In the grand tapestry of digital assets, a new pattern of despair has emerged, as the crypto market, much like a skittish gazelle, has leapt into the abyss of the crypto fear and greed index, landing with a thud on sentiment levels not witnessed since the autumn of 2024.

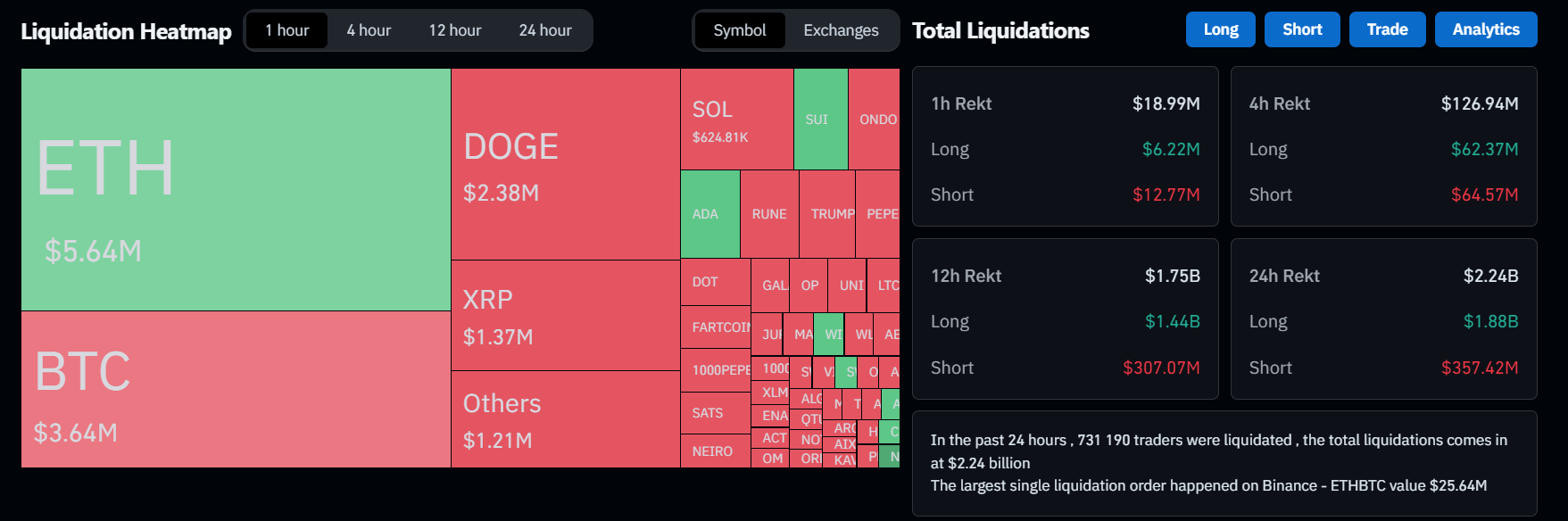

As if by some mischievous sorcery, a concoction of fresh U.S. tariffs, a paucity of liquidity, and a frenzy of panic selling has obliterated over $2 billion from the market’s coffers in the past diurnal cycle, according to the arcane scrolls of Coinglass. Amidst this brouhaha, the venerable Bitcoin (BTC) saw its value erode by nearly 6%, plummeting to the vicinity of $91,200 before executing a modest pirouette. Yet, it was the altcoins that bore the brunt of the onslaught, their vale diminishing with the pomp of a deflating soufflé.

Ethereum (ETH), with a grace befitting a dancer losing its balance, tumbled by 18%, whilst XRP (XRP) donned the mantle of the grand vanquished, shedding a full 20% of its value. Meanwhile, Solana (SOL), despite its sunny namesake, witnessed an 8% decline as the total market cap, once robust and burly, shrank to a mere $3.15 trillion.

Sell-off: another typical weak Monday driven by low liquidity and CTAs chasing – Asia market these days can’t take any negative news nor apply independent thinking.

The tariffs won’t lead to much productivity shock or inflation shock for the U.S. – market will recover soon.

Matrixport’s co-founder, the sagacious Daniel Yan, decried the day as “another typical weak Monday,” casting aspersions on the Asian markets for their penchant for reacting to bad news with all the subtlety of a cat startled by a cucumber. He pointed out the volatility, with Coinbase’s ETH premium—a harbinger of robust U.S. demand—skyrocketing to 6%, while the crème de la crème of tokens suffered an average 22% loss.

At the moment, it does look as though #xrp entered an expanded flat wave 4 correction in December last year.

The loss of the green line increased the correction to come into play. It wasn’t my primary expectation, but it is what it is, we have to respect price structure over…

A cryptic X user, known to the digital masses as @Coins_Kid, mused in an X post on the ides of February that XRP’s price structure resembled an “expanded flat wave 4 correction” since the waning months of the previous year. This user, with the solemnity of an oracle, suggested that the price was painting a picture of further descent, though some optimists might see a bargain amidst the wreckage.

Santiment’s data, akin to a compass in a tempest, indicates that traders are retreating to the safety of their galleons. One wise soul, upon analyzing the collective sentiment, noted, “Talks of buying the dip have calmed down. Big targets like $110K-120K for Bitcoin are getting less attention.”

In the midst of this financial maelstrom, Bitwise’s head of alpha strategies, the erudite Jeff Park, posits that these tariffs are but a pawn in a grander chess game. He postulates that the U.S., in a bid to weaken the dollar without toppling its fiscal tower of Babel, is orchestrating a modern-day “Plaza Accord.”

This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher.

And so, as the tariffs cast their shadow over the economy, they may indeed be the machinations of a larger scheme. The long-term prognosis for Bitcoin, in the face of a weakened dollar, lower U.S. rates, and the global economy’s existential waltz, is one of ascent—violent, skyward, and with the grace of a phoenix rising from the ashes, according to Park’s Feb. 3 X epistle.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2025-02-03 10:28