison time, what can we anticipate for the future of the platform, and is there any possibility for the FTX exchange to bounce back?

In November 2022, FTX, once a prominent player in the crypto industry, experienced a sudden collapse resulting in its bankruptcy. More recently, Sam Bankman-Fried, the ex-CEO of FTX, was sentenced to 25 years in prison for offenses such as fraud and theft of user funds. This development leaves many wondering: What’s next for FTX? Crypto.news delves into how this judgment will shape the future of the exchange.

Prosecutor requested 40-year sentence

Based on the ruling by the judge, it’s estimated that FTX clients suffered losses totaling $8 billion, investors lost an additional $1.7 billion, and the exchange’s creditors lost $1.3 billion. The financial chaos caused by these losses resulted in at least three clients of FTX taking their own lives. During the court proceedings, there was a possibility that Sam Bankman-Fried, the ex-CEO of FTX, could face life in prison. In the courtroom, Judge Lewis Kaplan stated that Bankman-Fried provided false testimony on more than one occasion.

Bankman-Fried acknowledged financial obligations of Alameda Research, a linked fund to FTX that filed for bankruptcy. He contended, nonetheless, that FTX could have steered clear of insolvency with proper management. Alameda held the power to utilize funds from FTX’s clients for ventures involving risk and discretionary spending. This encompassed investments in US politicians.

Prosecutors sought a harsh sentence of 40 years, but Bankman-Fried’s legal team pleaded for leniency, proposing a maximum term of six and a half years. They emphasized his background, academic achievements, time on Wall Street, and involvement in founding trading companies as reasons for their argument. The defense maintained that Bankman-Fried was driven by factors beyond simple greed.

Failed attempts to restart FTX

On June 28, 2023, FTX CEO John Ray announced that FTX.com had initiated a consultation with stakeholders to relaunch the exchange. According to reports from The Wall Street Journal, it was expected that the platform would undergo a rebranding when it resumed operations.

In August 2023, FTX announced their plan for a comeback, which involved setting up a fresh marketplace for non-US customers amongst other steps. By the end of October 2023, FTX executives were in discussions with three potential investors regarding the revival of their platform. The exchange weighed its options, which included selling the business and customer base or bringing on a collaborator to help relaunch.

Based on Kevin M. Cofsky’s perspective as an investment banker at Perella Weinberg Partners involved in the negotiations, FTX needs to make a decision on whether to keep operating by mid-December 2023. The company is exploring two possible deals: either selling the entire exchange and customer base or partnering with someone to help relaunch the platform.

“We are engaging with multiple parties every day.”

Kevin M. Cofsky, an investment banker at Perella Weinberg Partners

At the close of January, FTX gave up on restarting their business and instead chose to sell off all their assets, distributing the resulting proceeds back to their clients.

FTX’s new management has been working on its bankruptcy case for over a year, aiming to salvage as much of the company’s assets as possible. According to FTX’s attorney, Andy Dietderich, they have been engaged in discussions with potential buyers and investors for several months. Nevertheless, these prospective parties require additional time before they can provide the substantial resources required to revitalize the exchange.

FTX was a questionable and dishonorable project masterminded by a disreputable individual with a criminal record. The expenses and hazards involved in transforming the mess Mr. Bankman-Fried abandoned into a reputable exchange were deemed excessive.

Andy Dietderich, FTX attorney

The team member voiced their sadness over FTX 2.0, since the business continues to possess crucial customer information that could potentially bring in income.

The lawyer additionally highlighted that FTX’s past purchases, valued at hundreds of millions of dollars, have mainly failed to deliver success. There isn’t much interest in acquiring these assets now. LedgerX, one of the few exchange subsidiaries deemed solvent during the parent company’s bankruptcy filing, turned out to be a disappointing investment, Dietderich stressed.

What is going on around FTX?

During the temporary management of FTX Group’s insolvency, they are liquidating cryptocurrencies and accumulating funds to repay debts owed to clients whose access was halted following the platform’s demise in late 2022.

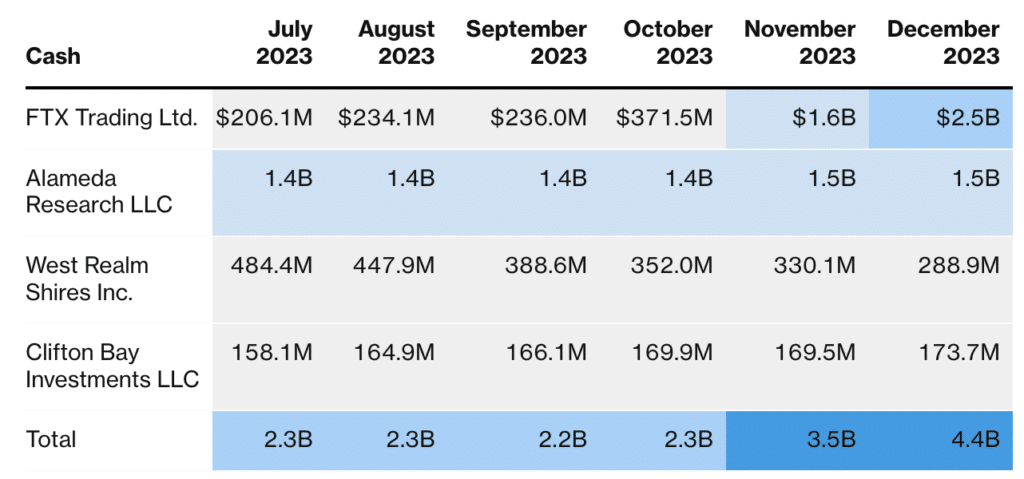

According to Bloomberg’s sources, FTX Group’s top four subsidiaries, which include FTX Trading and Alameda Research, saw their cash reserves nearly double in 2023, reaching a total of $4.4 billion. The interim administration of FTX managed to rake in over $1.8 billion from digital asset sales last December alone, as mentioned in communications sent by FTX’s bankruptcy advisors to U.S. regulatory bodies.

FTX has managed to retrieve approximately $7 billion worth of assets to refund affected customers, as per Dietderich’s announcement. In coordination with several regulatory bodies, they have chosen to postpone the process of reclaiming around $9 billion in claims until all customers have been made whole first.

FTX intends to fulfill its obligation to repay all clients, however, the payouts will be determined by the cryptocurrency prices as they were in November 2022 – a time when FTX and the larger crypto market experienced a significant downturn. Many displeased FTX clients have taken their grievances to court. By receiving compensation at this rate (around $17,000 per Bitcoin), these clients would effectively forfeit any gains from the crypto market’s growth in 2023 since their assets were frozen when FTX went bankrupt.

Despite their attempts to appeal, the court dismissed these requests during a hearing on January 31st. At this point, they granted compensation based on current prices in accordance with U.S. bankruptcy law which clearly states that debts should be discharged according to their worth at the time of the company’s bankruptcy filing.

Will SBF conviction be a turning point in FTX story?

Previously, FTX and its founder Sam Bankman-Fried had a strong connection. However, after FTX filed for bankruptcy, their trajectories have significantly differed. Now, Bankman-Fried is confronting potential jail time, while FTX is concentrating on repaying its debts to clients, leaving the exchange in a diminished state compared to before.

The split between FTX and Bankman-Fried suggests that his personal circumstances are unlikely to influence the current workings of the exchange. In the absence of a rescuer for FTX, its path seems focused on resolving its financial obligations. As for Bankman-Fried, he may face extended prison time and carry the label of orchestrator of one of crypto’s most significant frauds.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-09 18:24