As a seasoned crypto investor with years of experience under my belt, I can confidently say that understanding Bitcoin Dominance (BTC.D) is as essential as having a reliable pair of binoculars for a safari expedition. It’s not just about spotting trends; it’s about anticipating them before they become mainstream.

From its beginning, Bitcoin has held a significant position in the crypto world. The Bitcoin Dominance (BTC.D) is an essential indicator that shows Bitcoin’s proportion of the overall cryptocurrency market cap. It functions as a gauge for Bitcoin’s impact on the market, allowing investors to comprehend market patterns and capital movements more effectively.

Delving into the intricacies of Bitcoin (BTC) dominance, this piece discusses its significant influence on shaping cryptocurrency market trends, as well as examining its effects on the overall digital currency landscape and the consequences that arise when it shifts in either direction. Let’s delve deeper!

What is Bitcoin Dominance?

In simpler terms, Bitcoin Dominance refers to the proportion of the entire cryptocurrency market that is made up by Bitcoin. This percentage is determined by taking the value of Bitcoin’s market cap (the total worth of all existing Bitcoins), dividing it by the sum of all crypto market caps, and then multiplying the result by 100.

For example: If Bitcoin’s market cap is $500 billion and the total crypto market cap is $1 trillion, BTC dominance would be: BTC Dominance = (500 billion / 1000 billion) × 100 = 50%

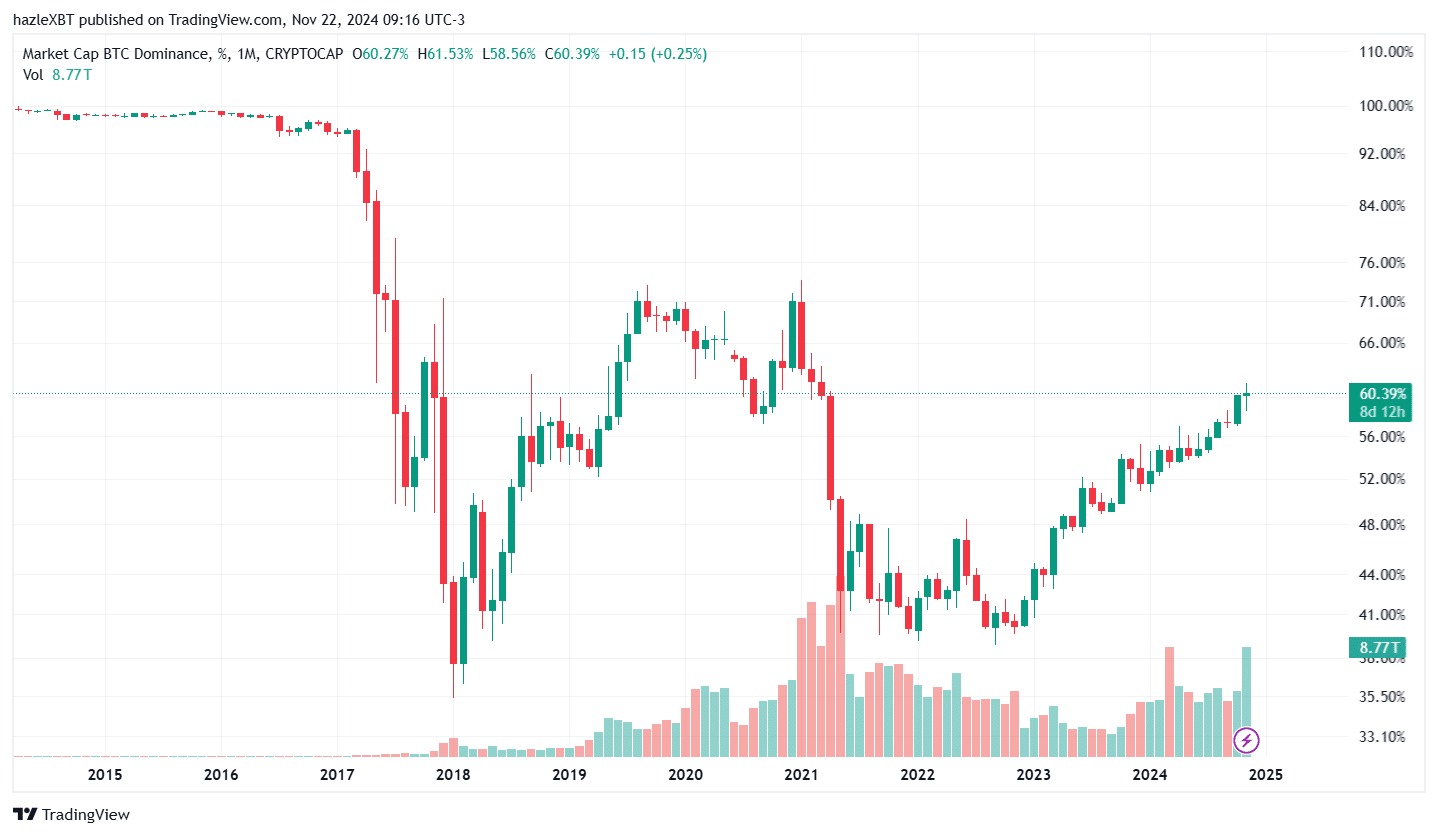

This measurement underscores Bitcoin’s position as the foremost digital currency, acting as a gauge for its impact on the market. In its initial stages, Bitcoin held more than 90% of the market share; however, with the emergence of alternative cryptocurrencies such as Ethereum, Ripple, and Solana, its dominance has seen significant fluctuations over the years.

Approximately 60% of the overall value in the crypto market is controlled by Bitcoin, equivalent to a market share worth around $1.95 trillion at present, as indicated by Coinmarketcap data.

How Bitcoin Dominance Impacts Crypto Market

Bitcoin Dominance significantly influences the behavior within the cryptocurrency sector. It serves as a vital predictor of upcoming trends, such as bitcoin price surges, altcoin seasons, and shifts in crypto investment patterns. Essentially, it functions as a barometer for market participants’ concentration of attention and resources. Here are some crucial aspects where Bitcoin dominance becomes particularly significant:

- Market Sentiment

When Bitcoin’s dominance is high, I often find myself leaning towards Bitcoin as a more secure and steady investment choice, particularly in uncertain markets. This preference could potentially lead to less enthusiasm for altcoins among speculators.

- Altcoin Performance

When the influence of Bitcoin increases, it’s common for alternative cryptocurrencies to perform poorly because a larger amount of capital tends to move towards Bitcoin instead of these other digital currencies. Conversely, a decrease in Bitcoin’s dominance typically indicates strong demand for altcoins over Bitcoin.

- Risk Appetite

As a crypto investor, when I notice Bitcoin’s dominance waning, it signals to me that investors are becoming more daring and eager to take on greater risks. In these situations, I tend to direct a larger portion of my investments towards the riskier, yet potentially more rewarding, altcoins.

What Happens When Bitcoin Dominance Decreases

When investment shifts from Bitcoin to other cryptocurrencies (altcoins), Bitcoin’s dominance decreases noticeably. During this period, the altcoin market expands at a rate much greater than Bitcoin, which merely follows moderate market fluctuations as it holds its ground.

The graph shows us that when Bitcoin’s influence (dominance) lessens, the total value of alternative cryptocurrencies (altcoins) significantly increases. The initial significant boost in altcoin market value took place from around 2016 to 2018, coinciding with Bitcoin’s price reaching over $10,000 for the first time. The second substantial increase in altcoins was immediately after Bitcoin reached a new record high of $63,500 in April 2021.

When Bitcoin’s influence wanes, alternative cryptocurrencies often see significant price surges due to increased attention from traders. This shift also contributes to heightened market volatility, as many short-term investors swiftly adjust their investment portfolios by pouring capital into various digital assets.

In simpler terms, when Bitcoin’s influence over the cryptocurrency market lessens (as indicated by a decrease in its dominance), it means Bitcoin may no longer be the primary force shaping the market for a while. This doesn’t necessarily mean that such a decline is beneficial because it could indicate waning interest in Bitcoin or the overall crypto market, suggesting a potential downturn.

What is Altseason and How it concerns Bitcoin Dominance

Altseason, or “altcoin season,” is a term that signifies a time when alternative cryptocurrencies (altcoins) experience substantial growth in value and market share compared to Bitcoin. This period often follows investors cashing out their Bitcoin profits and redirecting their funds towards altcoins. It’s also quite typical during bullish market trends.

As a researcher delving into the realm of cryptocurrencies, I’ve noticed an intriguing pattern: Altseasons might be sparked not just by market sentiments but also by sudden technological leaps, such as the debut of groundbreaking projects or significant updates within the DeFi sector. A telltale sign of an approaching altseason is when top altcoins like Ethereum (ETH) start outperforming Bitcoin.

During Altseason, we often see an increase in the market values of lesser-known cryptocurrencies, accompanied by a rise in online chatter about fresh and upcoming digital currency initiatives on social media platforms.

Conclusion

The concept of Bitcoin Dominance offers valuable insights into the behavior and tendencies within the cryptocurrency industry. When the dominance is strong, Bitcoin usually sets the pace for the market, but when it weakens, it could point towards the start of an “altcoin season” where alternative coins gain prominence. Grasping these patterns aids traders and investors in making strategic decisions and taking advantage of market prospects.

Also Read : Next Bitcoin: Which Cryptocurrency Holds the Greatest Potential?

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

2024-11-22 19:02