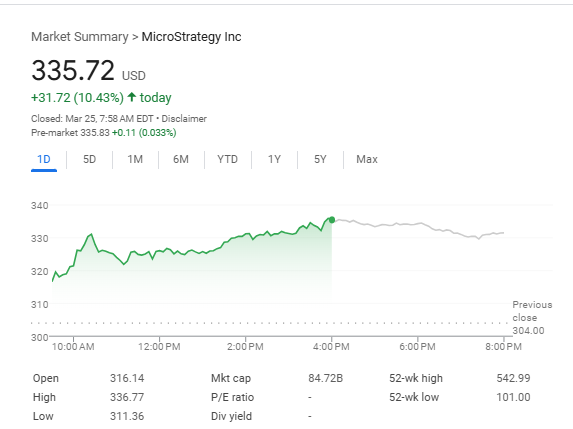

In a twist of financial fate, MicroStrategy (MSTR) has ascended 10.43% today, soaring to the heavens at $335.72. The stock’s celestial journey took it to a peak of $336.77, narrowly avoiding the abyss of $311.36. The global stock market, in a grand act of charity, added $1.2 trillion to its value, as if to say, “Let them eat cake!”

Bitcoin, the digital Midas, has turned everything it touches to gold, including MicroStrategy’s coffers. Michael Saylor, the maestro of this financial orchestra, has been on a Bitcoin shopping spree. So much so, they’ve rebranded to Strategy—because, why not?

The company has thrown caution to the wind, investing $584 million more into the Bitcoin abyss, amassing a treasure trove of 506,137 BTC, valued at a staggering $44.1 billion. This bold move has already reaped $3 billion in Bitcoin gains this quarter, with a 74.3% return in 2024. It’s as if they’re printing money!

Bitcoin’s rise means MSTR’s rise. Analysts, with their crystal balls, predict the stock might hit $700 by June. Fingers crossed, they’re not just guessing!

Market Analyst Peter DiCarlo, in a moment of clairvoyance, declared, “The THT Wave has triggered a bottom signal on $MSTR—and historically, this setup has led to explosive moves. Our model projects a target of $700 by end of June,” he proclaimed, as if divinely inspired.

The THT Wave pattern, a mysterious market signal, has historically preceded massive price rallies. DiCarlo suggests MSTR is also forming a falling wedge breakout, which could be the signal for an impending skyrocket. With Bitcoin’s relentless ascent, it seems the stars are aligning for a colossal leap.

Michael Saylor’s Strategy has become the world’s biggest corporate Bitcoin holder, boasting 500k BTC. With 2.4% of all Bitcoins in circulation, Saylor’s aggressive strategy has made him a crypto demigod. He preaches that Bitcoin is the future, and so far, it seems the future is bright—or at least, it’s working out for his company.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-25 20:06