In the unhurried ballet of June, the price of Bitcoin—capricious, glaring, indifferent—danced from a sullen $100,500 to a preening $111,000, and back again, as if recalling the remembered lights of past seasons. No delirium, no wild, feverish leaps—just the persistent dignity of an asset determined to hover above that mythical $100,000, as though clinging to the last branch in a storm.

The charts—how predictable their lines, their studied silences!—unfurled a week of modest pulse and quiet resolve. Bitcoin, ever the sphinx, drifted slowly between the corridor of muted hope and dogged skepticism, its traders doomed to swing between optimism and a motherly fretfulness, checking the window for better sunshine.

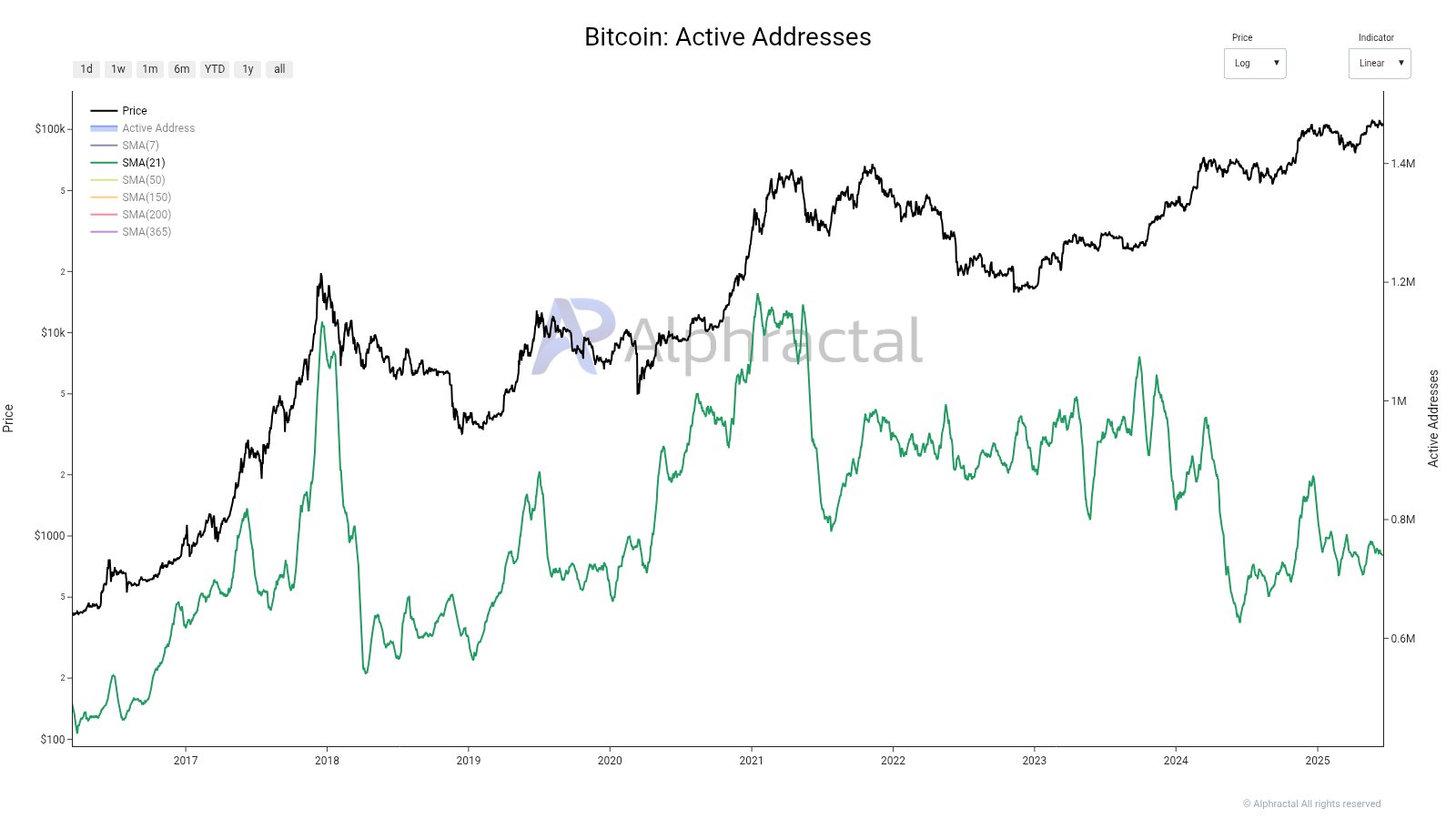

Active Addresses: Echoes From a Quieter Year

On the twentieth day of June, as birds chirped on nameless wires and the world scrolled endlessly, the analysts at Alphractal announced—with the pomp of a town crier and the subtlety of a sleeping cat—that Bitcoin’s active addresses had crept back to their 2020 beds. No parades, no euphoric marches—just the familiar rustle of digital wallets stirring in their sleep.

Active Addresses, that metric beloved by both mystics and spreadsheet devotees, tallies the count of unique digital homes putting their boots on. If an address sends or receives, it is marked in the ledger, immortalized for the span of a ticker tape.

Alphractal’s solemn chart drew a parallel between now and a world haunted by a pandemic, angst, and politicians wielding uncertainty like a theater prop. The same low hum, the same absence of thunderous applause—a déjà vu dressed in code.

Alphractal then, with a flourish, offered two theories, as if ordering from a menu with only two items and neither particularly appetizing. Possibility one: investors are jaded, unable to muster excitement in a market where “crypto influencer” means “guy who lost your money.” Bitcoin above $100k? Yawn. Pass the salt.

Or, option two: this is faith incarnate, a thousand digital monks HODLing through winter, unwilling to blink. Too bad, said Alphractal, for the other charts—volumes both on-chain and spot—are drowsy. Interest, it seems, is flatlining harder than a romantic subplot in a Soviet novel.

Thus, above $100,000, Bitcoin stands not as emperor but as survivor. “Only the most resilient,” they say, “are making use of this long-prophesied $100k-per-BTC existence”—which is poetic talk for “everyone else went fishing.”

Bitcoin Price: A Portrait in Melancholy

And now, a snapshot: at the moment of this unremarkable writing, Bitcoin fiddles with $103,290—down 1% in a day, dropping 2.4% over seven. The solemn numbers, courtesy of CoinGecko, strike no awe nor panic—merely the careful exhale of those who have seen worse.

The digital steppe is quiet now. The caravans rest. Somewhere, a trader refreshes his screen, longing for 2021—if not for the profits, then at least for the drama.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-06-21 21:47