As a seasoned researcher with a penchant for understanding the intricacies of the crypto world, I find myself captivated by the unique proposition that wstETH presents. With a background steeped in blockchain technology and decentralized finance (DeFi), I’ve witnessed the rise and fall of numerous tokens, each promising a slice of the digital gold rush.

Wrapped Staked Ether (wstETH) is currently trading at $3,982.77 – a 7.8% surge in a day, while Ethereum (ETH) is priced at $3,359.14. That’s a difference of $623.63, and here’s why.

The history of wstETH dates back to the launch of the Lido protocol, which allows users to stake their ETH and receive stETH in return. Staking ETH means locking it up to help secure the Ethereum network, and in return, stakers earn rewards.

Yet, it’s not straightforward to trade or use stETH within DeFi. To address this issue, Lido introduced wstETH, which is essentially a “wrapped” form of stETH. This wrapped version continues to provide staking rewards while offering more liquidity and versatility for use across various DeFi platforms.

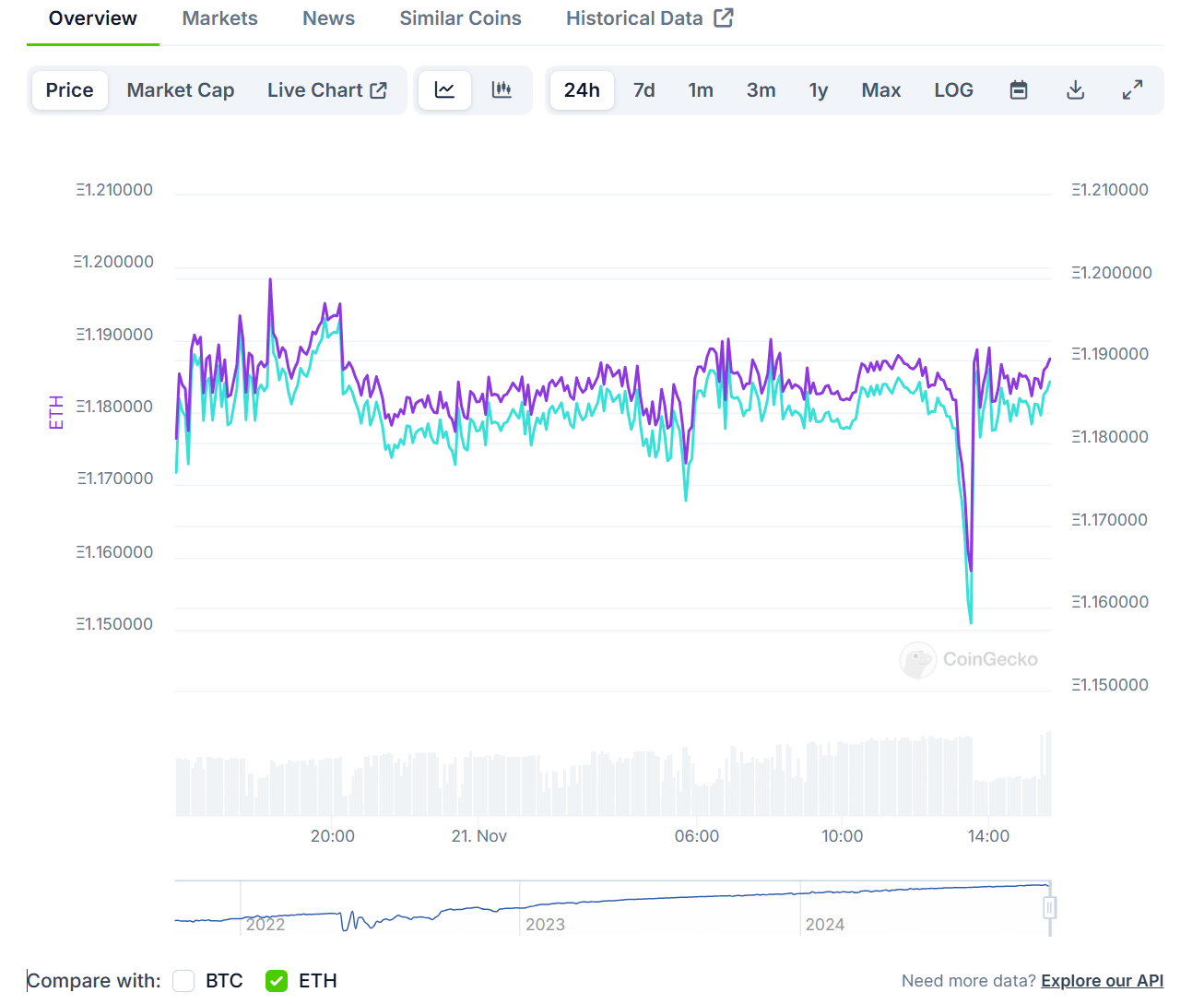

As reported by CoinGecko, the value of one unit of stETH is almost equivalent to that of one unit of ETH, showing a minor fluctuation of around 0.03%.

Glancing at the overall scope, Ethereum boasts a market capitalization of approximately $405 billion, placing it among the most substantial cryptocurrencies globally. In contrast, wstETH’s market cap stands at only $14.42 billion.

This is logical since wstETH merely symbolizes the ETH that’s been staked using the Lido protocol. It’s not intended to rival Ethereum’s vast scope, but rather to cater to a particular need for stakers.

As an analyst, I’ve noticed a significant disparity between the 24-hour trading volumes of Ethereum (ETH) and wstETH. ETH boasts a massive volume of $6.5 billion, while that of wstETH stands at a mere $50 million. This can be attributed to the fact that ETH is extensively traded across numerous platforms, whereas wstETH is predominantly utilized by individuals engaged in DeFi activities such as borrowing, lending, or farming additional rewards.

Essentially, wstETH is an appealing choice for individuals who wish to stake their ETH while also receiving rewards. It offers the unique advantage of allowing you to use your ETH holdings freely, unlike traditional staking where your ETH might be locked away. This dual functionality is one of the reasons why it’s gaining traction in the market, although it may not yet have the same level of trading volume as Ethereum itself.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-21 19:32