- Two key price clusters are like the bouncers at a club, keeping the riff-raff out!

- Strategic buys during dips? More like strategic hoarding! LINK holders are in it for the long haul!

So, here we are, folks! Chainlink [LINK] is doing its best impression of a tightrope walker, teetering between two major price clusters. On-chain data is practically screaming about the intense accumulation from long-term holders. With the $14.6 support acting like a cozy blanket and the $16 resistance being the annoying sibling who won’t let you have any fun, LINK’s next move is all about the die-hard fans! 🎢

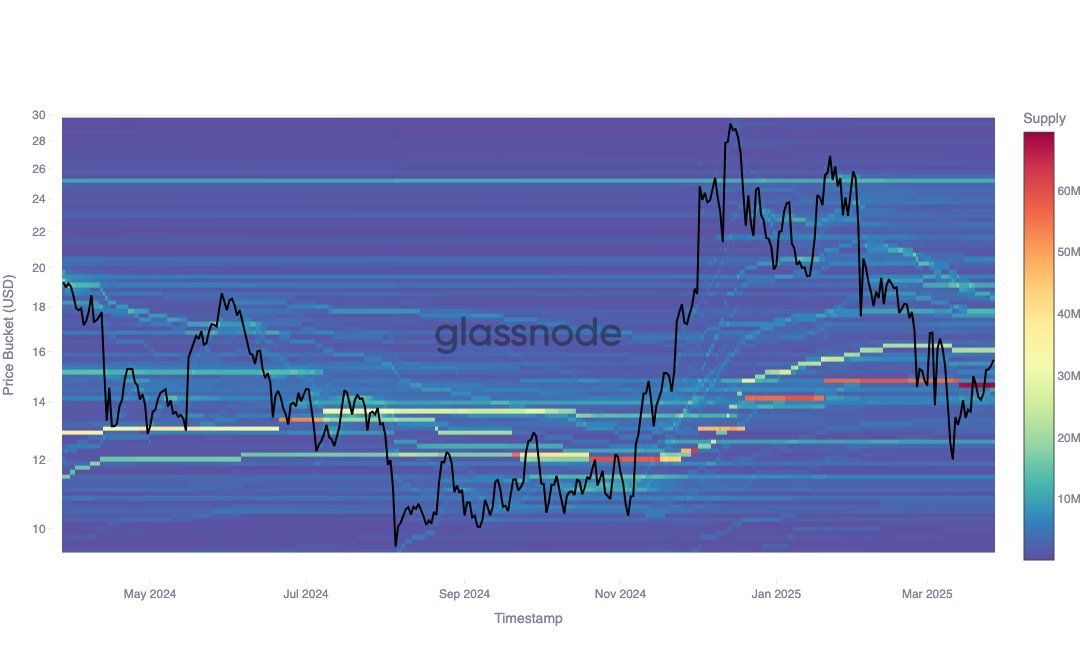

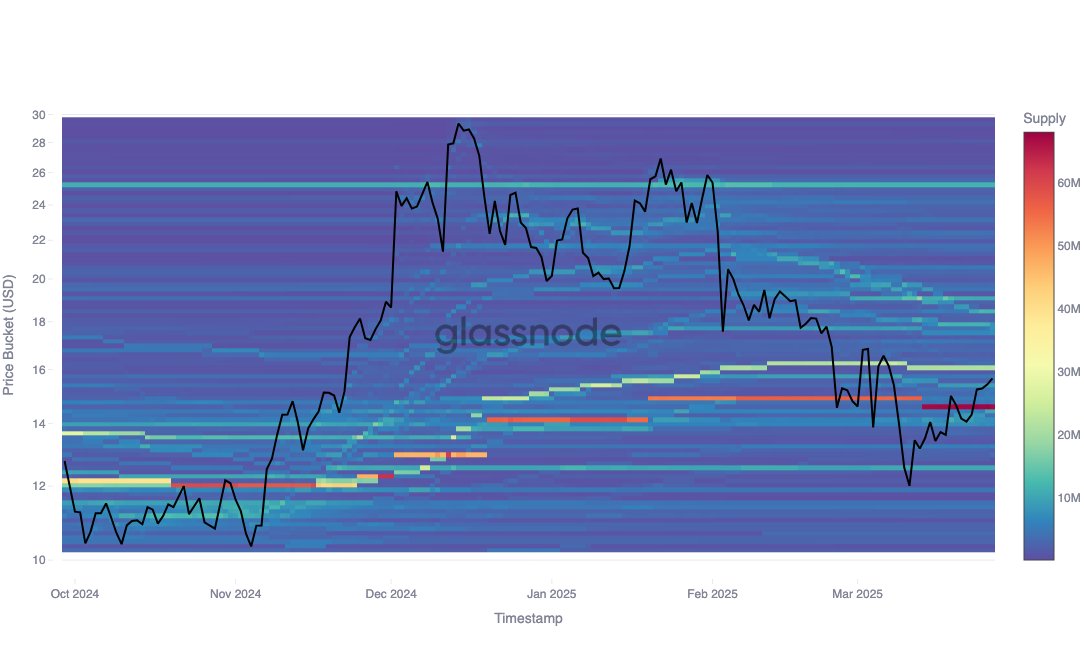

Chainlink Cost Basis clusters reveal strategic accumulation

As of this very moment, Chainlink’s Cost Basis Distribution is showing off two dominant clusters – $14.6 and $16. These zones are like the VIP sections of a club, holding approximately 65 million and 20 million LINK, respectively. And no, these zones are not just random; they reflect the high-conviction behavior of investors who are probably wearing “I love LINK” t-shirts.

The $16 cluster is like that friend who always buys the overpriced drinks during market dips – from the December crash to the February correction and again around the 11 March low. Cheers to that! 🥂

This steady repositioning is a sign that these investors are not your average day traders; they’re the strategic allocators with the patience of a saint. 🙏

So, the $16-level? Less likely to face heavy sell pressure unless the market decides to throw a tantrum. But let’s be real, it’s still a near-term resistance, having rejected price attempts like a bad date.

$14.6 cluster offers reinforced support backed by historical buys

The $14.6-level is like the wise old sage of support, backed by approximately 65 million LINK and a wide base of long-term buyers who probably have a shrine dedicated to their investments.

These investors entered around the $17 and $28 zones in December, revisited the market at $25 in January, and notably re-accumulated during the 15 March recovery off the $12-mark. Talk about commitment! 💍

This pattern of engagement paints a picture of patient, price-aware holders, less likely to be shaken by volatility. They’re like the calm in the storm, enhancing $14.6’s credibility as a strong psychological and technical floor in the current market structure. 🧘♂️

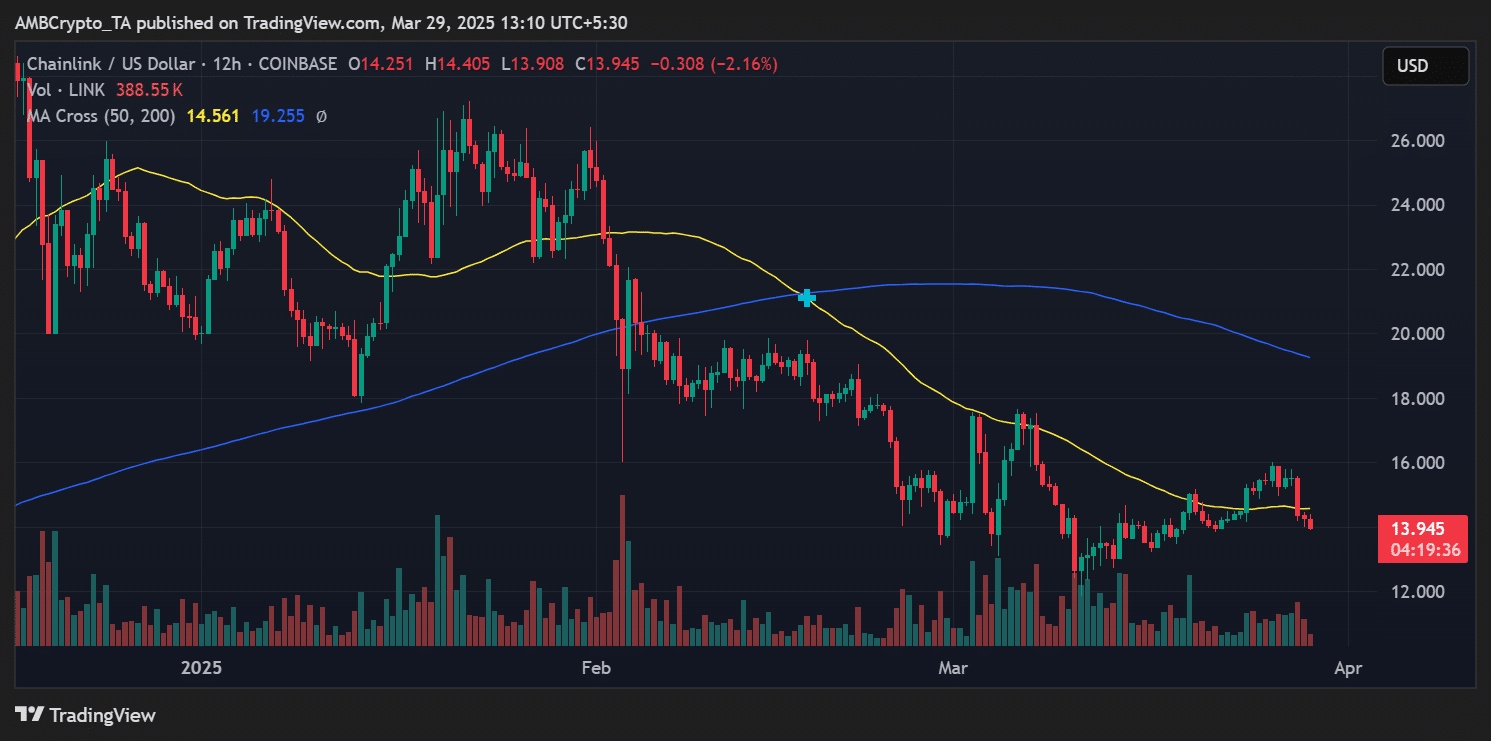

LINK caught between MAs as momentum weakens

From a technical standpoint, LINK was trading at $13.94 – under both the 50-day [$14.56] and 200-day [$19.25] moving averages. The 50/200-day death cross seen in early March is casting a shadow darker than my last breakup. 😱

Still, the recent bounce off $12 was in line with the on-chain cluster data – a sign that bottoming efforts may be underway. If LINK reclaims $14.6 with strong volume, a retest of the $16 barrier could follow. But let’s not get ahead of ourselves; expect resistance there unless the broader market decides to play nice.

Conclusion

Chainlink’s price is compressing within zones of historical buyer interest right now. While $14.6 offers credible support, $16 has emerged as the resistance battleground.

Whether LINK can break out depends on broader market liquidity and whether long-term holders continue to absorb supply without triggering profit-taking. So, grab your popcorn, folks! 🍿

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Hero Tale best builds – One for melee, one for ranged characters

2025-03-30 01:15