As a researcher with a background in blockchain technology and NFTs, I’ve closely followed the developments at Yuga Labs and the broader NFT market. The recent restructuring efforts by Yuga Labs have generated significant buzz within the community, and I’m eager to understand how investors and collectors are reacting to these changes.

Amidst the ongoing restructuring at Yuga Labs, what is the response from investors and collectors regarding the shifting landscape in the NFT marketplace?

Yuga Labs, the firm responsible for the widely acclaimed Bored Ape Yacht Club (BAYC) Non-Fungible Token (NFT) series, is currently undergoing a reorganization process.

Amidst difficult times for the company, this decision was made, characterized by a significant drop in the worth of its primary NFTs and the necessity to adjust its strategic direction.

In a frank communication on X, CEO Greg Solano admitted to the challenges facing our company and presented a roadmap for moving forward.

As a dedicated researcher deeply committed to revitalizing Yuga and returning it to its authentic origins, today presented a particularly challenging day for me. Making progress in this endeavor necessitates tough choices, and among the most difficult decisions I’ve had to make was parting ways with some exceptionally skilled team members. Here’s what I shared with the team this morning:

— Garga.eth (Greg Solano) 🍌 (@CryptoGarga) April 26, 2024

As a researcher examining Yuga Labs’ recent developments, I cannot help but emphasize the significance of Solano’s statements regarding refocusing and enhancing agility within the company. By positioning Yuga Labs as a more streamlined and proficient entity, Solano intends to deepen the organization’s expertise in crypto technologies.

One significant aspect of Yuga Labs’ reorganization strategy involves selling off specific gaming projects. Notably, HV-MTL and Legends of the Mara, two prominent initiatives, have been taken over by gaming company Faraway.

Further, Yuga Labs is focusing more resources on their Otherside metaverse initiative. Introduced at the height of the 2022 Non-Fungible Token (NFT) craze, Otherside aspires to construct a virtual realm where individuals can socialize, generate content, and exchange NFTs.

In spite of market difficulties, Yuga Labs has announced their intentions to move forward with this ambitious project.

Some members of the cryptocurrency world have shown approval towards Yuga Labs’ reorganization, viewing it as a necessary step for growth. However, other individuals have voiced concerns over the potential implications this may have on Yuga Labs’ NFT product line.

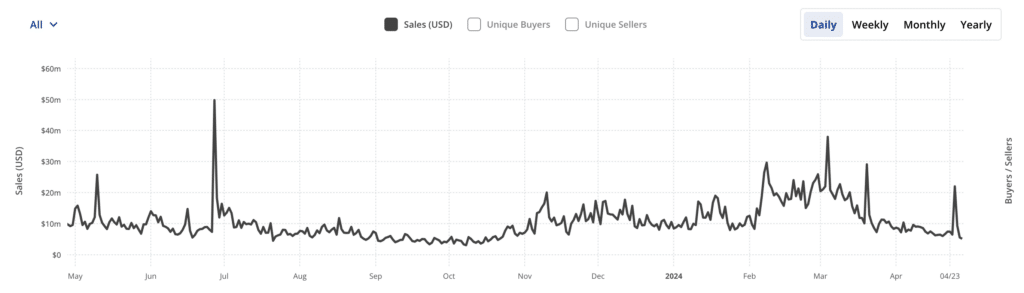

Current performance of BAYC NFTs

After Yuga Labs revealed their plans for company reorganization, there’s been a significant improvement in the success of their premier BAYC NFT series.

I’ve examined the data up until April 30th, and I noticed a significant surge in trading activity for BAYC NFTs within the last 24-hours. Around 1,300 ETH were exchanged during this period, which translates to approximately $4.2 million in value.

Approximately 11% of the total NFT market cap, worth around $4.23 billion, is represented by the estimated value of BAYC NFTs, approximately $466 million in Ethereum (147,139 ETH).

The sales count of BAYC NFTs has experienced a significant surge, amounting to over a 52% rise, totaling 96 units.

Performance of the NFT market

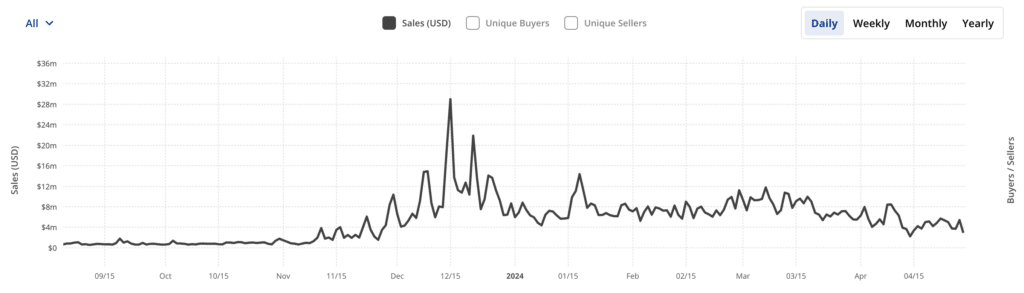

The NFT sector has recently witnessed a surge in action and expansion. Notable rises in transactions and values have been observed across multiple blockchains and initiatives.

As a crypto investor, I’ve observed that Ethereum (ETH) has recorded the highest sales volume in the last 24 hours as of April 30, with approximately $9 million worth of transactions. However, I’ve also noticed a significant decrease in Ethereum’s monthly trading volume compared to March. It currently stands at around $250 million, representing a drop of more than 57%.

Bitcoin: In the past day, Bitcoin (BTC) saw approximately $7.5 million worth of NFT transactions, making it the second-leading platform for such sales. During March, Bitcoin recorded a total of $542 million in NFT sales, marking its strongest month since December 2021 and representing a 70% rise compared to the preceding period.

Solana: As of April 30th, Solana (SOL) ranked third with sales amounting to $4.7 million within the last 24 hours, representing a notable 52% rise in daily transactions. March proved to be an exceptional month for NFTs on the Solana blockchain, recording over $250 million in sales – marking a considerable 16% growth from the previous month. Notably, the average sale price for Solana NFTs surpassed the $100 threshold for the first time since April 2023.

The average price for selling NFTs has hit a nearly two-year high on various blockchains, marking a significant rise in NFT values as a whole.

If this trend continues, we could see renewed interest and investment in the NFT space.

What to expect next?

According to TechNavio’s forecast, the NFT market is expected to grow robustly at a yearly rate of 30.28% from 2024 to 2028, surpassing a total value of $68 billion by the end of the stated period.

In 2024, TechNavio predicts a year-over-year growth in the NFT market cap of at least 23.27%.

In terms of geography, North America and Europe have taken the forefront in the adoption of Non-Fungible Tokens (NFTs). Yet, intriguing data from Metav.rs reveals that individuals from Singapore, China, and Venezuela were the most engaged NFT traders during the year 2023.

As a researcher studying the adoption of Non-Fungible Tokens (NFTs) in Thailand, I’ve found an intriguing trend: Thirty percent of women in this country have shown an interest in collecting NFTs, which is higher than the 23% of men.

Approximately 7 out of 10 Americans have yet to discover what NFTs represent, pointing towards a vast opportunity for growth in the United States market.

Approximately 3.5% of the population in France have already bought NFTs, while nearly half (around 45%) of young adults between 18 and 24 years old express a willingness to make such purchases.

As a crypto investor, I’m constantly keeping an eye on regulatory developments that could affect the NFT market. With governments around the world increasing their scrutiny of the crypto sphere, it’s likely that new rules and regulations will emerge. These changes could potentially impact the value and demand for NFTs. Furthermore, the inherent volatility of this asset class adds an element of risk that could significantly influence the outcome of my investments in NFTs.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-30 11:38