As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen my fair share of ups and downs. The current scenario with Ripple (XRP) is quite intriguing, to say the least. The steady rise in its price, just shy of its year-to-date high, coupled with the imminent launch of RLUSD, has certainly piqued my interest.

The cost of Ripple remained relatively stable close to its peak for this year, as anticipation grew for the upcoming release of the RLUSD stablecoin.

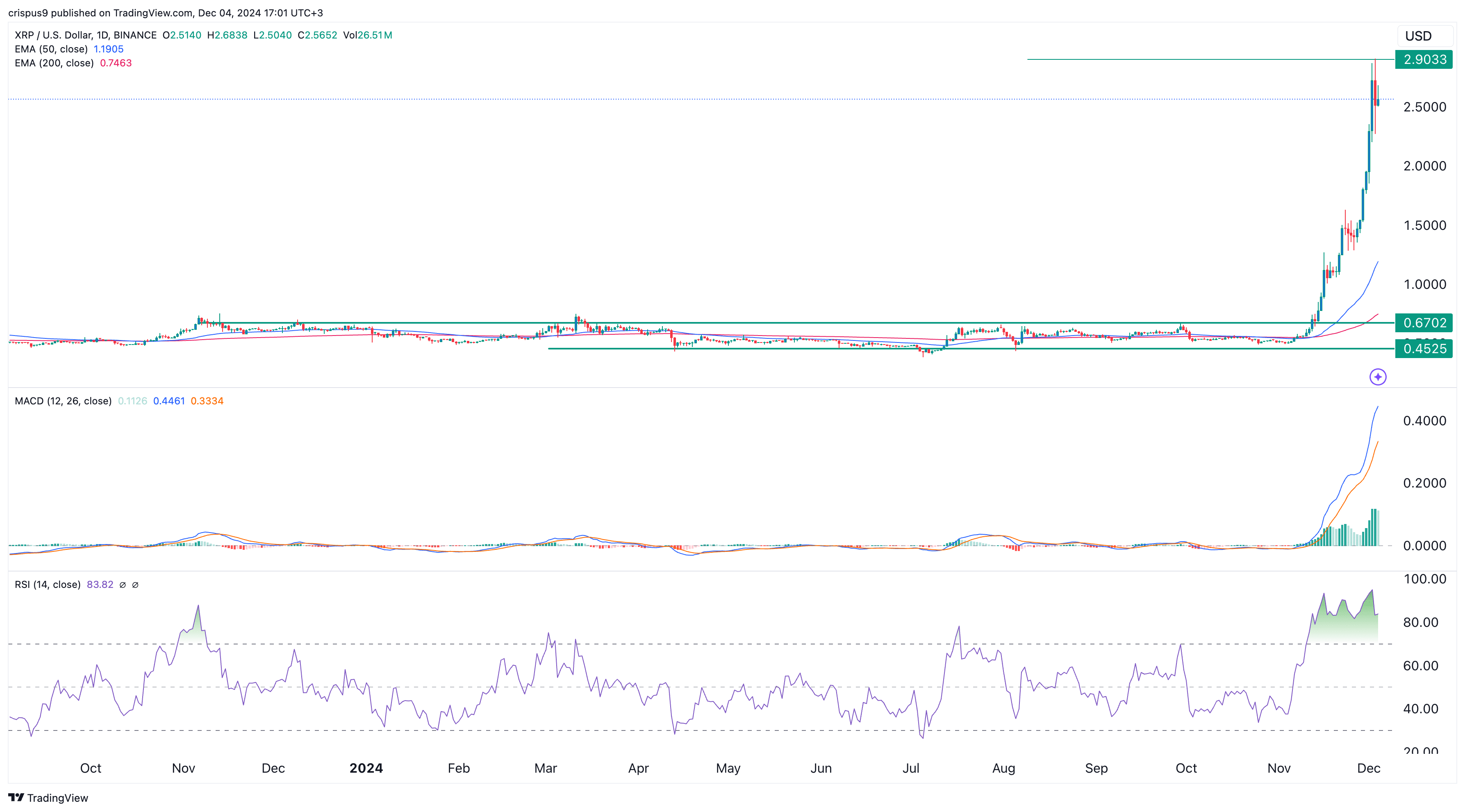

On this Wednesday morning, the value of Ripple’s XRP coin hovered near a significant level, just shy of its highest point for the year so far, which stands at approximately $2.900.

In a recent post on X, the founder of Cardano (ADA), Charles Hoskinson, expressed his enthusiasm for the upcoming launch of RLUSD. This sentiment came after reading an article in CT that offered additional information about this stablecoin which will be made available starting December 4th.

Excited about RLUSD

— Charles Hoskinson (@IOHK_Charles) December 4, 2024

It’s possible that his post indicates a potential agreement for RLUSD stablecoin to debut on the Cardano blockchain, which could be substantial given that its network currently holds only $24 million in stablecoins. If RLUSD were to extend into the Cardano ecosystem, it could contribute to an increase in their stablecoin volume.

1-to-1 pegged to the U.S. dollar, RLUSD aspires to challenge other expanding stablecoins such as Tether and USD Coin in the market. At present, Tether holds a dominant position with approximately 70% of the market share. Other contenders include USD Coin (USDC), USDS, Etherna USDe, and Dai, which follow closely behind. Upon its launch, RLUSD will be available on both the Ethereum network and the XRP Ledger.

One potential rephrasing could be: The primary hurdle faced by the RLUSD stablecoin is intense competition from other players. To illustrate, even though PayPal backs its PYUSD with a well-known brand, it has only managed to gather $495 million in assets.

The RLUSD launch coincides with a significant upswing in XRP’s value, which has surged more than 400% from its minimum this year.

The price of XRP has risen due to optimism among investors regarding potential modifications at the Securities and Exchange Commission. It’s anticipated that Gary Gensler, who has been engaged in a dispute with Ripple Labs for nearly four years, will resign in January.

Currently, there are discussions about Donald Trump potentially appointing Paul Atkins, known for his crypto-friendly stance, as the new leader of the agency. This possible appointment might pave the way for an XRP Exchange Traded Fund (ETF) by 2025 and more advantageous regulations in the crypto sphere.

XRP price analysis

Over the past few weeks, the daily graph indicates that the value of Ripple has been performing strongly. It’s surpassed crucial thresholds at $1 and $2 and is currently trying to push beyond $3.

The current price of XRP is higher than its various moving averages, and technical indicators such as the Relative Strength Indicator (RSI) and Moving Average Convergence Divergence (MACD) have reached unusually high, or “overbought,” readings.

In simpler terms, the graph of Ripple appears to be shaping like a bullish pennant, which is generally a positive signal for traders. This suggests that the value of XRP may continue climbing, possibly surpassing the $3 mark.

The risk, however, is that the coin could experience a brief pullback as it moves to the markdown phase of the Wyckoff Method. If this happens, it may drop to about $1.50.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-12-04 17:58