Ah, the Federal Reserve—the grand puppet master of the U.S. economy, now apparently moonlighting as the crypto world’s most unpredictable frenemy. As Chair Jerome Powell prepares to drop his latest policy bombshell, Bitcoin investors are clutching their digital wallets, wondering if this is the moment the Fed finally pulls the rug out from under their beloved decentralized currency. 🪙💨

Quantitative tightening, or QT for those who enjoy acronyms as much as they enjoy financial anxiety, is the Fed’s way of saying, “Let’s suck some money out of the economy and see what happens.” It’s like turning off the tap in a bathtub, except the bathtub is the global financial system, and the water is your life savings. 🛁💸

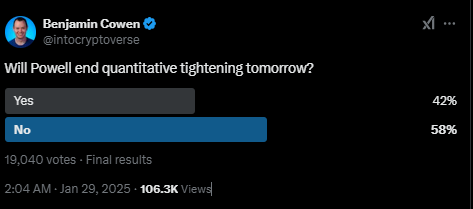

In a poll conducted by crypto analyst Benjamin Cowen on X (formerly known as Twitter, for those of you still catching up), 42% of respondents optimistically believe QT will end, while 58% are bracing for more financial tightening. It’s like a coin toss, except the coin is Bitcoin, and it’s currently teetering on the edge of a cliff. 🪙🦅

Meanwhile, Bitcoin’s price has been playing a high-stakes game of limbo, hovering just above $100,000. But technical indicators like the Relative Strength Index (RSI) are whispering sweet nothings about an impending drop. Even the TD Sequential indicator has flashed a big, fat “sell” signal, suggesting Bitcoin might soon be taking a nosedive to $96,000. 📉💔

To make matters worse, Bitcoin’s price chart is currently rocking a bearish flag pattern, which is basically the financial equivalent of waving a white flag. Analysts are also pointing out that the cryptocurrency is struggling to break through the $103,400 resistance level, which is like trying to climb a greased pole while wearing roller skates. 🐻🚩

All eyes are now on the Federal Open Market Committee (FOMC) meeting, where the Fed will decide whether to be Bitcoin’s fairy godmother or its wicked stepmother. If they lower interest rates or loosen monetary policy, Bitcoin could soar past $110,000. But if they go full hawk mode, traders might start dumping Bitcoin faster than a hot potato, sending prices plummeting to test support levels. 🦅📉

So, will the Fed send Bitcoin crashing below $100,000? Or will it defy gravity once again? Stay tuned, folks. The only thing certain in this wild ride is uncertainty. 🎢🤷♂️

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-29 23:01