As an analyst with a background in cryptocurrency and experience following the Mt. Gox saga, I believe that while the potential selling pressure from Mt. Gox creditors receiving their long-awaited payouts cannot be entirely ruled out, it may not lead to a catastrophic market crash.

Some early Bitcoin adopters, who had yet to pay back their debts after a decade, might not have sold off their Bitcoins in large quantities as was once feared.

A dark cloud casts an ominous shadow over the cryptocurrency market, as memories of a failed crypto exchange from more than a decade past linger ominously.

As a crypto investor, I’ve witnessed firsthand how Mt. Gox was once a dominant player in the Bitcoin market, processing over 70% of all global transactions. Regrettably, its past glory came crashing down following a series of daring hacking incidents that led to the loss of approximately 850,000 BTC.

In 2014, the failing Japanese Bitcoin trading platform declared bankruptcy, leaving its customers, a significant number of whom had embraced Bitcoin early on, without receiving their payments.

As a crypto investor, I can tell you that the process of retrieving some of the stolen Bitcoins is a tedious task. Approximately 142,000 BTC have been successfully recovered so far, which will then be dispersed among the affected parties.

Though victims won’t fully recover their losses, they can find solace in the fact that Bitcoin’s value has significantly increased over the past ten years. In monetary terms, their initial investment still yields a profit, even if it’s not as substantial as it could have been.

What’s more, the BTC hard fork in 2017 also means they’ll be entitled to a chunk of Bitcoin Cash.

The creditor’s compensation is set to be settled by October, bringing an end to a protracted dispute that has been plagued by numerous postponements. However, there are growing concerns among certain financial analysts regarding the current state of this process.

‘Beware of Mt. Gox’

As a crypto investor who once held an account with Mt. Gox, I’ve been keeping an eye on the platform’s progress in processing our claims through the dedicated subreddit we set up for this purpose.

On April 22, some accounts saw a great deal of buzz as updates were rolled out. Certain individuals have already received their advance repayments in the form of cash, while others have been informed of the amount of Bitcoin (BTC) and Bitcoin Cash (BCH) they will receive soon.

As a crypto investor, I’ve recently come across an intriguing perspective from K33 Research. They believe that the 142,000 BTC, approximately worth $9 billion currently, could negatively impact the market in the near future. In simpler terms, this large stash of Bitcoin might put downward pressure on prices.

There’s a concern that once people obtain their cryptocurrency again, they may quickly convert it into traditional currency, leading to increased selling and market volatility.

But there are a few things worth bearing in mind here.

The Mt. Gox Creditor with the largest outstanding debt has announced they have no intention of selling the Bitcoins they are due to receive.

As a crypto investor, I understand that processing a large number of transactions comes with its own set of administrative challenges. Consequently, it’s unrealistic to expect all transactions to be completed in one swift go. Additionally, I’ve noticed that customers from certain regions have received their initial cash payouts ahead of others.

As a crypto investor, I’ve noticed that Bitcoin’s daily trading volumes usually exceed $10 billion. This gives me confidence that the market can handle selling pressure. However, if there’s confirmation of payouts from major players or events, it could potentially unsettle traders.

One important consideration is this: A significant number of people expecting a Bitcoin payout held belief in it prior to its widespread popularity.

Hold or sell?

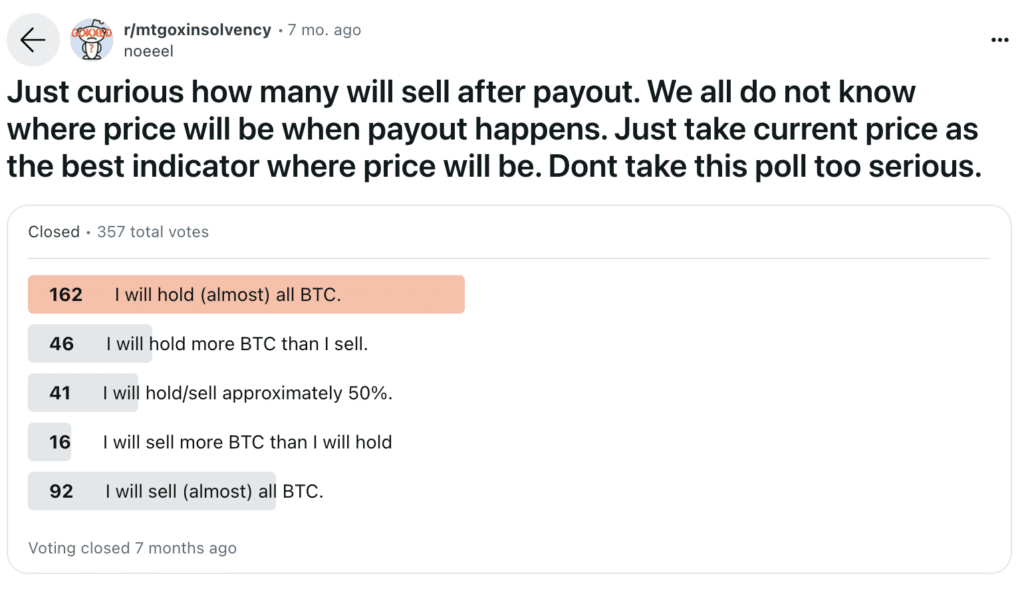

Towards the end of last year, an intriguing survey conducted on the Mt. Gox Reddit forum shed light on the thoughts of ordinary creditors.

Among the 357 crypto investors surveyed, only a quarter of us indicated that we plan to sell nearly all of our Bitcoins. Around eleven percent of us shared our intention to exchange half of the Bitcoin we acquire for traditional fiat currency.

But by far, the biggest bloc of voters — 45% — vowed to hold on to their digital assets.

“I held for 10 years. I don’t mind holding for another 10,” one quipped.

They have earned sufficient profits from Bitcoin and are not motivated by financial gains to sell. Instead, they find enjoyment in watching Bitcoin’s development and being involved in it.

Certain individuals indicated a wish to withdraw from the cryptocurrency market with their recent earnings, and instead consider spending the funds on vacations or exploring alternative investment options, such as rival digital currencies.

End of an era

In dollar terms at least, Mt. Gox remains the biggest crypto heist in the industry’s history.

Two Russian citizens have been accused by the U.S. of laundering stolen Bitcoin from a daring cyberattack, but the true identities of other individuals implicated in the crime remain concealed.

Despite the vast transformation of the market since Bitcoin’s exchange collapsed in February 2014, when its value was only $550, some might contend that historical patterns persist.

Due to the sudden halt of withdrawals and subsequent collapse of several trading platforms, a large number of creditors have lined up.

As a crypto investor who was unfortunate enough to have my funds tied up in FTX when it collapsed, I’m among over 100,000 individuals eagerly waiting for compensation. Fortunately, the recent surge in cryptocurrency valuations has brought some optimism – potentially allowing us to receive more than our original claims.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-05-06 14:53