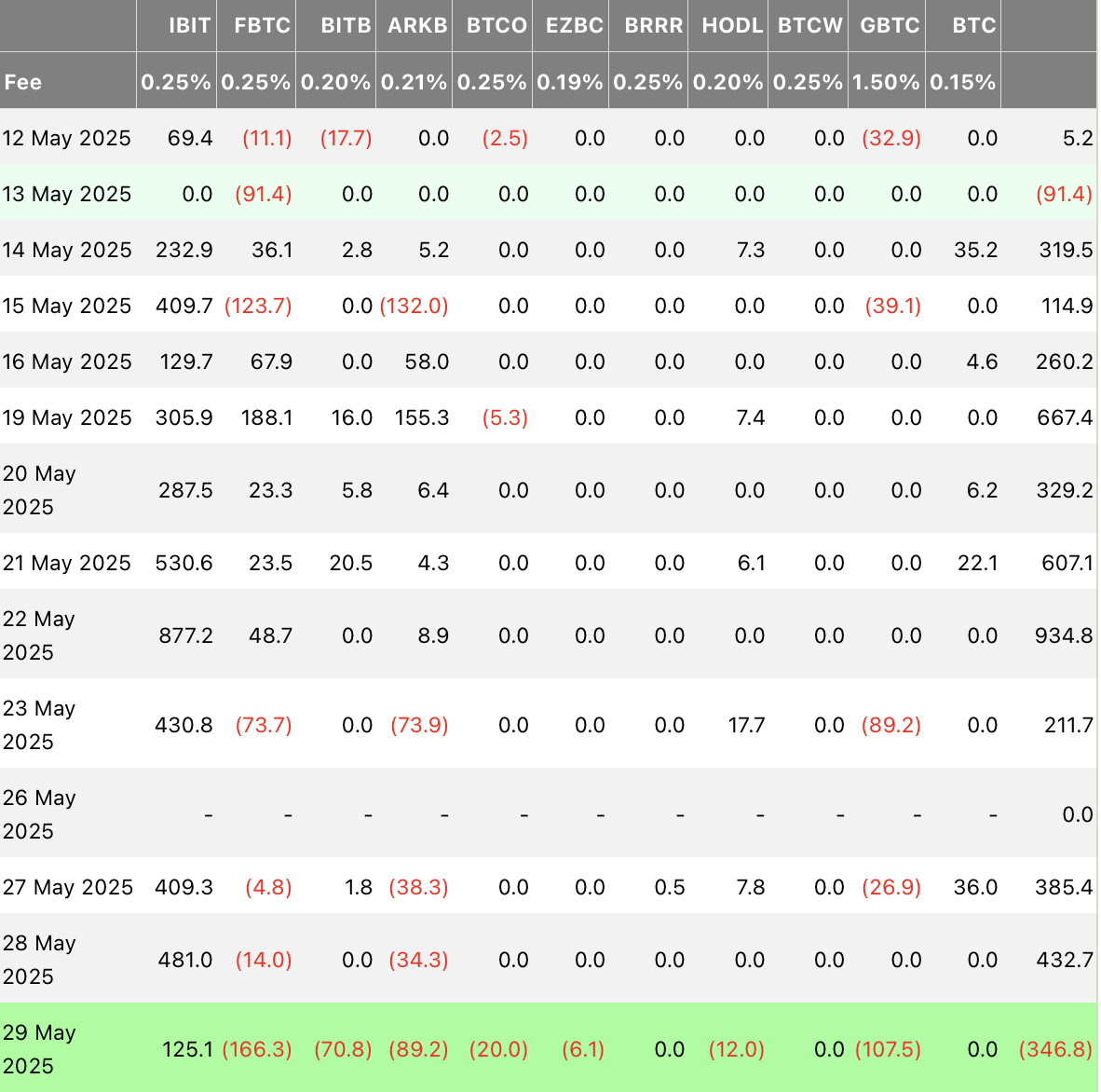

In the most curious of circumstances, the esteemed BlackRock’s iShares Bitcoin Trust (IBIT) emerged as the solitary beacon of hope, attracting a most respectable sum of $125 million in fresh capital, whilst the broader investor populace seemed to retreat with all the enthusiasm of a cat avoiding a bath. 🐱💦

Alas, the Fidelity’s FBTC, in a rather dramatic fashion, led the unfortunate outflows, suffering a loss of $166.32 million. One might say it was akin to a gentleman losing his waistcoat at a ball—most distressing! Grayscale’s GBTC followed suit, with a rather disheartening $107.53 million in net redemptions. 😩

Furthermore, the funds of Ark Invest and 21Shares’ ARKB were not spared from this financial tempest, recording a significant outflow of $89.22 million, while Bitwise’s BITB saw a withdrawal of $70.85 million, as if the investors had suddenly remembered a pressing engagement elsewhere. 🏃♂️💨

ETFs under the management of VanEck, Valkyrie, Invesco, and Franklin Templeton similarly reported capital exits, as if they were all partaking in a most unfortunate game of musical chairs. 🎶

On this fateful Thursday, the downturn interrupted a most commendable performance streak, which had been largely attributed to the gallant efforts of BlackRock’s IBIT, a fund that had previously ushered in billions during a sustained inflow cycle. The shift now suggests a rather temporary pause in institutional accumulation, as the market appears to be exercising a most prudent caution. 🧐

Read More

- Gold Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-05-30 10:21