Like a tempestuous Russian winter, the Bitcoin price has crashed to a low of $91,170, leaving a trail of devastation in its wake. The cryptocurrency market, once a beacon of hope, now lies in tatters, a victim of the whims of the Federal Reserve and the erratic Donald Trump.

As the Bitcoin price tumbled, the stock market followed suit, a grim reminder that even the mighty can fall. The 16% drop from its highest level this year was a stark warning that the cryptocurrency market is not immune to the vagaries of the global economy.

And what was the catalyst for this chaos? The specter of stagflation, that most dreaded of economic monsters, reared its ugly head, casting a pall of uncertainty over the market. The Federal Reserve, that bastion of economic wisdom, was forced to confront the possibility of higher inflation, a prospect that sent shivers down the spines of investors.

And then, like a bolt from the blue, Donald Trump unleashed his tariffs, a move that sent shockwaves through the market. The impact on consumer spending was immediate, as the uncertainty surrounding the tariffs led to a sharp decline in confidence. The Federal Reserve, ever vigilant, was forced to consider the possibility of maintaining higher interest rates for longer, a move that would have far-reaching consequences for the cryptocurrency market.

As the Bitcoin price crashed, the liquidations piled up, a grim reminder of the risks involved in playing the cryptocurrency market. According to CoinGlass, the daily liquidations jumped to almost $400 million, a staggering figure that highlighted the volatility of the market.

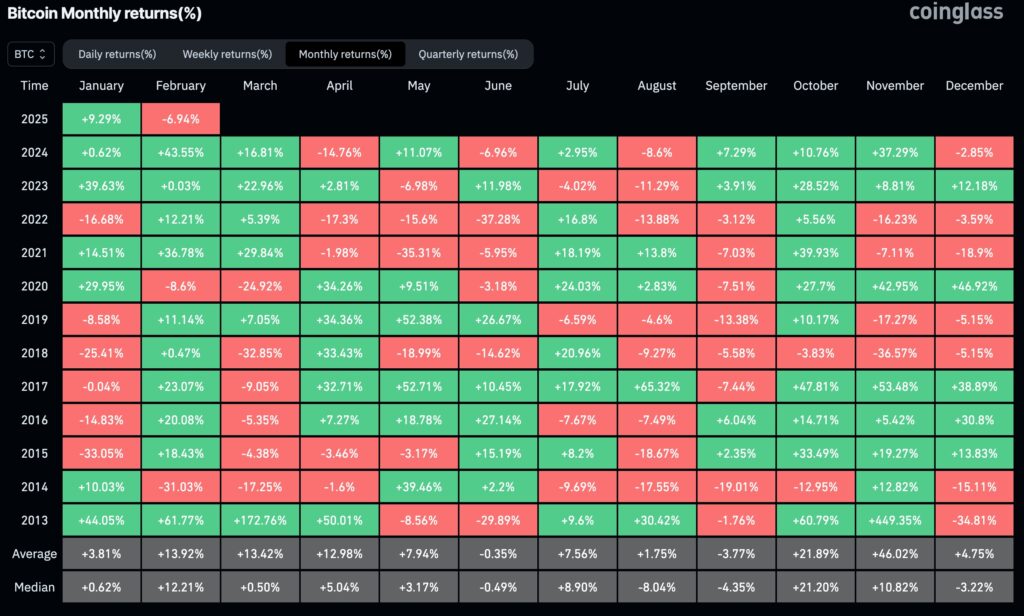

But fear not, dear investor, for there are signs that the Bitcoin price may rebound. Firstly, the cryptocurrency has a tendency to end the week on a positive note, a trend that has been observed in recent weeks. Secondly, seasonality data suggests that February is a good month for Bitcoin, with an average return of 14% since 2013. And thirdly, Donald Trump’s tariffs may yet prove to be a blessing in disguise, as the threat of trade talks may lead to a rebound in the market.

So, dear investor, do not despair. The Bitcoin price may yet rise from the ashes, like a phoenix from the flames. The daily chart shows that the cryptocurrency has been moving sideways in recent months, a consolidation that has led to the formation of a bullish flag pattern. And with the 50-day and 100-day Exponential Moving Averages still intact, the stage is set for a strong bullish breakout later this month.

Bitcoin price forecast

So, buckle up, dear investor, and hold on to your seat. The Bitcoin price may be about to embark on a wild ride, one that will take it to dizzying heights. The initial target is the year-to-date high of $109,200, a figure that may yet prove to be a mere stepping stone on the road to greatness.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-03 15:06