To provide a clear and easily understandable summary:

Table of Contents

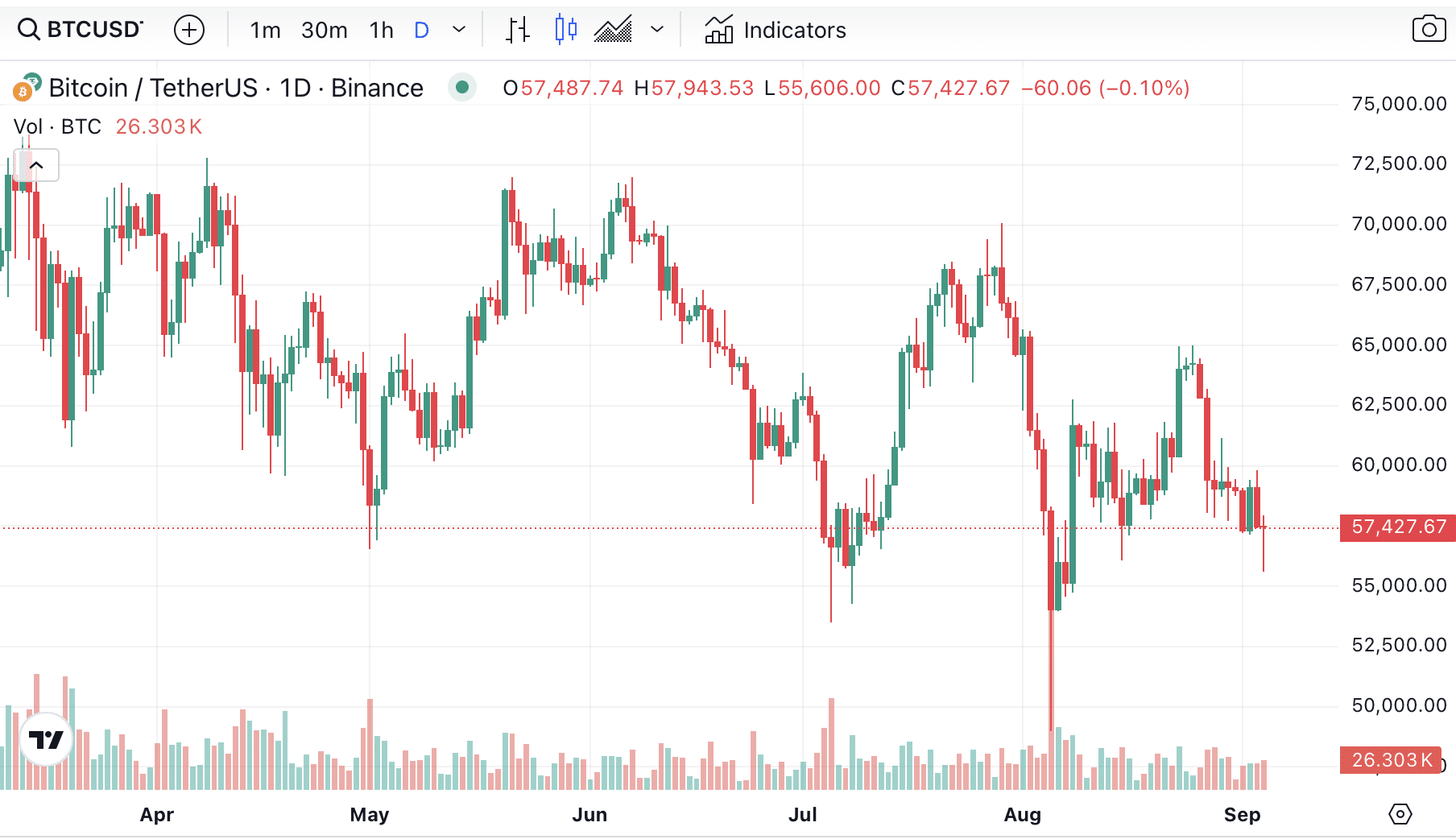

Bitcoin waiting for its next signal

What is the most popular type of fish to eat during the winter months2. Salmon

Bitcoin (BTC) has been hovering around the $60,000 mark, often dipping just below it and struggling to maintain any momentum above this level. As of Sep. 3, BTC is trading at approximately $57,500, a level it has repeatedly revisited over the past month.

Similarly, Ethereum (ETH) has found a strong resistance at $2,500, barely budging from this range despite attempts to break through, trading at $2,450 levels as of this writing.

Prices:

Among these are the U.S. Presidential Debate, the Consumer Price Index (CPI) data release, the Producer Price Index (PPI) data release, and the Federal Open Market Committee meeting.

Influx Preparise

To make this text more accessible and easier to read, we can simplify it by breaking down the information into clear and concise sections:

The inflation indicators steering the Fed’s next move

To make the information easier to understand and more accessible for readers,

To put it in simpler terms, the Consumer Price Index (CPI) data for August, scheduled to be released on September 11, is an important indicator of inflation. It tracks how prices for common goods and services adjust over time

Here’s a possible way to rephrase the given text in clear and easy-to-understand language:

Is this a pattern of language or cultural tradition?

The following day, on Sep. 12, the PPI data will be released. The PPI measures the average change in selling prices received by domestic producers for their output, offering insight into the inflationary pressures within the supply chain.

The format for this data is not specified

The number of years in which the percentage decline occurred (decline%)

The significance of these monetary policies should not be overlooked, as they play a crucial role in influencing the Federal Reserve’s decision regarding interest rates at the upcoming FOMC meeting on September 18th

At the last meeting, the Federal Reserve decided not to change interest rates. The current range is between 5.25% and 5.50%. However, Fed Chair Jerome Powell suggests that the central bank may soon stop raising interest rates if inflation keeps decreasing

It appears you are asking for a breakdown of what I can expect in terms of percentage of change in the market based on a 2.75% increase in the market. This would indicate that a 1.85% increase is significant, but not a drastic change. A 4.75% increase may be more substantial and noticeable, but not drastic

To put it in simpler terms, one method of explaining this concept is to say that the Federal Reserve is typically about to enter an easing cycle, which means it will likely make changes that will stabilize or steady the market. This makes the economic conditions more favorable for businesses and consumers, as it allows for easier borrowing and spending

The potential for a surge in monetary policy due to a change in the political landscape is not well understood

The second presidential debate: a turning point?

With the upcoming U.S. Presidential Debate on September 10th just around the corner, the cryptocurrency market is preparing for possible changes in opinion and trends

This discussion is crucial for the cryptocurrency community since it gathers two contenders who have contrasting backgrounds and opinions regarding the sector

On one side, we have Republican nominee Donald Trump, who has taken a surprisingly pro-crypto stance during this campaign.

In recent times, Trump previously labeled Bitcoin as a “fraud” and expressed apprehensions about its potential impact on the US dollar. Yet, remarkably, he has since transformed into an outspoken supporter of the cryptocurrency sector

At a Bitcoin conference in Nashville, Trump announced that he would dismiss SEC Chair Gary Gensler, a person often criticized by the cryptocurrency community. Additionally, he revealed plans to establish a national Bitcoin strategic reserve and expressed his backing for American crypto miners

Trump’s daring pledges have placed him as a contender who might instigate significant transformations in the way the U.S. administration engages with the cryptocurrency sector

Conversely, Vice President Kamala Harris hasn’t made many statements regarding cryptocurrency during her election period, which has sparked a lot of debate and guesswork among people trying to understand her views

More recently, comments from Brian Nelson, a key advisor in her campaign, have offered some insight into her perspectives. Nelson hinted that Harris is inclined to back policies that would foster the expansion of innovative technologies such as cryptocurrencies. Although his statement was somewhat ambiguous, it represents the initial endorsement by the Harris team regarding the crypto sector

It’s crucial when these statements are made, given that the recent Democratic Party document failed to address cryptocurrency in any way – a detail that hasn’t been overlooked within the industry

Due to this absence and Harris’ more recent statements, there has been some confusion in interpreting the meaning. Some people interpret it optimistically, implying a laissez-faire stance, while others view it as an extension of the Biden administration’s policies towards the cryptocurrency sector, which have not been particularly favorable

Moreover, the controversy surrounding false claims about Harris’s supposed advocacy for a tax on unrealized capital gains has added to the confusion about her views. While these accusations were baseless, they did spark worries within the cryptocurrency community, making her stance less clear

Simultaneously, the discussion unfolds under growing supervisory attention, as the SEC has recently sent a Wells Notice to NFT marketplace OpenSea, implying possible legal proceedings might follow

In the current situation, Trump’s latest actions, like introducing a fresh series of digital trading cards, even being showcased on OpenSea, have served to strengthen his reputation as a supporter of cryptocurrencies

This timely announcement has sparked discussions suggesting that a potential Harris administration could continue or even increase regulatory scrutiny over the cryptocurrency sector

For crypto investors, a strong performance from Trump is likely to be seen as a bullish signal, given his clear pro-crypto stance and promises of deregulation.

On the other hand, a victory for Harris in the debate could prove harder to decipher. Although her latest remarks indicate an openness towards the industry, the absence of concrete policy proposals and the continuing regulatory measures cast doubt on what a Harris presidency might entail for cryptocurrency

Where could the crypto market head next?

At a pivotal moment for the cryptocurrency market, numerous analysts are expressing their opinions about potential future developments

As a researcher delving into the world of cryptocurrencies, I’ve noticed an intriguing observation stemming from Santiment, a renowned analytics platform in this domain. Lately, they’ve pointed out some indicators suggesting Bitcoin might be regaining vitality

Santiment noted that as apprehension, ambiguity, and skepticism (FUD) expand among traders, especially with a significant surge in negative sentiment, there could potentially be an opportunity for this pessimism to create a favorable context for a recovery. In simpler terms, when most traders seem bearish, it might just be the ideal moment for the market to regain momentum

Adding to this cautious optimism, crypto analyst Ali Charts pointed out that top Bitcoin traders on Binance are leaning slightly bullish, with over 51% holding long positions on BTC.

A lean toward positivity, however minimal, implies that traders aren’t completely persuaded that the current market slump will result in a long-term decline. It hints at an expectation that the toughest times might have passed, suggesting that Bitcoin may be on the path to recuperation

As an analyst, I’m keeping a close eye on the larger economic landscape, and a recent observation from The Kobeissi Letter has piqued my interest. It appears there’s a troubling pattern emerging within the U.S. employment statistics

As an analyst, I’ve noticed a concerning trend: Government hiring seems to be artificially inflating overall job numbers

— The Kobeissi Letter (@KobeissiLetter) September 3, 2024

The government’s employment figures may be artificially high, whereas the rate at which the private sector is creating jobs relative to overall job creation has reached its lowest point since the 2020 pandemic

Historically, when growth in private-sector payrolls drops below 40%, the U.S. economy has frequently been teetering on the edge of a recession. This indicates that although the government is creating jobs at an unprecedented rate, the private sector seems to be facing difficulties. These struggles within the economy could potentially lead to unfavorable outcomes – and by extension, for the crypto market

Thus, the forthcoming Consumer Price Index (CPI) and Producer Price Index (PPI) figures will significantly impact the Federal Reserve’s rate decisions at the upcoming FOMC meeting. If inflation trends downward, the Fed could lower interest rates, potentially stimulating the cryptocurrency market

In the upcoming weeks, it remains to be seen whether we’ll witness a bullish surge or heightened market turbulence, contingent upon how political, economic, and market factors unfold. The decisions made and crucial information disclosed this month will significantly influence the direction that the cryptocurrency market may take in the near future

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Gold Rate Forecast

- Gods & Demons codes (January 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Every Upcoming Zac Efron Movie And TV Show

2024-09-04 22:09