Well now, on May 4th, 2025, our old friend Bitcoin was loungin’ at $95,426, with a market cap plumper than a Mississippi catfish fry—$1.895 trillion. In the last day alone, she’d seen $13.546 billion slide across the poker table, never straying much from $95,415 to $96,493. The thing moved less than my Uncle Silas after supper.

Bitcoin

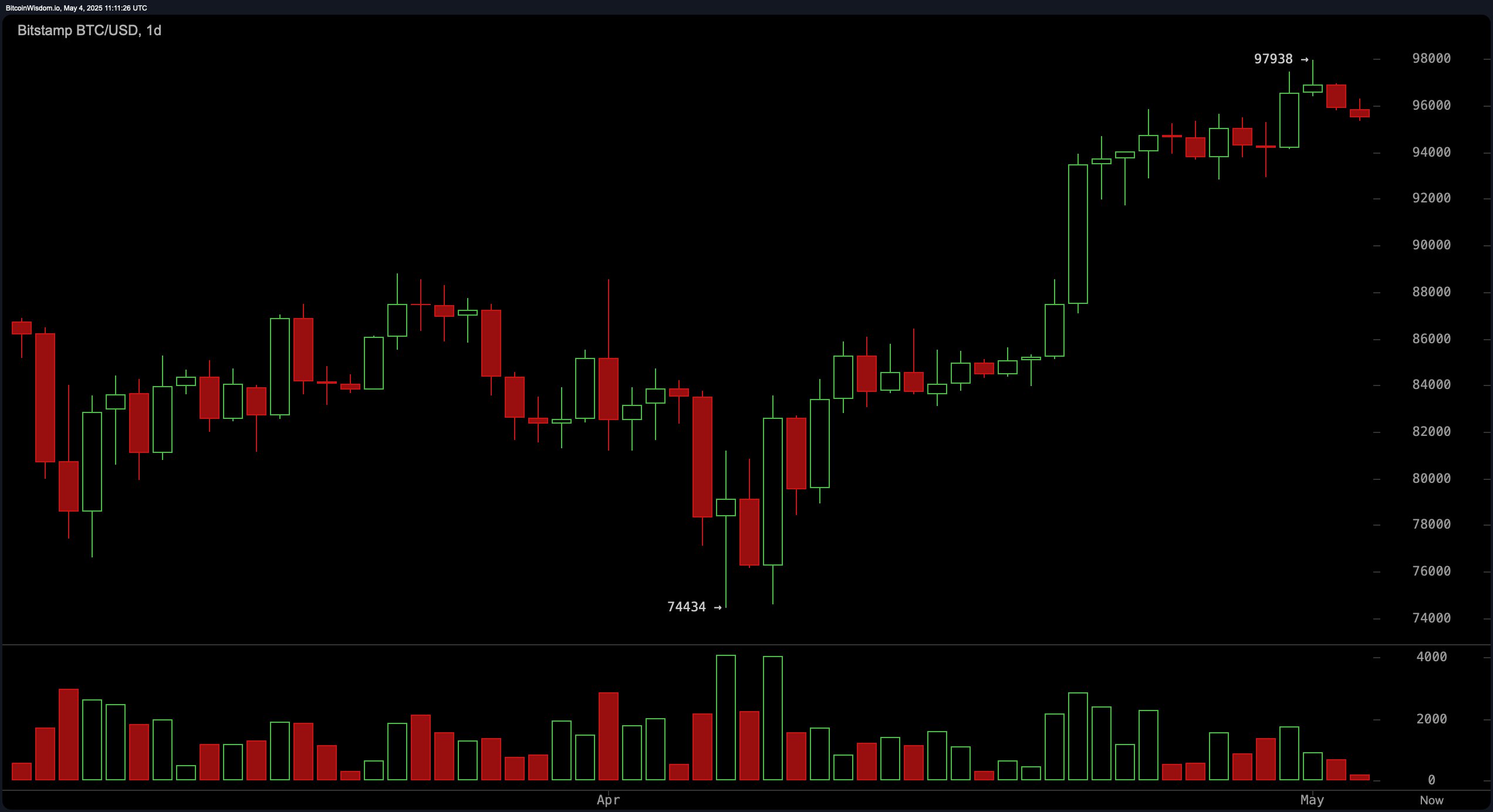

Peepin’ at the daily chart, you’ll spy a rally so big it’d make a circus strongman blush, clawing back from a lowly $74,434. But now our bullish bull appears to be puffin’ and wheezin’ near $97,938. Three red candles in a row, like stoplights at midnight, signal hesitation bigger’n a snake in a rocking chair factory. Volume has dropped off faster than a steamboat gambler’s poker hand, and when prices rise while the crowd’s gone home, that usually means a pullback’s about as likely as rain in April. The savvier players might buy the dip ‘round $92,000 to $94,000 and get ready to cash in if she tips up near $98,000—unless the market decides to go wild and actually do somethin’ dramatic for once.

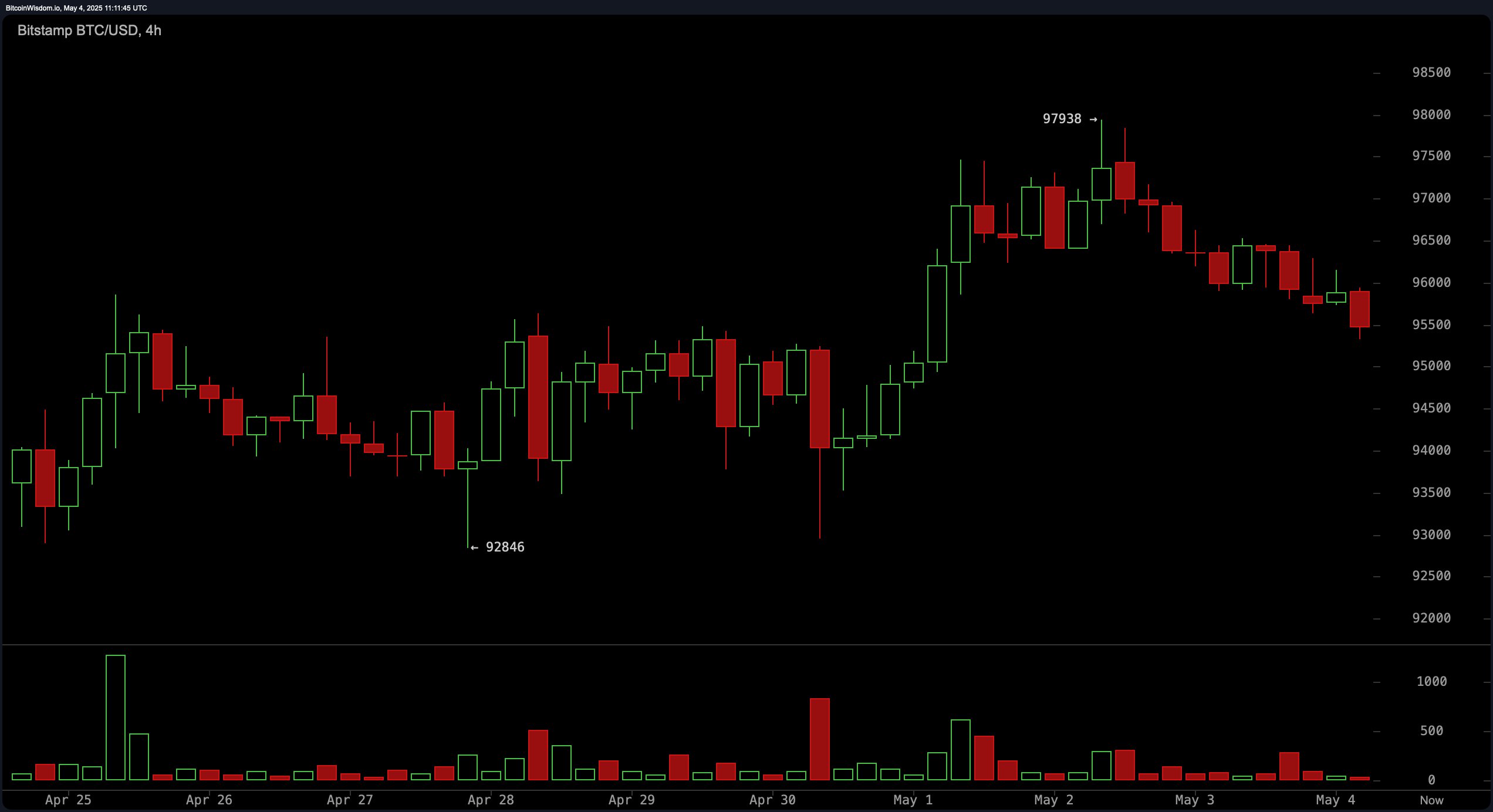

The 4-hour chart is another creature entirely. Once $97,000 waved bye-bye, the market started nosedivin’ like Aunt Polly’s biscuits. Lower highs? Lower lows? You bet—$92,846 is startin’ to look like the last life jacket on the Titanic. Bears are runnin’ the show for now, slammin’ the volume up and the hope down. If you’re itchin’ for some action, a brave soul might try shortin’ near $96,000 to $96,500, but keep them stops above $97,500 or risk gettin’ whacked like Tom Sawyer caught with a slingshot. On the other hand, if some bullish magic appears ‘round $92,800 to $93,000, the prudent might try a long—a low-stakes poker hand just to keep life interesting.

Now, glancin’ at the 1-hour chart, it’s plain as the nose on Huck Finn’s face—downtrend’s still chuggin’ along, slow as molasses in January. Support at $95,330 seems about as sturdy as a raft built from cider barrels, with resistance still grinnin’ at $97,938. Any “bullish” attempts look limper than a dogcatcher’s handshake—tiny green candles tryin’ to look important. Scalp traders might short if we bonk on that $96,000 wall again, but if you see a hefty bullish candle show up near $95,000, might be worth a quick ride up (just keep those stop-losses tight or you’ll be swimmin’ for shore).

If it’s indicators you want, well bless your heart—the momentum gadgets are as split as a family at a Sunday picnic. RSI at 65, Stochastic at 86, CCI at 68—nothin’ too wild, but the ADX at 32 says we ain’t at the county fair just yet. The momentum’s yellin’ “sell!” while MACD whispers, “Hey, buy me.” In other words: the market’s in a deadlock, sittin’ on the fence daydreamin’ about dinner. Watchin’ the volume’s the best bet, ‘cause anything else is as clear as river mud.

But what about the moving averages? Why, they’re rootin’ for the bulls, with short, medium, and long-term signals all wavin’ buy flags from the riverbank. The 10-period EMA and SMA are up high, proppin’ up the price like a raft keeps Huck afloat. Longer-term indicators point north, too, meanin’ the bigger picture probably stays bullish (unless the river turns and you wind up rowing backwards, which happens even to the best of us).

Bull Verdict:

If Bitcoin don’t drop below $94,000 and buyers come stampedin’ back, we might just see a re-try for $97,938. Momentum’s with the bulls, all the indicators winkin’ and nudgin’—but you’ll wanna see them keep holdin’ things together down on the shorter timeframes first. Your uncle ain’t gettin’ rich on wishful thinkin’ alone.

Bear Verdict:

But if the bottom falls out beneath $91,500 and the volume’s heavier than Aunt Polly’s fruitcake, prepare for the bulls to head for the hills. Sellers will holler, “Told ya so!” and Bitcoin could tumble down to $88,000 or lower before anyone comes fixin’ things back up. So, buckle up—it could get bumpier’n a mule on a mountain trail. 🐴

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-05-04 15:01