As a seasoned crypto investor with a knack for navigating the tumultuous waters of digital asset markets, I find myself both alarmed and intrigued by the recent outflows. The economic data suggesting a possible pause in the U.S. interest rate cut has certainly cast a shadow over the market, but it’s not the first time we’ve seen such shifts.

Last week saw significant withdrawals from digital asset investment products, mainly due to decreased anticipation for a U.S. interest rate reduction following the release of robust economic statistics.

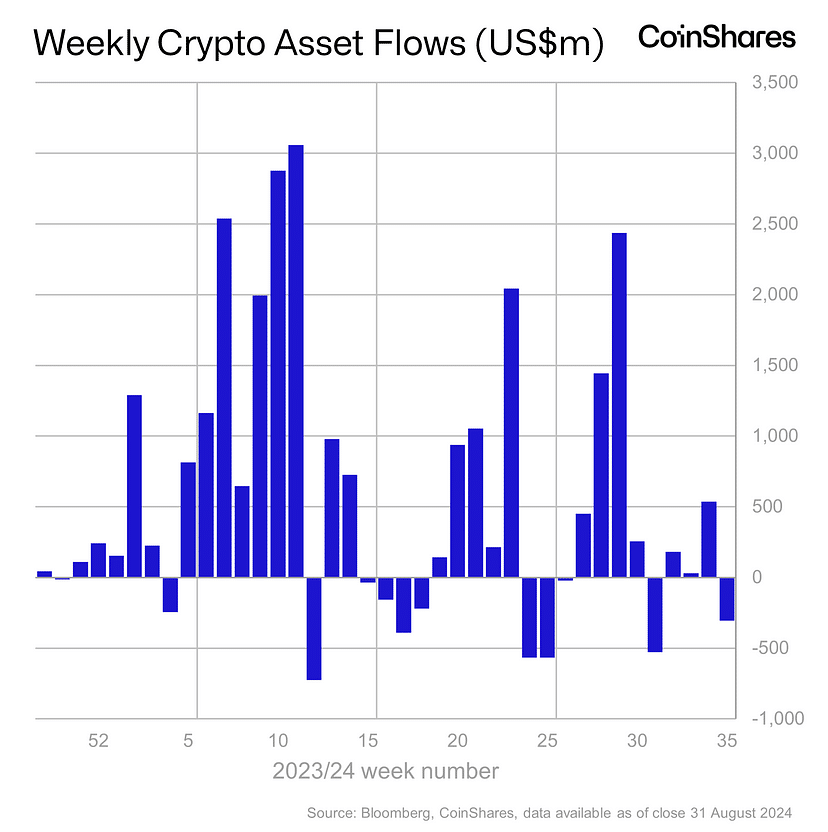

It appears that a pessimistic mood regarding cryptocurrencies has spread across multiple platforms and locations, since digital asset investment funds experienced a net withdrawal of approximately $305 million last week, as indicated by CoinShares.

In a September 2nd blog post, James Butterfill, the head of research at CoinShares, noted that the outflows seemed to be caused by stronger-than-anticipated U.S. economic data, which decreased the probability of a 0.5% interest rate reduction by the Federal Reserve.

“As the Federal Reserve moves nearer to a potential shift in its monetary policy, we anticipate the asset class will grow more responsive to changes in interest rate forecasts.”

CoinShares head of research James Butterfill

As a researcher examining global investment trends, I’ve found that the United States topped the list in outflows, with a significant sum of $318 million being withdrawn. Notably, Germany and Sweden followed suit, experiencing outflows of $7.3 million and $4.3 million respectively. Conversely, Switzerland and Canada reported modest inflows, with Switzerland recording an inflow of $5.5 million and Canada seeing a more substantial inflow of $13 million.

Bitcoin (BTC) experienced a significant drain of about $320 million, while short-term investment products based on Bitcoin attracted $4.4 million for a second consecutive week, marking their highest inflows since March. Conversely, Ethereum (ETH) faced outflows totaling $5.7 million, and trading activity remained sluggish, accounting for only 15% of the volume witnessed during the U.S. ETF launch period.

Despite the general downward trend, Solana (SOL) saw an influx of $7.6 million. Interestingly, blockchain stocks also witnessed a surge, drawing in $11 million, primarily towards investment vehicles centered around Bitcoin mining operations, as observed by Butterfill.

Earlier reports from crypto.news indicate that Bitcoin experienced a significant decline of nearly 10% in August, contrastingly, the Nasdaq 100 index saw an increase of more than 2%, and gold reached its highest point ever at $2,530. This unusual performance took place even though the U.S. dollar index dipped to $100.1, a decrease of over 6% from its peak this year. Analysts at Kaiko, a French blockchain firm, speculate that the drop in Bitcoin could be due to investor anxiety over decreasing liquidity within the Bitcoin market and mounting fears that governments may start offloading their Bitcoin holdings.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-09-02 13:28