As a researcher with extensive experience in the cryptocurrency market, I’ve closely observed the market’s recent trends and identified some promising assets to watch this week. Last week, we saw a mild recovery in the market, with Bitcoin (BTC) eventually regaining lost ground and leading other altcoins to follow suit.

Last week, the cryptocurrency market showed signs of improvement after an initial rough patch for Bitcoin (BTC). Although Bitcoin suffered some early losses at the beginning of the week, it eventually regained some ground, boosting the overall market sentiment.

Certain altcoins bounced back strongly, contributing to a rebound of $70 billion in the overall cryptocurrency market. Consequently, the market closed the week with a total capitalization of $2.21 trillion.

Based on their strong showings over the past week, here are the cryptocurrencies worth keeping an eye on as we enter the new one.

XLM reclaims $0.1 in 12% gain

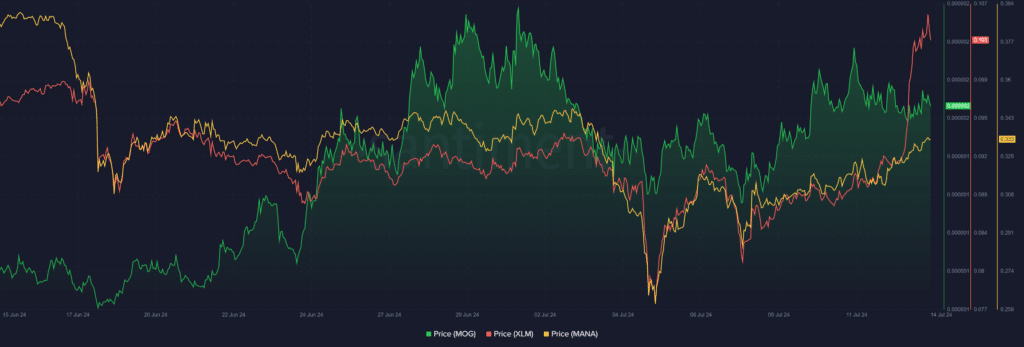

On July 7, Stellar (XLM) experienced a significant decline of 7.40%, joining the list of other cryptocurrencies affected by the market downturn. However, it managed to bounce back within five days, registering modest gains and reaching a slightly positive position by July 12.

It’s intriguing that XLM‘s price surge began on July 13, mirroring XRP‘s trend. On this day, XLM experienced a notable increase of 12.05%. This allowed it to regain the $0.1 threshold for the first time in over a month.

The weekly volatility of Stellar, as indicated by Santiment’s data, has reached a one-month high of 0.066. Moreover, the MACD line of this asset has surpassed its Signal line, signaling a bullish trend. However, it is essential for investors to keep an eye on the resistance level at $0.1096, which corresponds to the 38.2% Fibonacci retracement mark.

MOG retests ATH

Last week, Mog Coin (MOG) experienced significant downward pressure at its onset, plummeting by 20.4% on July 7. This decline was driven in part by Bitcoin’s selling pressure, which intensified due to the German government’s actions. This represented MOG’s most substantial intraday loss in close to four months.

Over a three-day span from July 8 to 10, MOG crypto asset recouped its previous losses, experiencing a notable surge of 28.8% in value. Following this period, the asset exhibited modest fluctuations with brief dips and rises for the next three days.

Mog Coin ended the week with a modest gain of 3.5%. Throughout this time frame, it attempted to challenge its record high of $0.000002129, but encountered resistance at $0.0000019. Looking ahead, Mog Coin aims to reverse the upper Bollinger Band at $0.000001925 into a support level. This potential shift could provide an opportunity for another attempt at reaching its all-time high.

MANA struggles at 20-day EMA

On July 7, Decentraland (MANA) experienced a 6.10% decrease in value. However, it managed to regain this loss throughout the remainder of the week. Notably, MANA posted six successive daily price increases from July 8 to 13.

The asset crossed above its 20-day moving average (EMA), indicating a shift in market sentiment towards bullishness. Nevertheless, the relative strength index (RSI) indicates that the uptrend may be weakening, leading some traders to anticipate a reversal and test the 20-day EMA as resistance again.

Keep an eye on this level, as a decrease to this point could trigger bearish momentum for MANA. If that happens, the cryptocurrency may find support at the Fibonacci 0.236 level, which is around $0.3085. This area is crucial in preventing potential losses below the significant psychological barrier of $0.30.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-14 18:34