Ah, Japan! Once the very picture of fiscal rectitude, a nation where bonds slumbered in the deep freeze of near-zero yields. But even the most disciplined of nations, it seems, cannot forever defy the iron laws of arithmetic. The rot, you see, has begun. The thirty-year Japanese Government Bond (JGB), that once-unshakeable pillar of stability, now writhes in agony, its yield catapulting to a dizzying 3.15%! A level unseen since the dawn of the new millennium, no less. A veritable earthquake in the land of the rising sun! 😱

And what pronouncements followed this tremor? The Kobeissi Letter, a missive of grave import, declared, with the solemnity of a funeral dirge: “Japan’s bond market is imploding!” Imploding, I tell you! For decades, Japan was the paragon of low interest rates, a haven for the weary investor. Now? High inflation, a policy outlook as changeable as the Siberian wind, and a debt-to-GDP ratio that would make even the most seasoned profligate blush – a staggering 260%! A veritable mountain of debt, threatening to bury the nation beneath its weight. 🏔️

Liquidity, that fickle mistress, vanished from the long end of Tokyo’s curve faster than a dissident in Stalin’s Russia. Zerohedge, that chronicler of market woes, relayed the disbelief of traders in New York: “Unbelievable! For the second day running, Japan’s bond market is bidless!” Bidless, I say! As if the bonds themselves were tainted with some unspeakable disease. The Bank of Japan, meanwhile, that august institution, pretends that nothing untoward is occurring. A Potemkin village of monetary policy! 🙈

Even within the hallowed halls of the Diet, Prime Minister Ishiba, a man not known for his candor, conceded that Japan’s fiscal plight is now “worse than Greece!” Greece, mind you! The very byword for economic catastrophe. Such a comparison would have been unthinkable during the halcyon days of deflation. And all this as public debt soars towards that ominous 260% of GDP, and Japanese investors, those stalwart holders of US Treasuries, contemplate the unthinkable: selling their overseas holdings to shore up their domestic accounts. A fire sale of national assets! 🔥

Why This Is Ultra-Bullish For Bitcoin

For those who have placed their faith in Bitcoin, the chain of cause and effect is as clear as a Siberian winter’s day. Stack Hodler, a voice crying in the wilderness of macroeconomics, declared to his followers: “Everyone expects Yield Curve Control. But Japan already tried YCC, and look at the result! A bond-market implosion unfolding before our very eyes!” Every Japanese bank, pension fund, and insurance company that placed its trust in the Bank of Japan now finds itself holding a “massive bag of flaming excrement!” A fitting reward for their misplaced faith. If this is the end result of YCC, why would any rational investor hold sovereign debt from nations drowning in debt? Central-bank credibility is crumbling like a poorly constructed dam. Scarce, neutral reserve assets – Bitcoin and gold – must be repriced dramatically higher! A clarion call for the digital age! 📢

Dan Tapiero, a man who manages billions in digital assets, reached the same conclusion with admirable brevity: “Quietly…and off the radar…the Japanese long-bond yields are going parabolic. Time to watch Japan…Unsustainable deficits have been the norm for 30 years…Now a problem. Very bullish gold and Bitcoin.” A problem, indeed! A problem that threatens to engulf the entire global financial system. 🌍

The systemic risk argument tightens its grip when one considers the global balance sheet. Bruce Florian, a man who understands the dark arts of macroeconomics, frames the situation as a game of musical chairs with a finite number of safe havens. “There are three times more debts than GDP, and interest rates are twice as high as economic growth… It’s like a game of musical chairs. Everyone knows there are fewer chairs than players.” A chilling analogy! 🥶

Florian highlights the perilous link between Tokyo and Washington: “The biggest buyer of US debt has been Japan… But this customer is now in financial trouble… There’s a high chance Japan will sell some of these bonds to stabilize its own situation… In a year when the USA needs to refinance $8 trillion, what happens if no buyers show up? The Fed will monetize the debt.” The punch line, he insists, is Bitcoin: “Bitcoin is shifting from a ‘nice-to-have’ asset to a must-have asset… In a world of unlimited debt, scarcity is the most radical form of reason.” Scarcity, that most precious of commodities in an age of boundless printing! 🖨️

Even the titans of Wall Street are beginning to see the writing on the wall. JPMorgan’s Jamie Dimon, a man not easily swayed by fashionable trends, declared, “I’m not a buyer of bonds. The risks are too high.” Ray Dalio, a sage of the financial markets, warned that the greater default risk now lies in “currency debasement,” not in missed coupons. And Larry Fink, whose firm’s spot-Bitcoin ETF has absorbed billions since its inception, proclaimed that Bitcoin is “an international asset” fit for times when “countries devalue their currencies.” A chorus of voices, all singing the same tune! 🎶

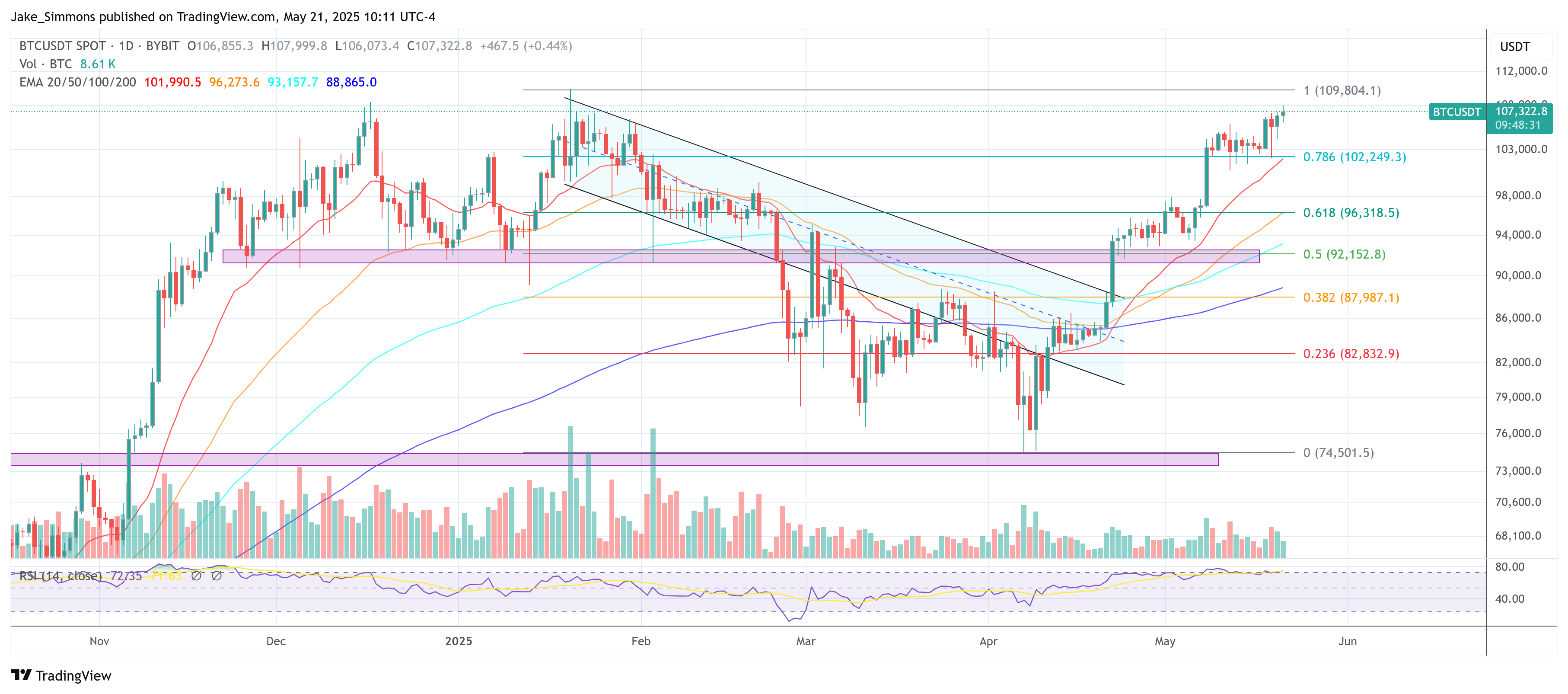

BTC Price Responds

Bitcoin’s price action is responding in real time. BTC rose to a lofty sum, less than a hair’s breadth from its halving-cycle high. None of this proves that Bitcoin is destined to replace sovereign debt, but the directional shift in marginal flows is undeniable. When the second-largest bond market on earth experiences two consecutive bidless sessions, and its prime minister compares the country to Greece, capital flees to assets whose supply cannot be conjured out of thin air. Bitcoin, engineered for hard-cap scarcity, slots neatly into that void. A lifeboat in a sea of debt! 🚢

Whether this is the moment sovereign debt loses its aura of “risk-free” remains to be seen. But one thing is certain: the implosion of Japan’s ultra-long JGBs has handed Bitcoin its clearest macro tail-wind since the pandemic-era liquidity flood. Except this time, the narrative is not emergency stimulus, but the dawning realization that even advanced nations are running out of balance-sheet room. For a growing number of investors, the word “bond” is beginning to rhyme less with “safety” and more with “risk,” while Bitcoin is rhyming – loudly – with “insurance.” A new world order, perhaps? Only time will tell. ⏳

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-05-22 05:14