In the grand theater of finance, where fortunes rise and fall like the tides, Ondo Finance’s token has staged a remarkable comeback after plummeting to a two-month low on a fateful Monday. This was amidst the cacophony of Bitcoin and its altcoin companions crashing down, all thanks to the looming specter of a trade war. Ah, the joys of modern economics! 😅

With a flourish, Ondo (ONDO) soared to a high of $1.4450, a staggering 60% leap from its nadir this week. This audacious ascent has inflated its market cap to a princely $4.57 billion, while its fully diluted valuation now stands at a dizzying $14.5 billion. Who knew that a little liquidity could work such wonders? 💰

The catalyst for this resurgence? The developers, in their infinite wisdom, unveiled Ondo Nexus—a technological marvel aimed at unlocking instant liquidity for third-party issuers of tokenized treasuries. It’s like giving a financial shot of espresso to a sleepy market! ☕️ This initiative will harness OUSG’s instant minting and redemption capabilities, enhancing liquidity and utility for tokenized treasuries. Because who doesn’t love a good treasury?

In a display of corporate camaraderie, Ondo has allied itself with titans of the industry, including Franklin Templeton, WisdomTree, Wellington Management, and Fundbridge Capital. Not to be left out, existing partners like BlackRock and PayPal are also joining the Nexus party. It’s a veritable who’s who of finance! 🎉

1/ Today, we’re excited to announce the launch of Ondo Nexus, a new technology initiative designed to unlock instant liquidity for third-party issuers of tokenized Treasuries.

Leveraging OUSG’s instant minting and redemption capabilities, Ondo Nexus enhances the liquidity and…

— Ondo Finance (@OndoFinance) February 3, 2025

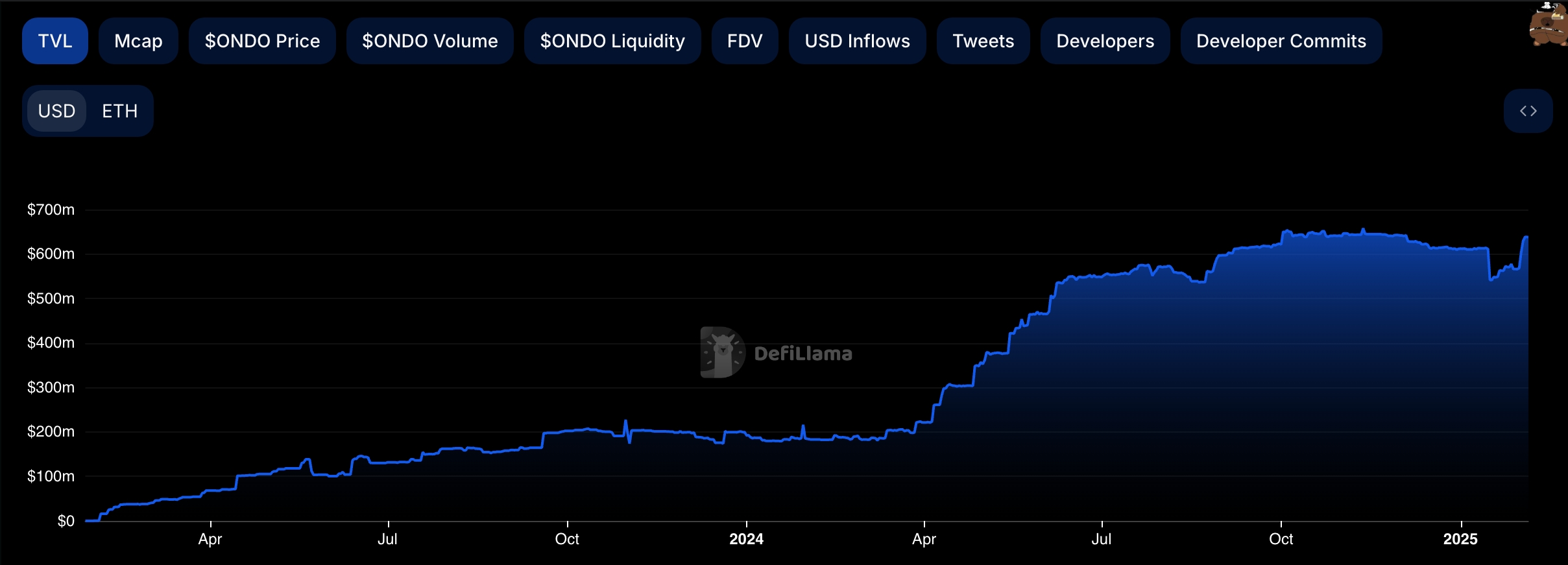

Ondo Finance’s ecosystem has surged to over $638 million, a remarkable leap from less than $1 million in February of the previous year. Most of these funds are nestled comfortably in the Ondo US Dollar Yield Token (USDY), while the remainder frolics in the Ondo Short-Term US Treasuries Fund. Talk about a financial glow-up! 🌟

As Ondo strides confidently into the burgeoning realm of real-world asset (RWA) tokenization, it finds itself in the company of heavyweights like BlackRock, Apollo Global Management, and Franklin Templeton, all of whom have embarked on their own tokenized ventures. BlackRock’s CEO, Larry Fink, has even urged the Securities and Exchange Commission to bless the tokenization of stocks and bonds. Because why not?

This meteoric rise has propelled several tokenization cryptocurrencies into the stratosphere this year. Take Mantra, for instance, whose price has skyrocketed by nearly 5,000% over the past 12 months, catapulting its market cap to over $5 billion. Now that’s what I call a party! 🎈

Ondo Price Forecast

The daily chart reveals that the Ondo token hit rock bottom at $0.9235 on that fateful Monday, as the cryptocurrency market collectively gasped. Yet, like a phoenix rising from the ashes, it has clawed back some of those losses and is now flirting with the key resistance level at $1.4760—the upper edge of the cup and handle pattern that graced the charts between June and November of last year.

Moreover, Ondo has crafted a falling wedge pattern, a classic bullish chart formation that whispers sweet nothings of potential to traders. It has also nudged slightly above the bottom of the trading range on the Murrey Math Lines tool. Could this be the moment we’ve all been waiting for?

Thus, the coin is poised for a robust bullish breakout, with the next key level to keep an eye on being $2.15—an all-time high that represents a tantalizing 50% leap from its current price. Buckle up, folks! 🚀

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2025-02-04 18:43