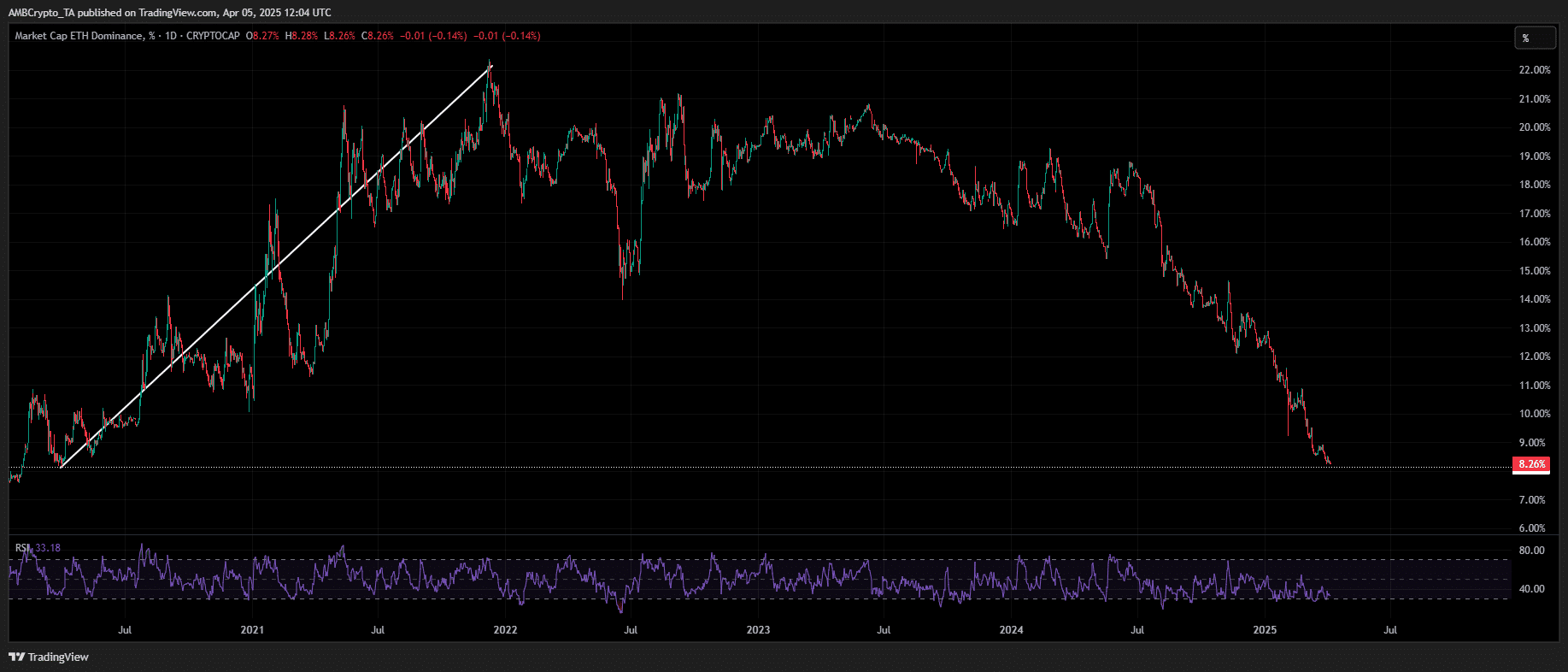

- Ethereum dominance has crashed to a five-year low of 8%. 😱

- AMBCrypto’s data reveals Ethereum’s dominance has been on a decline since mid-2024, despite a bullish cycle. 😕

Ethereum [ETH] has emerged as one of Q1’s biggest high-cap underperformers, much like a student who forgot to study for the final exam. 📉

While its price drawdown remains in focus, a more concerning metric is its market dominance, which has plummeted to a five-year low of 8%. It’s like being the last kid picked for the dodgeball team. 😢

In fact, it’s the metric that has retracted levels last witnessed during the COVID-induced market cycle. It seems like COVID wasn’t just bad for our health but also for Ethereum’s market dominance. 😷

Back then, ETH dominance staged a sharp Q2 recovery, reclaiming a double-digit foothold. But this time, key technicals diverge – RSI remains anchored in oversold territory, failing to reset despite ETH trading at a two-year low. It’s like trying to catch a slippery fish with your bare hands. 🐠

Clearly, Ethereum’s risk-off sentiment remains elevated, suppressing fresh retail inflows and limiting upside momentum. Given the current conditions, a 2020-style dominance resurgence appears unlikely. It’s like trying to win a race with a broken leg. 🏃♂️

Additionally, beyond on-chain metrics and technicals, a broader structural shift is evident. It’s like the tectonic plates shifting beneath our feet. 🌋

AMBCrypto’s analysis of the chart above highlights Ethereum’s sustained dominance downtrend since mid-2024, despite a historically bullish macrocycle. It’s like trying to swim upstream against a strong current. 🐟

Key catalysts – including post-halving capital rotations, the Trump rally, and the Federal Reserve’s three rate cuts – failed to ignite a meaningful recovery. Despite these tailwinds, ETH closed the year with a modest 47% annual gain. It’s like getting a participation trophy for coming in second place. 🥇

However, its market dominance eroded by 4%, retracing to 12% by Q4 2024, underscoring persistent “relative” weakness against broader market trends. It’s like being the bridesmaid but never the bride. 💍

Ethereum dominance declines against macro trends

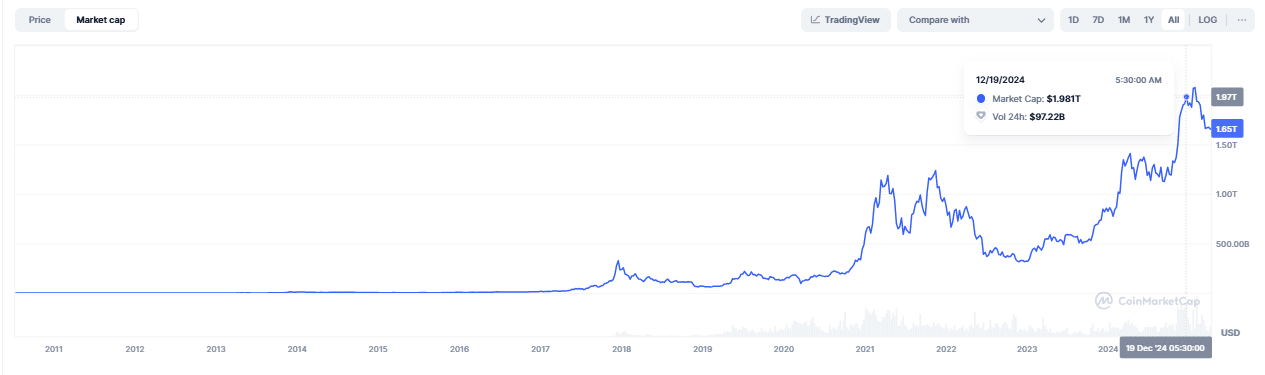

As Ethereum’s dominance eroded throughout 2024, Bitcoin’s market dominance (BTC.D) surged from 54% to 61% by mid-Q4, propelling BTC’s total market capitalization near the $2 trillion milestone for the first time in history. It’s like watching your rival win the championship while you’re still playing in the minor leagues. 🏆

This shift underscores ETH’s relative weakness, driven by aggressive capital rotations into Bitcoin, fueled by macro-driven risk positioning and speculative front-running of a potential “Trump pump.” It’s like watching a train wreck in slow motion. 🚂

A similar capital flow imbalance is now unfolding. Institutional demand for Bitcoin has dominated since March, while ETH ETFs continue to bleed outflows, signaling weak conviction. It’s like watching a horror movie where the victims keep making bad decisions. 🎃

As macro uncertainty deepens, institutional liquidity will dictate market stability. Bitcoin is increasingly cementing its role as a risk-off asset. Meanwhile, Ethereum continues to lose market share – its five-year dominance low reinforcing the narrative of persistent capital rotation away from ETH. It’s like being left out of the party because you didn’t get the invite. 😣

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-06 02:18