In simpler terms, Ripple (XRP) may experience a considerable increase in its price due to both underlying and technical factors during this bull market phase.

On Monday, Ripple (XRP), the third-largest digital currency, was priced at $2.45 as Congress met to verify Donald Trump’s presidential victory. Since its September low, it has experienced a significant surge of 375%. It currently hovers just under last year’s peak of $2.90.

As a hopeful crypto investor, I’m eagerly awaiting the formalization of Trump’s election, set for January 20th. This significant milestone brings us one step closer to seeing the President-elect’s commitment to positioning the U.S. as a significant player in the cryptocurrency sector become reality. With his pledge to foster an environment conducive to friendly regulations, I can’t help but feel optimistic about the future of my investments and the broader crypto industry.

One possible action from his administration could involve seeking approval from the Securities and Exchange Commission for the launch of spot exchange-traded funds (ETFs). As it stands, Bitcoin and Ethereum spot ETFs have amassed a combined total of approximately $124 billion in assets.

It seems that many Polymarket users anticipate a Ripple Exchange Traded Fund (ETF) could receive approval before the end of this year. Based on a survey with approximately $2,700 in assets, there’s roughly a 71% probability that an ETF tied to XRP may be approved by the end of the year. This possibility appears reasonable, considering that XRP is one of the oldest cryptocurrencies and currently holds the third-largest market capitalization, valued at more than $140 billion.

Trump’s incoming administration might favorably impact Ripple, potentially owing to anticipated changes at the Securities and Exchange Commission (SEC). The current SEC Chair, Gary Gensler, who has been vocal about his skepticism towards cryptocurrencies, is speculated to step down. It’s likely that he may be replaced by Paul Atkins, who has a more open stance on digital assets.

Previously supportive regulator, Atkins, might choose to dismiss some legal actions against digital assets that the agency has initiated. Similarly, former President Trump had made promises to reduce regulations in crucial sectors, such as cryptocurrency.

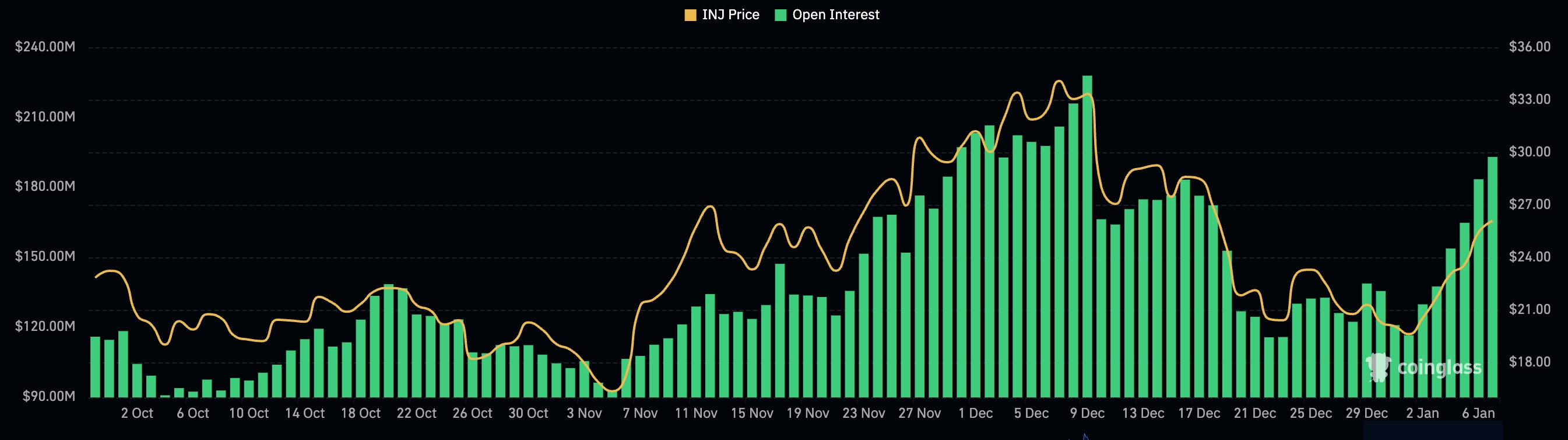

Currently, the open interest for XRP in the futures market is on the increase, currently standing at a peak of $192 million – the highest it’s been since December 9.

XRP price has formed a highly bullish pattern

The daily graph shows that XRP appears to be forming a robust bullish structure, hinting at a possible price increase over the next few weeks.

The token’s price movement has formed a bullish pennant, starting at $0.49 and peaking at $1.8958, with the price currently consolidating within a triangular pattern. This pattern is nearing an important intersection point.

Over the past period, XRP consistently stays above both its 50-day and 200-day moving averages, as these lines intersected in a positive indication on November 12th.

Based on the current trends, it appears that the price of XRP is expected to keep climbing, with the next significant barrier at approximately $2.90 – a peak from 2024. Overcoming this threshold might lead to further growth towards the psychologically important goal of $5.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-06 20:14