Oh, Grayscale, that beacon of digital decadence, has once again flung open the doors to its quarterly soiree, revealing the crème de la crème of cryptocurrencies with a wink to the future.

Keeping up with the times like a socialite at a cocktail party, the firm reshuffles its deck of digital darlings every quarter, gauging the pulse of network soirées, market flirtations, and the steadfastness of their crypto coquetries.

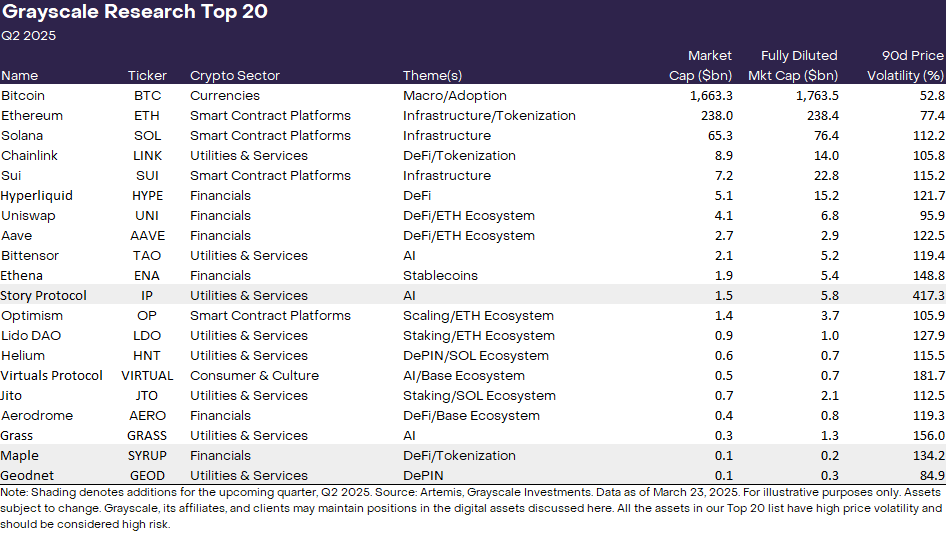

🎉 The latest guest list, my dears, introduces three newcomers—Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP)—a nod to the practical glamour of decentralized finance (DeFi), the allure of decentralized physical infrastructure networks (DePIN), and the chic of intellectual property (IP) on the blockchain.

Grayscale, with the precision of a seasoned host, categorizes the crypto world into five delightful sectors: currencies, smart contract platforms, financials, consumer & culture, and utilities & services. This taxonomy allows them to keep tabs on the trends and spot the next big thing in each category, like a hawk-eyed critic at a fashion show.

With the latest shuffle, the crypto sectors now boast227 distinct assets, totaling a staggering $2.6 trillion in market capitalization—a veritable empire covering the lion’s share of the global crypto market.

Maple Finance (SYRUP), the belle of the DeFi ball, specializes in institutional lending. With platforms catering to both the accredited and the DeFi-native, Maple Finance is the life of the party, having grown to $600 million in Total Value Locked (TVL) and boasting $20 million in annualized network fee revenue. Ambitious plans are afoot to scale Syrup.fi to a $2 billion TVL by mingling with other DeFi darlings, including Pendle (PENDLE).

Geodnet (GEOD), on the other hand, has cemented its place as the darling of the DePIN scene. Offering geospatial data with centimeter-level precision, it caters to a variety of industries, from agriculture to autonomous vehicles, like a versatile socialite. With over14,000 active devices in130 countries and a500% YoY increase in network fees to $3 million, Geodnet is not just a pretty face but a formidable contender in the blockchain infrastructure arena.

Story Protocol (IP) is the intellectual property ingenue, bringing IP rights onto the blockchain. In a world where AI-generated content causes copyright kerfuffles, Story Protocol offers a solution for creators and investors alike to monetize and trade IP rights. It’s already made a splash with music rights from stars like Justin Bieber and BTS, launching its own IP-focused blockchain and token in February2025.

As for the uninvited, Grayscale has politely shown three assets the door: Akash Network (AKT), Arweave (AR), and Jupiter (JUP). Despite the snub, Grayscale maintains these projects are still part of the crypto ecosystem’s fabric, just not the stars of this particular show.

“Grayscale Research, ever the gracious host, continues to value each of these projects as integral to the crypto ecosystem. However, the revised Top20 list, we believe, might just offer a more alluring risk-adjusted return for the season ahead,” they quipped with a knowing smile.

Beyond these fresh faces, Grayscale keeps its spotlight on the perennial favorites: Ethereum scaling solutions, AI-integrated blockchain developments, and innovations in DeFi and staking. Assets like Optimism (OP), Bittensor (TAO), and Lido DAO (LDO) remain in the limelight, reflecting the firm’s penchant for areas ripe with potential.

Meanwhile, Grayscale’s expansion into evaluating additional digital assets continues apace. January2025 saw nearly40 altcoins under their discerning eye, while October unveiled a list of35 potential candidates for their investment products. It’s a never-ending carousel of crypto charm, and Grayscale is the maestro of this digital symphony.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-03-26 14:32