Ah, Bitcoin, that ever-elusive enigma! On this fateful Wednesday, as the world dangles on the precipice of uncertainty, our digital savior has jubilantly pranced back to a staggering $105,000, after a fleeting visit to the depths of $103,000. How delightfully predictable! This rebound, of course, happens just as the Middle East decides to crank up the tension dial—who doesn’t love a bit of market drama? 🎭

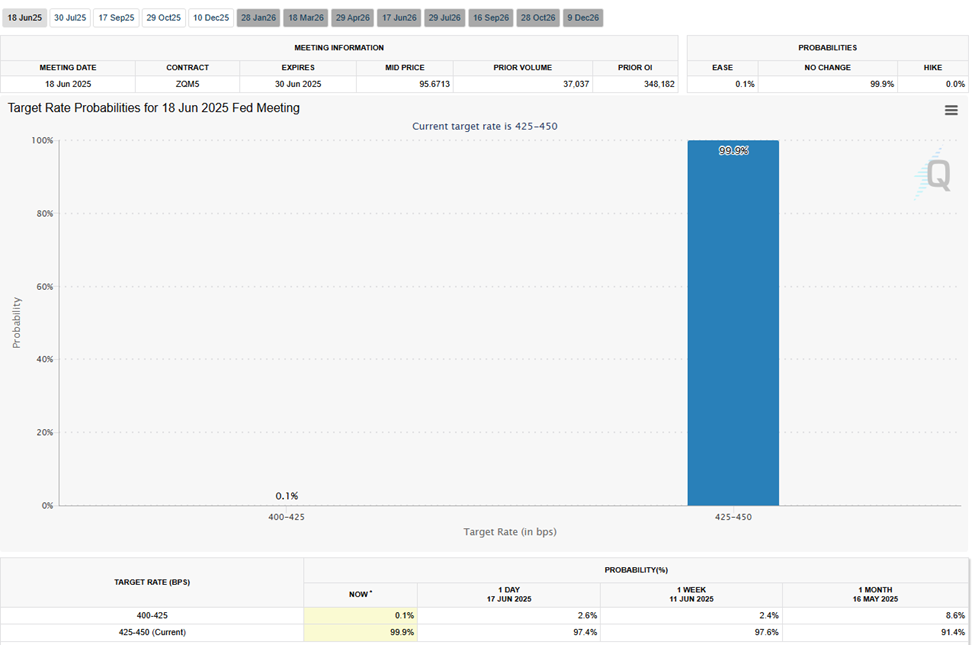

And what’s that in the distance? A looming decision from the FOMC (Federal Open Market Committee)—the clock is ticking and traders salivate. Will they raise the rates or leave us hanging? Stay tuned, folks! 🕒

Iran’s Strait of Hormuz Blockade: Just Another Day in Paradise! 🙃

This juicy price surge is fueled by delightful fears of an oil shock. Iran, in a fit of braggadocio, has declared that all oil and LNG tankers must now come bearing gifts—a.k.a. prior approval—to pass through the Strait of Hormuz, that narrow bottleneck where nearly 20% of the world’s oil trade flounders. Truly, what a congenial way to boost market anxiety!

“The IRGC has decided: if you want to pass through our prestigious waterways, it’ll cost you—maybe a friendly wave from the Ayatollah! ”

“Khandouzi, our former Economy Minister, being the gracious host, announced that starting tomorrow, oil tankers are now essentially on extended vacation for 100 days!”— tim anderson (@timand2037) June 18, 2025

This zenith of geopolitical risk is, of course, no random act; it’s part of a grander pièce de résistance. Defense intelligence, posting from the cozy confines of Twitter, insists that Iran’s most formidable weapon is not some laughable missile but a mere blockade. Quite the cunning plan!

Meanwhile, Brian Krassenstein, a commentator with an opinion as spicy as chili sauce, suggests that this new blockade will hardly make a dent in gas prices or sway the FOMC to reduce interest rates. “But wait,” you say, “what about oil production?” Well, fear not! Reuters reports that OPEC+ plans to throw a few extra barrels onto the fire. Isn’t it delightful when chaos meets opportunism?

“Oh, and let’s not forget—greater demand from the wonders of OPEC+, particularly Saudi Arabia, will surely balance the supply scales! Everyone wins! Right?” reported some analyst feeling particularly optimistic about the whole affair.

But before we raise our glasses to celebrate, some analysts might rain on the parade, warning about an imminent oil shock. Should the Strait of Hormuz fully shut its doors, prices could skyrocket like a teenager on a sugar rush! 🍬

“Any assault on oil production or export facilities will send Brent crude soaring to $100, or perhaps even $120 or $130 if the Strait is shut tight. Bon appétit!” noted Andy Lipow, President of Lipow Oil Associates, showing a flair for the dramatic.

In sync with JPMorgan’s audacious predictions, a little scuffle with Iran could send oil to the stratosphere and inflate US CPI to a delightful 5%. Who could resist such a thrilling ride? 🎢

“JP Morgan found that if we poke the bear—aka Iran—it might just end up costing us $120 for oil on our road trip, and isn’t there a CPI to consider? We’re parked currently in the mid-70’s!”

— Cheddar Flow (@CheddarFlow) June 13, 2025

As the Fed Fiddles, Bitcoin Rises Like a Breadwinner! 💰

As traditional markets munch on their nails, Bitcoin pops back up, reclaiming the $105,000 mark with a sense of dramatic flair. BeInCrypto tells us that BTC has leaped to a cozy $105,299—because why not add a little extra during a crisis?

In an age where chaos reigns, Bitcoin is revered as the go-to hedge against inflation and uncertainty, while gold behaves like a moody teenager, oscillating wildly as everyone rushes to grab hard assets.

With energy prices on the verge of a breakout, both Bitcoin and gold are resuscitating as the “go to” safe havens—because who needs stability when you have digital currency and shiny rocks? 🌟

Crypto analyst Daan Crypto Trades quips that Bitcoin’s rise from $103,000 to above $105,000 keeps it hugging the $100,000–$110,000 monthly range—how quaint!

“The glory of a mere 10% displacement is almost mundane in this climate!” the analyst mused, sipping his overpriced coffee.

As Iran steals the spotlight, the US FOMC prepares to unveil the big news of the day. Will they raise rates? The suspense is almost palpable! According to the clever tools at CME FedWatch, a rate change should be filed under ‘unlikely’, but we’re all ears for Jerome Powell the Magician and his thrilling show on inflation amidst the geopolitical ruckus.

As reported, the market trembles, investors are just a tick away from panic, and all eyes remain glued to Bitcoin, which may yet be subjected to new tests—especially if the energy crisis explodes into a full-blown catastrophe or if the Fed decides to play hardball. What a delightful cocktail of chaos! 🍸

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-06-18 13:47