Amid the swirling dance of market forces, Ripple has found a new partner in BNY Mellon, the grand old bank of Wall Street, to custody the reserves of its U.S. dollar-pegged stablecoin, RLUSD. This strategic alliance, like a well-choreographed tango, has set the stage for a potential breakout in XRP’s price, which is now testing the $2.40 resistance level. 🎶

With the charts hinting at a bullish waltz and the market humming with optimism, the crypto community is on the edge of their seats, waiting to see if this double dose of news will propel XRP to new heights. 🚀

XRP Price Climbs Toward $2.40 Amid Bullish Technical Setup

The XRP price has surged to test the $2.40 resistance level, a move that seems almost poetic in its timing. The 0.382 Fibonacci level at $2.268, a pivotal area not revisited since early May, has been reclaimed, signaling a potential continuation toward the $2.70 mark. If momentum holds, XRP could be on its way to a grand finale. 🎉

On the 4-hour chart, XRP’s technicals are a symphony of bullish signals. The 20-period EMA has crossed above the 50, 100, and 200-period EMAs, a clear sign that buyers are in control. XRP is trading along the upper Bollinger Band, a dance that suggests rising volatility and a potential breakout. 🕺

From a broader perspective, XRP’s daily and weekly charts suggest a confirmed reversal, supported by a higher low at $2.06 and a sustained break above a descending trendline that has capped prices since February. If XRP can secure a weekly close above $2.70, it could open the door to the $3.00 to $3.40 zone. However, a failure to hold above $2.30 could lead to a short-term pullback toward the $2.10 demand level. As of the latest market data, XRP is holding steady just under the $2.40 level, with traders watching for the next move. 🕵️♂️

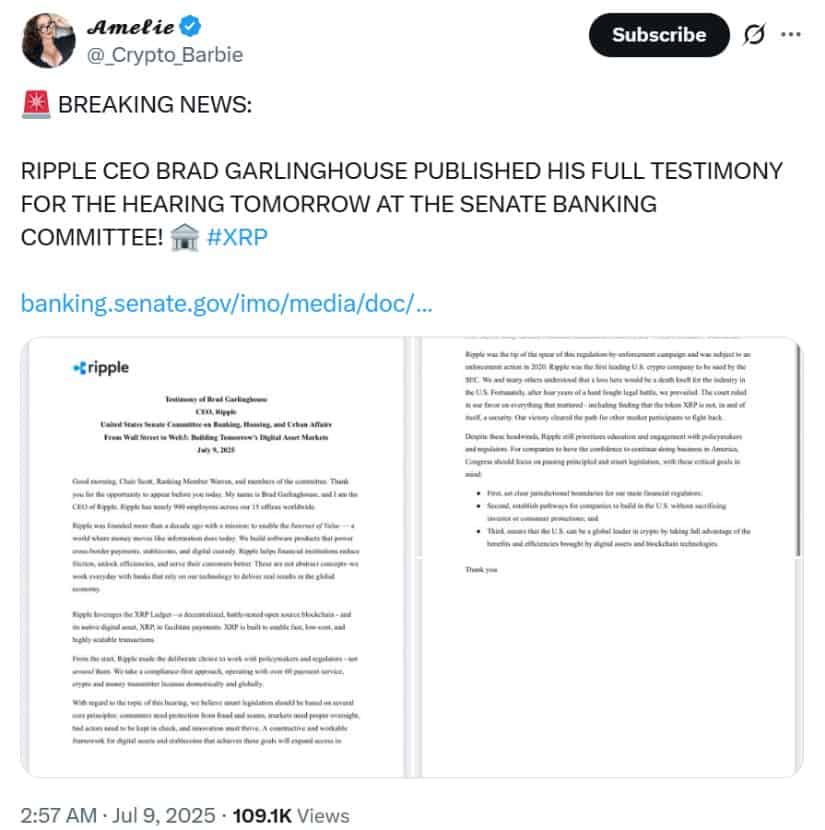

Ripple CEO Urges Regulatory Clarity During U.S. Senate Testimony

The XRP price rally coincides with Ripple CEO Brad Garlinghouse’s appearance before the U.S. Senate Banking Committee, where he advocated for clearer regulatory frameworks around digital assets. The hearing, titled “From Wall Street to Web3,” was a stage for bridging the gap between traditional finance and decentralized technologies. 🏛️

Garlinghouse emphasized Ripple’s compliance-first approach and highlighted the XRP Ledger (XRPL) as a scalable solution for stablecoin issuance and cross-border payments. His testimony added weight to XRP’s growing relevance in the global financial landscape. “The U.S. needs regulatory clarity to remain competitive in blockchain innovation,” he stated, a call that resonates with Ripple’s broader strategy. 📢

Ripple Taps BNY Mellon for Custody RLUSD Reserves

In a major institutional move, Ripple has chosen BNY Mellon, America’s oldest bank and a $50 trillion asset manager, as the official custodian for its Ripple USD (RLUSD) stablecoin reserves. This partnership aims to enhance transparency, compliance, and trust in RLUSD, a move that aligns with the “stablecoin summer” narrative. 🌞

“As primary custodian, we are thrilled to support the growth and adoption of RLUSD,” said Emily Portney, BNY Mellon’s global head of asset servicing. “We’re working closely with Ripple to help shape the future of finance.” The collaboration signals Ripple’s deepening ties with traditional financial institutions, especially as Washington accelerates efforts to pass federal stablecoin legislation. 🏦

RLUSD, which launched in December 2024, is currently regulated at the state level by the New York Department of Financial Services (NYDFS). However, Ripple has recently applied for a national trust bank charter with the OCC, a move that could grant the company federal banking privileges. If successful, Ripple would join the ranks of crypto-native firms like Circle and Anchorage Digital. The company has also filed for a Federal Reserve master account to gain direct access to the central bank’s payment rails. 🏦✨

Institutional Interest in RLUSD Signals Broader Adoption

The move to bring BNY Mellon on board aligns with Ripple’s ambitions to expand RLUSD’s role in global payments. Ripple’s senior VP of stablecoins, Jack McDonald, highlighted that dual regulation—state and federal—would set a new benchmark for transparency in the stablecoin industry. 📜

With a market cap nearing $469 million, RLUSD has quickly grown into one of the most prominent new entrants in the stablecoin space. The token’s momentum is further fueled by speculative interest from major companies like Amazon, Apple, Uber, and Walmart, which are reportedly exploring stablecoin integrations for payment efficiency. 🛍️🚗

Ripple’s proactive approach to regulation and infrastructure has helped lift XRP prices, which surged past the $2.28 resistance following news of the banking license application and BNY Mellon partnership. 📈

XRP Price Prediction 2025: What’s Next?

Given the current market structure and momentum, XRP’s medium-term price targets are now projected between $2.70 and $3.40. The confirmation of institutional partnerships, the Senate testimony, and Ripple’s stablecoin push have all contributed to renewed investor confidence. 🌟

From a longer-term perspective, XRP price prediction 2025 scenarios remain optimistic, especially if regulatory clarity is achieved and Ripple gains federal banking approval. However, risks remain. The Ripple vs SEC case, while mostly resolved, could still introduce unexpected developments. Traders are also closely watching macroeconomic indicators and legislative timelines for further cues. 🕵️♀️🔍

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- The 15 Highest-Grossing Movies Of 2024

- All New and Upcoming Characters in Zenless Zone Zero Explained

- Castle Duels tier list – Best Legendary and Epic cards

2025-07-09 22:04