As someone who has closely followed the cryptocurrency industry for years and worked with various players within it, I find the story of PlusToken both intriguing and cautionary. The way this financial pyramid scheme was able to operate under the radar for so long, with suspected sales starting as early as July 2019, is a testament to how complex and often opaque the crypto world can be.

Investigative reporter Colin Wu from China uncovered the details behind PlusToken, a massive cryptocurrency fraud scheme ranked among the biggest in the industry’s history.

Table of Contents

Based on the reporter’s account, the Chinese government has seized a substantial haul of digital currencies. The PlusToken collective, headed by a high-school educated individual from Changsha, amassed approximately 310,000 Bitcoins (BTC), 9.17 million Ethereums (ETH), and over 51 million EOS through the use of a straightforward Ponzi and pyramid scheme structure. The Chinese law enforcement agencies have confiscated around 190,000 BTC, 830,000 ETH, and 27.24 million EOS.

A man hailing from Changsha, Hunan, boasting only a middle school education, amassed a fortune worth 310,000 Bitcoins, 9.17 million Ethereum, and over 51 million EOS tokens. His business model was a complex combination of a Ponzi and pyramid scheme: he solicited funds from investors under the false promise of guaranteed returns, while simultaneously developing both the upstream and downstream sectors.

Colin Wu, journalist

Based on Wu’s findings, it is revealed that certain seized cryptocurrencies were allegedly disposed of via Beijing Zhifan Technology – a Chinese counterpart to the American firm Chainalysis. Yet, the fate of the remaining assets remains undisclosed.

According to Wu and Jiang Zhuoer’s findings, the majority of seized bitcoins were offloaded on the market between late 2019 and mid-2020. During this period, bitcoin prices saw considerable volatility, ranging from $7,000 to $12,000.

Based on my analysis of the situation, it is unclear what will happen to the remaining assets besides the Bitcoins that have been sold through Huobi. According to international analysts monitoring PlusToken transactions, approximately 15,000 Bitcoin could still be in circulation and may be waiting to be sold. Furthermore, they suspect that the Ethereum addresses have remained unchanged throughout this process.

As an analyst, I’ve observed a potential mismatch between the addresses provided by the police and those documented by external observers in their reports. It’s essential to note that the investigation is ongoing, and the authorities are still working to verify certain addresses that have yet to be fully corroborated.

What is known about PlusToken

In 2019, users of the PlusToken cryptocurrency wallet suffered a significant loss to the tune of $3 billion when the project’s leaders abruptly disappeared with the funds. The platform was introduced in 2018 as a decentralized international initiative supposedly spearheaded by a South Korean team. Its target demographic included Asian and European markets.

Investors in PlusToken were given the assurance of regular monthly payouts ranging from 6% to 19%, as well as incentives for recruiting additional members. The business aimed to enroll a total of 10 million users by the close of 2019, despite only reporting 3 million participants at that time.

Investigation

Beginning in March 2019, authorities in China’s southern province of Hunan launched an examination into the illegal PlusToken investment scheme. Since that time, the leader of the Chinese branch, Chen Bo, along with five other individuals connected to the venture, have gone into hiding.

Approximately several months following the suspension of the platform, Dovey Wan, managing partner at Primitive Ventures, announced that Chinese law enforcement had successfully arrested key suspects in the PlusToken case.

I’d like to bring up an important topic that has been on my mind lately, following the recent selling spree by PLUS Token. This Chinese Ponzi scheme is said to have defrauded roughly 70,000 Bitcoin and around 800,000 Ethereum. In my previous Coindesk op-ed, I touched upon it briefly but given its potential impact on the market, it warrants more discussion. Keep in mind that these transactions could trigger additional sell-offs.

— Dovey “Rug the fiat” Wan (hiring) (@DoveyWan) August 14, 2019

Around the same period, Peckshield’s auditing report indicated that approximately 1,000 Bitcoin worth of funds were transferred from various wallets to both Bittrex and Huobi exchanges.

Based on an examination of transaction data from PlusToken’s wallet conducted by the security audit firm Peckshield in early July, approximately $1,000 was identified as being transferred to both Bitrrex and Huobi. In essence, the process of selling off assets began around this time.

— Dovey “Rug the fiat” Wan (hiring) (@DoveyWan) August 14, 2019

As a researcher studying the cryptocurrency market, I’ve come across whispers within Chinese trading circles suggesting that an individual linked to PlusToken is reportedly draining 100 Bitcoin at a time and transferring it to the Binance exchange.

Over the past few days, there have been reports from Chinese traders on Binance about an individual continuously selling large quantities of Bitcoin, around 100 coins at a time. I haven’t located the specific chat thread yet, but I suspect this may be connected to the ongoing situation with PlusToken.

— Dovey “Rug the fiat” Wan (hiring) (@DoveyWan) August 14, 2019

I analyzed a significant cryptocurrency scam that came to light in July 2020. The PlusToken scheme saw the detainment of 27 primary suspects and 82 secondary actors involved in the illegal operation.

Dovey Wan verified details regarding the apprehension of PlusToken’s masterminds. She elaborated that warrants for their arrest had been outstanding for a full year. The complexity of tracking down these individuals stems from the fact that they scattered to various nations, making the investigation process intricate.

First sales of confiscated assets

Back in November 2020, news broke out that Chinese officials confiscated approximately $4.2 billion in cryptocurrencies from thePlusToken Ponzi scheme. The authorities plan to auction off this digital fortune and transfer the earnings into the national coffers.

During that period, news broke out that the government confiscated the following cryptocurrencies: 195,000 Bitcoins (BTC), 833,000 Ethereums (ETH), 1.4 million Litecoins (LTC), 27.6 million EOS tokens, 74,000 Dash coins, 487 million Ripple (XRP), 6 billion Dogecoins (DOGE), 80,000 Bitcash (BCH), and 214,000 Tether (USDT).

Cryptocurrency landscape in China

China has served as a leading and influential force in the global cryptocurrency sector for an extended period. In terms of mining, it held its ground alongside other nations, contributing substantially to the total computing power of major digital coin networks. The manufacturing of mining equipment on a large scale also took root there. However, the landscape shifted dramatically in 2021 as the People’s Bank of China prohibited all activities related to cryptocurrencies.

Crypto exchange websites and numerous online resources focusing on cryptocurrencies were prohibited. To clear up any confusion, the regulatory body made it clear that Tether’s stablecoins, Bitcoin, and Ethereum are not considered fiat currencies. Several years prior, Chinese authorities effectively halted Initial Coin Offerings (ICOs) in 2017, citing potential violations of financial regulations as the reason.

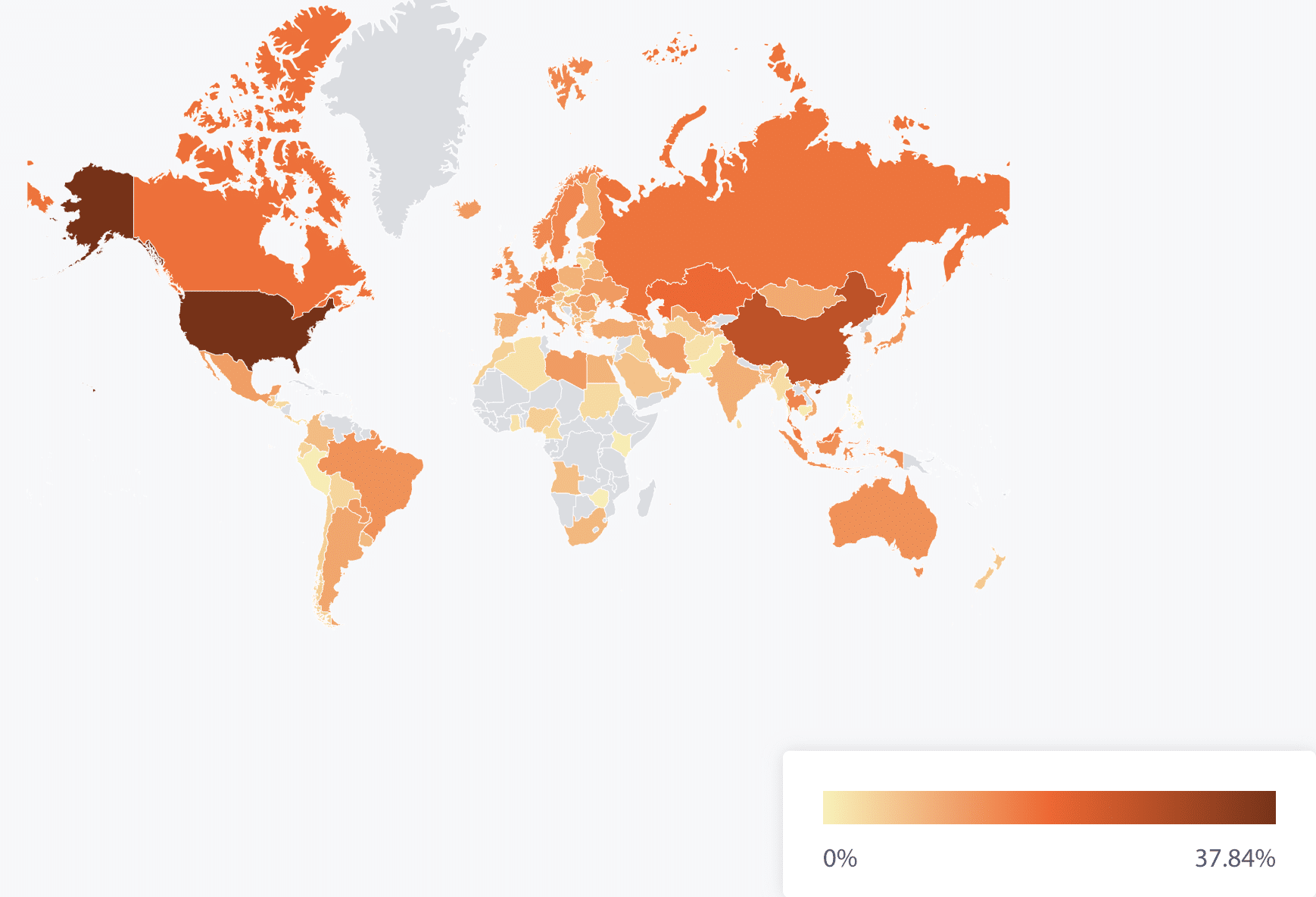

According to current information from CCAF specialists, approximately one fifth (21.11%) of the global hashrate comes from mainland China. Notably, this represents only a 10% decrease compared to the June 2021 statistics. This significant percentage persists even after the implementation of a full ban on cryptocurrency mining.

As a researcher studying the global market for mining equipment, I’ve discovered that some of the largest companies in this sector are based in China. Among these are Bitmain, known for their Antminer series devices, and WhatsMiner with their MicroBT miners. Additionally, I’ve come across miners manufactured by Innosilicon, AGM, Canaan, and Ebang.

Despite the existing restrictions, China continues to hold significant influence in the realm of cryptocurrencies, operating covertly behind the scenes.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-07-15 18:37