Bitcoin‘s price has taken a nosedive to $101,579 today—down 3.5% in just a single day and a whopping 4.5% over the past week. And it’s not just a mild decline; nearly $1 billion in leveraged crypto positions were Liquidated into the ether across major exchanges. Yes, almost a billion dollars—an amount that would make most of us question our life choices.

This slippery slope coincided with a political soap opera of epic proportions—Elon Musk and President Donald Trump at each other’s throats like cats in a bag, setting markets on edge and scaring investors into the arms of… well, probably just less risky investments.

Nearly $1 Billion Liquidated as Market Reacts to Political Volatility

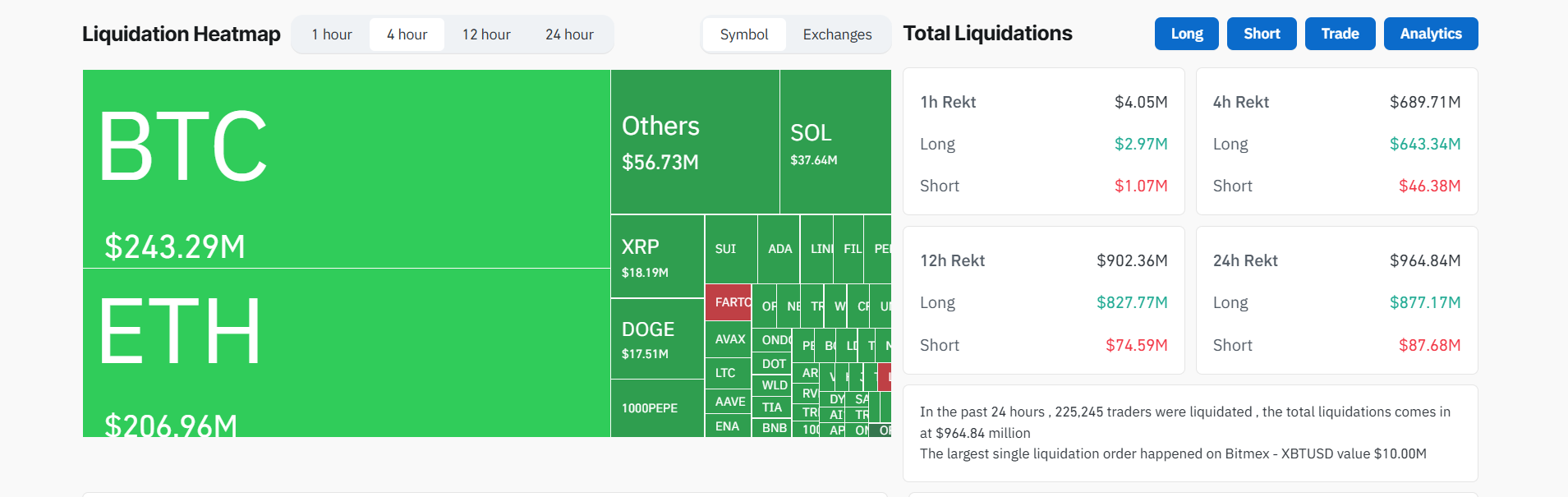

According to the liquidity detectives, a total of $964.84 million was wiped out in the last 24 hours. Of that, a car-wrecking $877.17 million were long positions—essentially investors betting the farm on Bitcoin rallying. Bitcoin itself lost $243.29 million in those liquidated bets, with Ethereum close behind at $206.96 million. Over 225,000 traders faced the digital equivalent of a slap across the face—liquidation style.

This sudden cascade of liquidations highlights something the market has known for some time—it’s feeling about as stable as a one-legged stool, especially with macro risks and domestic US political theatrics causing chaos in the world of digital assets.

Trump-Musk Feud Sparks Volatility, Because What Could Possibly Go Wrong? 🤡

As if the markets weren’t already spicy enough, along comes the Trump and Musk drama, like a fiery reality TV show you didn’t know you signed up for. Musk went on record criticizing Trump’s $1.6 trillion “One Big Beautiful Bill Act”—bitter words exchanged, dare I say, more heated than a family feud at a Sunday roast.

Musk also accused lawmakers of making the US look like a financial theme park, ballooning the deficit and slashing electric vehicle subsidies that Tesla secretly depends on. Naturally, Trump retaliated by threatening to snatch away all federal contracts from Musk’s companies—Tesla, SpaceX, and Starlink—causing Tesla stocks to slide 15%. Tesla’s price plummeted faster than a space rocket with a bad engine.

In turn, Musk suggested Trump might face impeachment and hinted at… well, some shady Epstein files—because why not throw more gasoline on this political bonfire?

Meanwhile, top White House aides convened moments of urgent whispering, probably debating whether to send Elon a strongly worded letter or just throw in the towel.

BREAKING: President Trump’s former White House Chief Strategist Steve Bannon calls for Elon Musk to be deported, per NY Times.

— The Kobeissi Letter (@KobeissiLetter) June 5, 2025

This celebrity-style clash threatens to destabilize everything from tech stocks to your favorite cryptocurrencies. Traders are rapidly selling off, clutching their digital pearls and hoping for the best.

Despite other signs of optimism—like institutions finally jumping on the crypto bandwagon and anticipation of rate cuts—this political melodrama is casting a long shadow over the market’s sunny disposition.

Can Bitcoin Keep Its $100,000 Crown or Will It Bow Out? 👑

In the world of numbers and imaginary digital coins, Bitcoin is delicately balancing just above a *very* psychological support level at $100,000. Cross below that, and we could be looking at a refreshing dip into the $95,000–$98,000 range—probably in time for a brief market tantrum.

If leveraged traders keep liquidating their long shots like there’s no tomorrow, Bitcoin might find itself testing the depths and discovering new lows, as low as $95,000 or possibly even $98,000 before finding some support—or a sympathetic shoulder to cry on.

#Bitcoin | The daily RSI (that’s one fancy way of saying “Are we overbought or oversold?”) is pointed downward, but with a bit of luck, we might see a reversal soon. Or not. Who knows!#BTC

— Kevin Svenson (@KevinSvenson_) June 6, 2025

The Trump-Musk feud has revealed just how intertwined crypto markets have become with actual politics and traditional finance—think of it as Bitcoin’s version of a daytime soap. Apparently, billionaires’ squabbles and legislative threats can whip the volatile beast into a frenzy, proving once again that in crypto, anything can happen—especially drama.

Until the political storm blows over—or some new catalyst appears—Bitcoin’s fate remains as fragile as a house of cards in a hurricane. Stay tuned, and maybe invest in a decent helmet.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2025-06-06 04:01