In the upcoming ten years, the rewards from mining new Bitcoins will be very small. How does this impact miners and users of this cryptocurrency network?

Bitcoins undergo halvings rarely, similar to the occurrence of World Cups and Olympics. This is because each event takes place approximately every four years.

In an unpredictable Bitcoin market where prices can fluctuate significantly day by day, the occurrence of halvings provides a level of assurance regarding the release of new coins into circulation.

With approximately 93% of Bitcoins currently in circulation, it’s important to note that: The remaining Bitcoins will become increasingly scarce to discover.

The Halving is Coming. #Bitcoin

— Michael Saylor⚡️ (@saylor) April 10, 2024

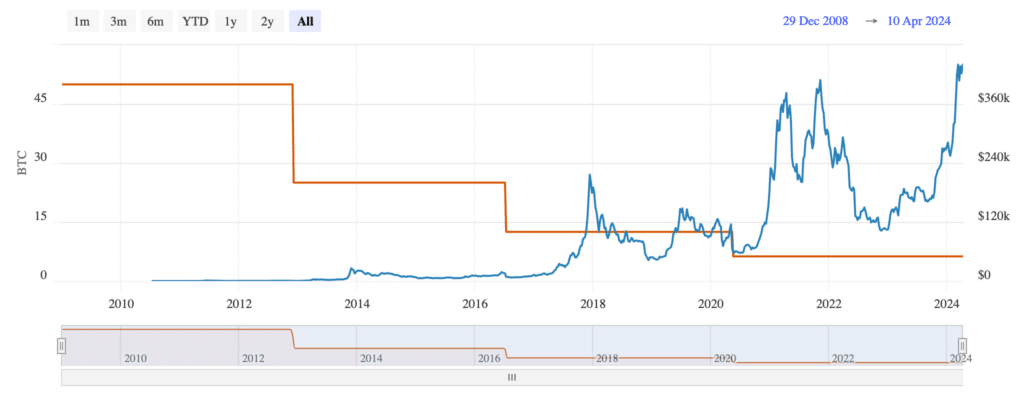

When Bitcoin’s blockchain started in 2009, miners could earn a massive reward of 50 BTC per block. However, this reward was gradually reduced: it dropped to 25 BTC in November 2012 and then to 12.5 BTC in July 2016. The third reduction in rewards occurred in May 2020, leaving miners with only 6.25 BTC every 10 minutes as their reward – a significant decrease from the initial 50 BTC. After this most recent reduction, each block now generates just 3.125 BTC in rewards.

Miners face both positive and negative developments in April 2024. On the one side, the halving event reduces the number of new Bitcoins created each day, from 7,200 to just 450. This represents a significant decrease compared to the early days of Bitcoin mining.

On a positive note, the value of this cryptocurrency in US dollars has skyrocketed. For instance, 3.125 Bitcoins are currently worth over hundreds of thousands of dollars. Contrastingly, in 2012 during the first halving, it only cost around $600 to acquire 50 Bitcoins.

So, what are future halvings going to look like? Let’s find out.

When are future Bitcoin halvings?

While it’s not possible to identify an exact date, we have a good approximation that the fifth halving of Bitcoin rewards is around the corner, anticipated in 2028. Halvings occur approximately every 210,000 blocks, and considering a new block is created roughly every 10 minutes, this means the reward reduction to 1.5625 BTC is imminent. This change will take effect when the Bitcoin network reaches a height of 1,050,000 blocks.

In the 2030s, according to Cathie Wood’s prediction, a Bitcoin could be valued at $1.5 million, or as low as $258,000 in her most pessimistic outlook. Notably, the 2032 Bitcoin halving will represent a major milestone since it will be the first time rewards for mining new blocks fall below one whole coin, to 0.78125 BTC instead. As Satoshis, which is the moniker for one hundred-millionth of a Bitcoin, gain significance for miners, we approach this pivotal moment in Bitcoin’s lifecycle.

In simpler terms, the rewards for miners will become significantly smaller over time. By the year 2036, miners would only earn approximately 0.390625 Bitcoin for their contributions to securing the network. This equates to roughly 56.25 Bitcoins being distributed every day.

The reductions in rewards for miners will continue to occur every four years starting from now, with each event taking place during the Summer Olympics. For instance, there will be reductions in 2040, 2044, and 2048, and so on. By the year 2052, miners would have received only a fraction of what they used to get as reward, which is equivalent to 0.0244140625 BTC. At present, this amount translates to approximately $1,660 in fiat currency. The process comes to an end in the year 2140 when all Bitcoins will have been mined.

What does this mean for miners?

Mining Bitcoins comes with significant costs. The process requires a large amount of electricity and advanced computing equipment to validate transactions and earn block rewards. Consequently, miners often need to upgrade their hardware regularly to stay competitive. However, Bitcoin’s price increases have managed to cover these expenses following each halving event, as demonstrated by the graph below.

With limited cryptocurrency available, miners must control their expenses to stay profitable and continue their operations.

Over time, fees paid by blockchain users for transactions will grow more significant as a revenue source. This doesn’t imply that everyday transactions will suddenly become exorbitantly priced for consumers; instead, advanced solutions like the Lightning Network and others will ensure affordability. However, the cost of larger transfers might need to increase to maintain profitability for miners.

In their latest analysis, Galaxy anticipates an increase in mergers and acquisitions due to energy cost savings, enhanced efficiency, securing capital, and promoting growth. Smaller businesses have already begun combining forces. However, despite the necessity of consolidation, there’s a risk of losing decentralization as a consequence.

In 2024, the Bitcoin halving event will be unique for several reasons. It follows closely on the heels of Bitcoin ETFs being introduced in the US, leading to a surge of fresh investor interest. Moreover, this is the first time that Bitcoin’s price has reached an all-time high before the block rewards were reduced. As the market evolves, miners will need to adjust accordingly.

Read More

- Gold Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-12 12:26