Somewhere in the Disc’s metaphysical Wall Street, the gods of fortune were too busy squabbling over the rules to notice Bitcoin ambling up to that fabled $100,000 mark, brushing the lint off its virtual jacket and nonchalantly sauntering to a place no number had gone before: $101,000.

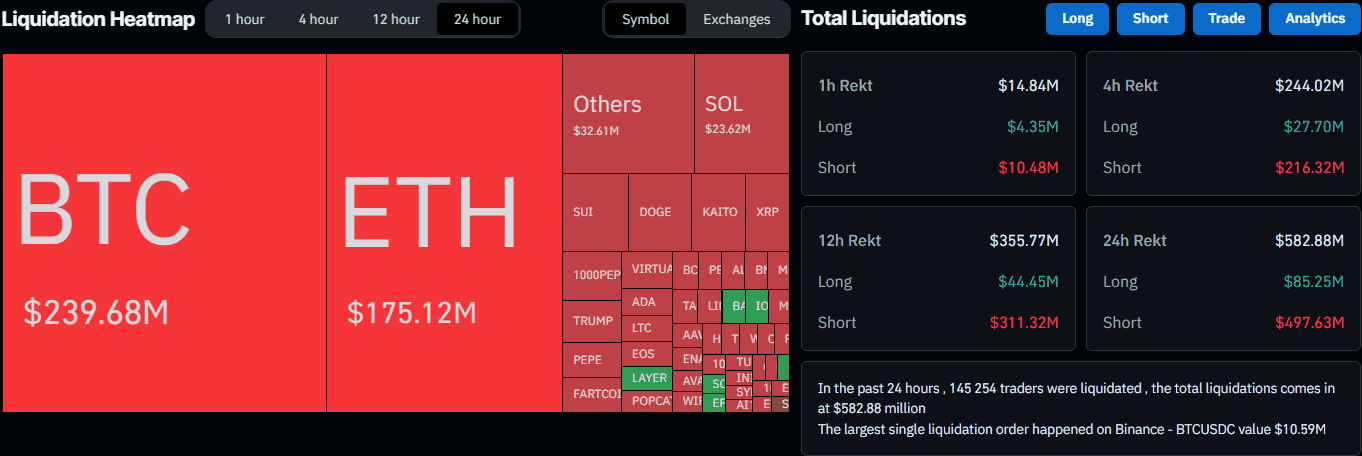

As often happens when something unthinkable becomes vaguely plausible, everything else joined in. Altcoins—those excitable, yappy little cousins of Bitcoin—started bouncing around like they’d sniffed too much Unregulated Optimism™. Amongst the motley crew, PEPE, SUI, and the delightfully aromatic FARTCOIN couldn’t resist the urge to stake their claim to fame.

Earlier today, CryptoPotato (not to be confused with CryptoCarrot, their starchier rival) confessed that BTC had nuzzled up to $99,700. Rumour has it, some very important people in very important suits were to convene in Switzerland for the ancient ritual known as Tariff Talks. Meanwhile, somewhere, Trump was possibly planning a spectacularly unpredictable announcement involving the UK, a large red button, or possibly both.

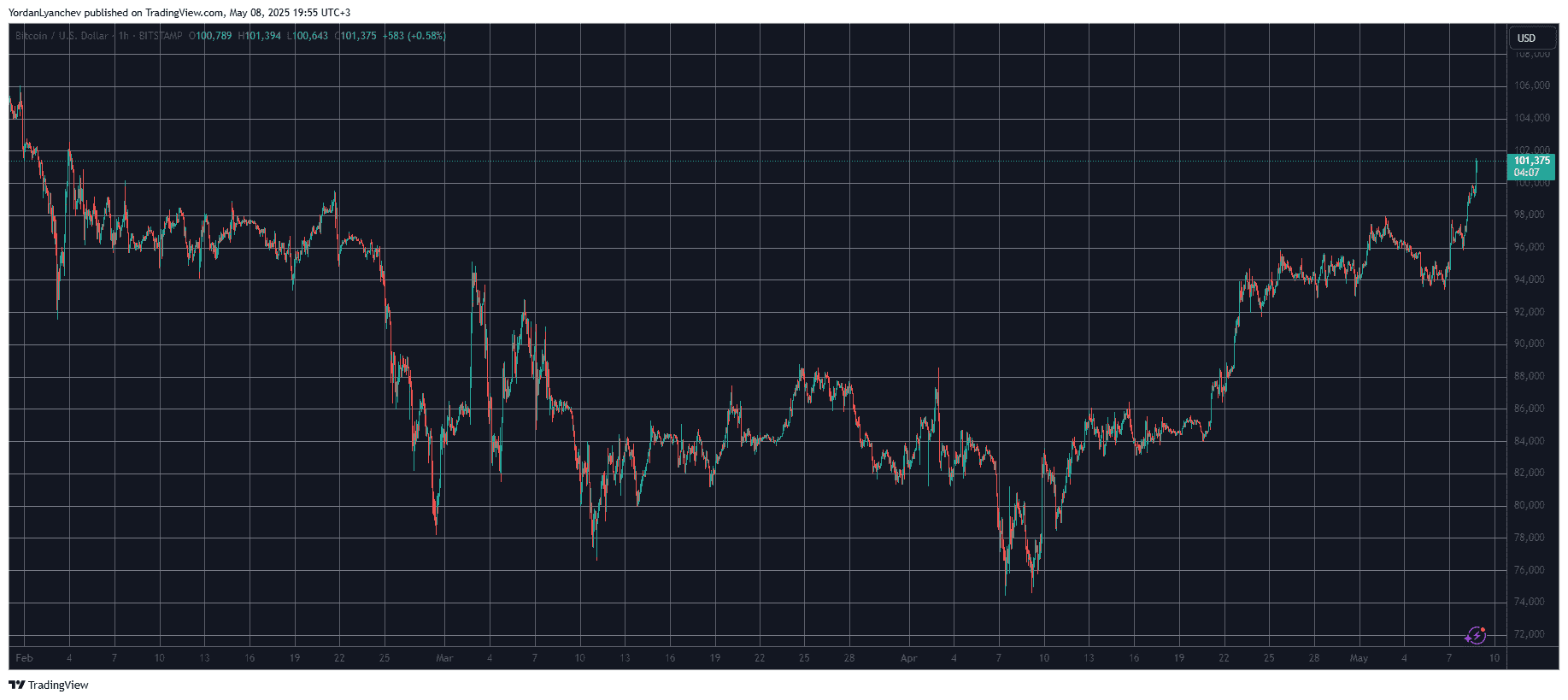

For a whole day, Bitcoin seemed to hover at the hallowed six-digit gates, like someone nervously eyeing the buffet before plunging into the vol-au-vents. Then, as though a toaster had finally popped somewhere in the universe, BTC rocketed up and beyond $101,000, setting a new record and possibly a new record for surprised day traders.

Lest we forget—only a month ago, Bitcoin was having the kind of existential crisis even philosophers would envy, bumbling about under $80,000 and occasionally plummeting below $75,000 during the not-so-cheerful Trade War Smörgåsbord.

Today, the realized cap has hit an all-time high, and, apparently, this particular joyride above $100,000 might even mean something different this time. Or it might not. The sages are currently checking their charts (and their medication).

Among the heavy-hitters of the day are VIRTUAL and PENGU, whose prices leapt by 36% and 33%. PEPE, SUI, and—yes—FARTCOIN followed with leaps of 20–25%, proving that in crypto, nothing says “serious financial instrument” quite like a coin named after jest or gastrointestinal distress.

Even Ethereum, brave little number two, worked up the nerve to smash through $2,000 for the first time in more than a month. If digital assets could sweat, ETH would need a towel.

The carnage among short sellers? $580 million in daily liquidations, with almost $500 million from shorts alone. 145,000 traders sent to the great Exchange in the Sky, where the only certainty is the uncertainty of their next margin call. 😬

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Arknights celebrates fifth anniversary in style with new limited-time event

- Grimguard Tactics tier list – Ranking the main classes

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-08 21:02