Ah, Chainlink! The cryptocurrency that has taken a nosedive this year, continuing its dramatic descent that began in December when it reached a dizzying height of $30.78. One might say it peaked like a cat on a hot tin roof, only to plummet to a rather unimpressive $17.4 on this fine Saturday, down a staggering 43% from its December glory. It seems the altcoin universe is experiencing a collective retreat, much like a group of tourists fleeing a particularly aggressive seagull.

But fear not, dear reader! There are three rather compelling reasons why the LINK price might just bounce back later this year, like a rubber ball thrown at a wall made of marshmallows.

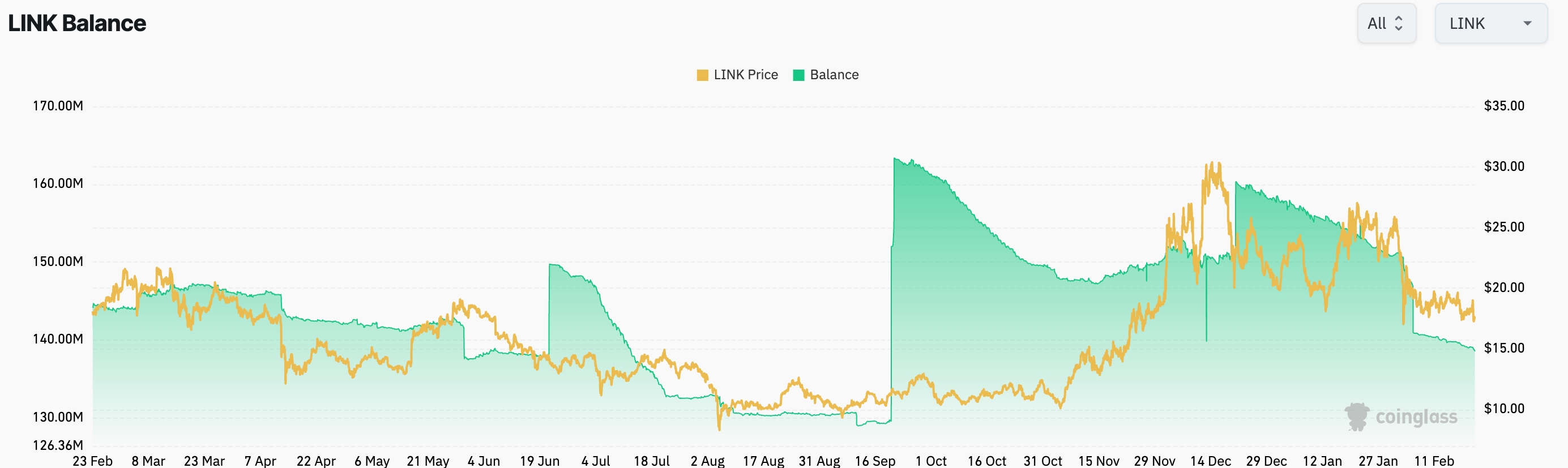

First up, it appears that many Chainlink holders are clinging to their coins like a toddler to a favorite stuffed animal. Evidence? The balances on exchanges have been plummeting faster than a lead balloon, dropping to a mere 138.8 million LINK coins—the lowest since September last year. They were a robust 160 million in December, but alas, those days are gone.

This decline in centralized exchange balances suggests that investors are feeling rather optimistic about the coin, choosing to keep their precious LINK in self-custody wallets instead of tossing them into the exchange abyss. Typically, CEX balances surge when investors are preparing to sell, but not this time! It’s like watching a group of people at a buffet, all deciding to skip the dessert table.

Next, the confidence among Chainlink holders is likely fueled by the tantalizing prospect that the Securities and Exchange Commission might just approve a spot LINK ETF later this year. If that happens, we could see a flood of inflows that would make even the most seasoned lifeguard nervous.

Moreover, Chainlink is not just any old cryptocurrency; it’s the heavyweight champion of the oracle network world, boasting a total value secured (TVS) of $35 billion. That’s significantly more than its competitors like Chronicle, Pyth, and RedStone, who are probably still trying to figure out how to tie their shoelaces.

Chainlink is also making waves in the Real World Asset tokenization industry, thanks to its cross-chain interoperability protocol. CCIP is the secret sauce that helps build, scale, connect, and send assets across various blockchains, much like a well-oiled intergalactic transport system.

Chainlink price analysis

Finally, we arrive at the technicals, which are looking rather robust. The weekly chart reveals that LINK has managed to stay just above the 100-week Exponential Moving Averages, even after its dramatic 43% crash from November’s peak. It’s like a tightrope walker who’s just a bit wobbly but still manages to stay upright.

LINK has also formed a rather impressive megaphone chart pattern, characterized by two diverging trendlines. In most cases, this pattern leads to a strong bullish breakout, which is a fancy way of saying that things could get exciting!

In LINK’s case, the initial target for a rebound is the November high of $30, followed closely by the 61.8% retracement point of $35. However, should it drop below the lower side of the megaphone, we might have to reconsider our bullish outlook, much like rethinking a vacation to a place with no Wi-Fi.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-02-22 16:55