As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations, and the recent bearish trend in cryptocurrencies is no exception.

Over the past two weeks, bearish pressures have consistently influenced the crypto market, causing it to take a significant hit. The total market capitalization of cryptocurrencies plummeted by an alarming $350 billion, representing a 10.4% decrease that brought the final figure to around $2.15 trillion at the end of the week.

Here are our picks for top cryptocurrencies to watch this week:

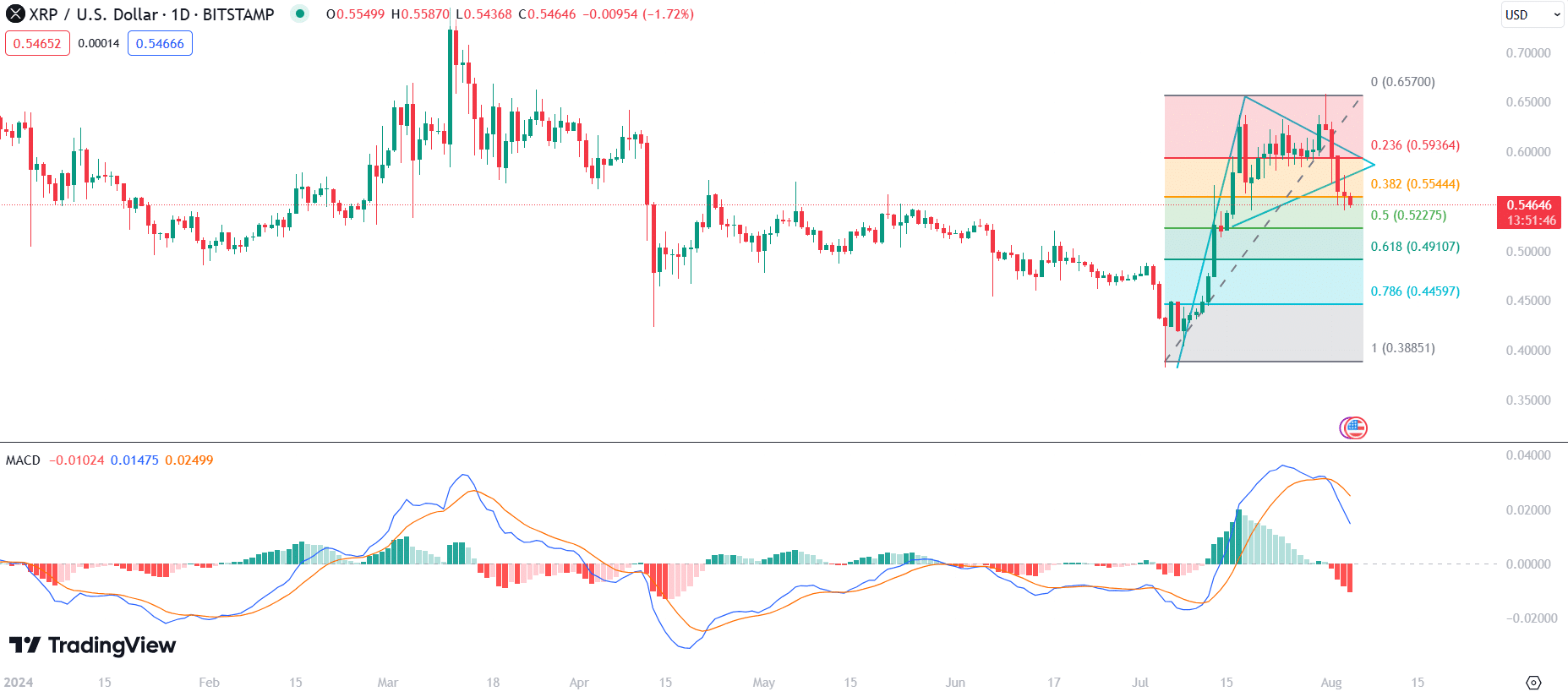

XRP breaks below bull pennant

XRP (XRP) began the week with a bullish push to a four-month high of $0.6580 on July 31.

Despite the wider market experiencing a downturn, XRP managed to correct its gains. It had shaped a bullish pennant during the consolidation period from July 18 to 30.

At first, the shape of the pennant seemed to imply that the upward trend from July 7 to July 17 would persist. However, on August 2, the asset fell below the pennant as it plummeted beneath $0.55, indicating a change in momentum towards bearishness. As a result, XRP closed last week with a decline of 6.5%.

Based on the daily chart analysis, XRP has dipped beneath the 0.382 Fibonacci retracement level at approximately $0.5544. If the bearish trend persists, XRP may experience a further decrease, potentially reaching the 0.618 Fibonacci level or around $0.4910. This area could act as a crucial support for XRP, preventing it from falling to levels last seen in early July.

Currently, the 0.5 and 1.618 retracement points are possible areas where XRP might find temporary support. If it manages to hold steady at these spots, there’s a possibility for a price reversal. But if bearish forces remain strong, XRP may keep on moving downwards.

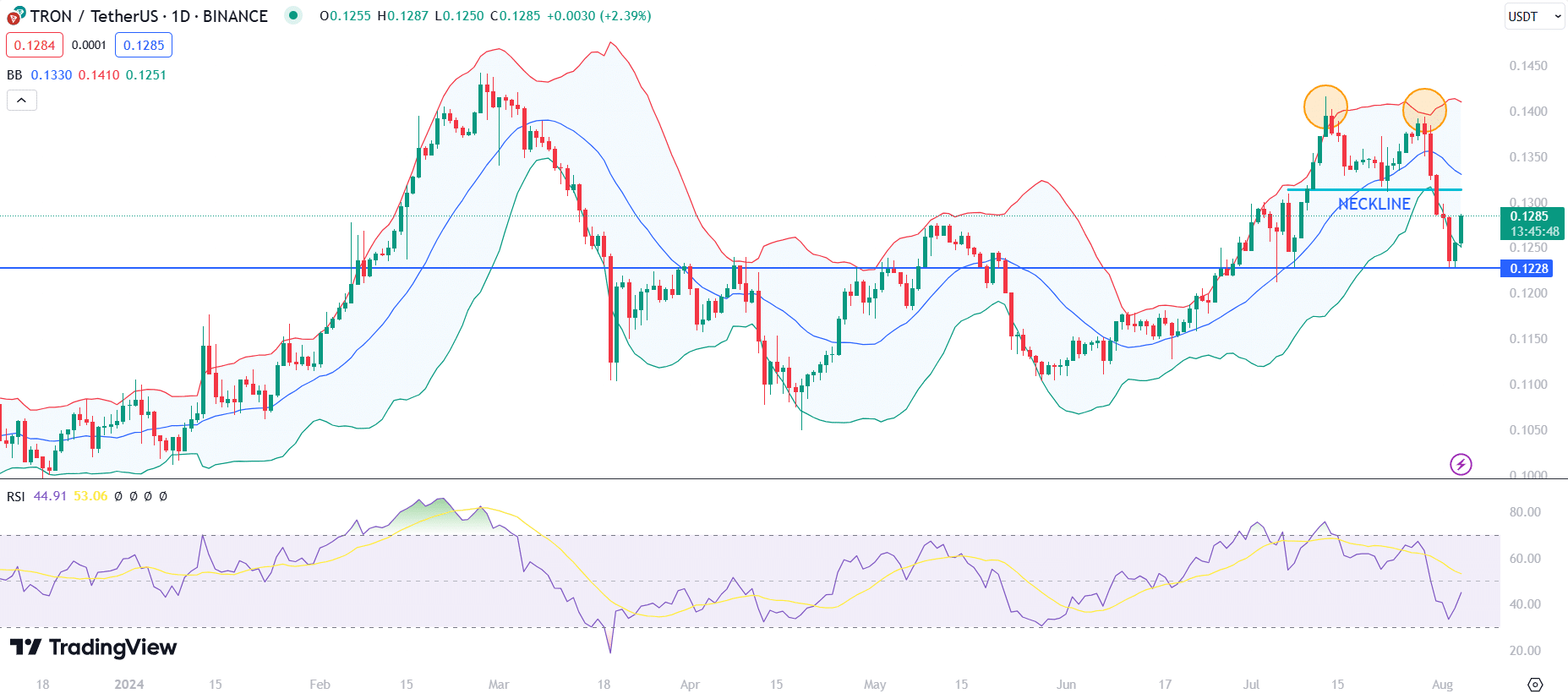

TRX suffers double top declines

Tron (TRX) kicked off the week on an upward trend, but its peak at $0.1394 created a bearish double-top formation in the process. This event occurred near the upper Bollinger Band level ($0.1397), further supporting the impending price correction.

After the emergence of a double top formation, I observed that TRX dipped below the neckline, validating the pattern and leading to a substantial drop to a three-week low of $0.1228. Yet, this level proved to be strong support for TRX, suggesting it might be readying for a rebound.

As a crypto investor, I’ve noticed that the current market recovery seems to be pushing the price towards the center of the Bollinger Band. This area, specifically around $0.1330, functions as a short-term resistance due to it aligning with the 20-day Simple Moving Average (SMA).

Keeping an eye on TRON’s progress is crucial, as it recently bounced from its support level at $0.1228 and currently trades around $0.1285. If TRON manages to surpass its previous resistance-turned-support (neckline) level again, this could signal a shift in the bearish trend towards a more bullish outlook, potentially leading to further increases.

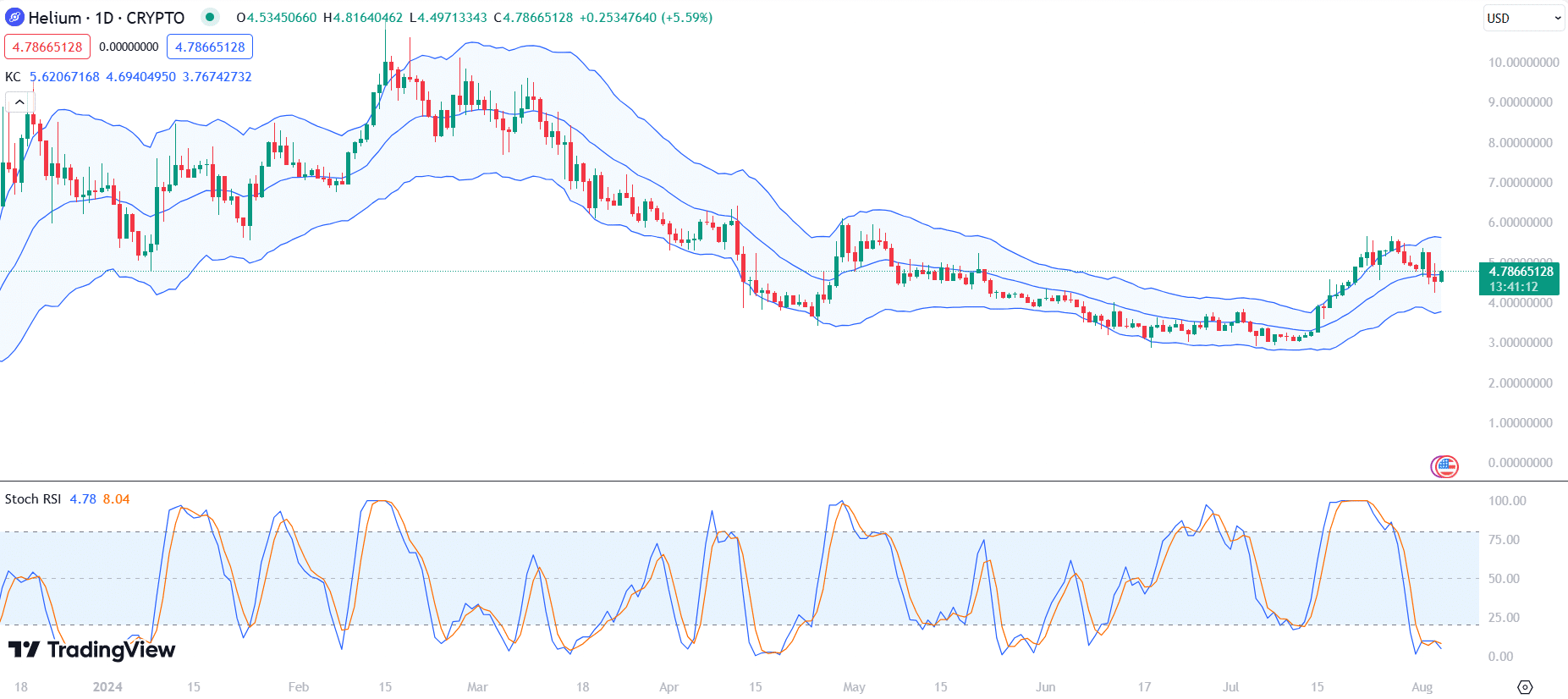

HNT slumps 18%

Last week, Helium (HNT) began with a bearish trend, experiencing a series of four daily decreases in a row. On August 1st, there was a significant 8% increase in its value during the day, but this positive momentum was quickly reversed by a steep 11.47% drop on the following day.

HNT ended the week with an 18% slump. Moreover, chart data confirms that Helium currently trades near the middle line of the Keltner Channel (KC).

Instead of the Stochastic RSI signaling HNT is oversold, it shows that selling pressure might be excessive. The Stochastic RSI values are approximately 4.78 for the %K line and 8.04 for the %D line, implying a possible reversal may occur soon due to potential reduction in selling pressure.

Keep an eye out for possible backing near the midpoint of the KC line at approximately $4.69. If Helium maintains its position above this point and the Stochastic RSI starts climbing, it might signal a good buying chance.

If we drop below this point, it might trigger additional falls that could take us down to around $3.76, marking the lower end of our Key Support (KC) boundary.

If Helium Network Token (HNT) manages to pick up speed again and approach the upper limit of its key resistance (KC), it will have to go above $5.62 to indicate a robust bullish phase.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-08-04 15:46