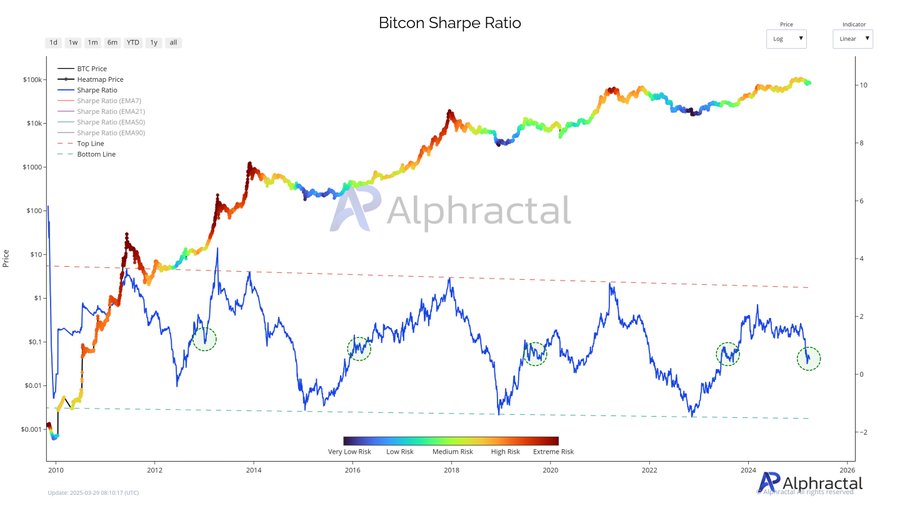

- Bitcoin’s Sharpe Ratio takes a snooze, hinting at a market nap amidst dwindling risk-adjusted profits.

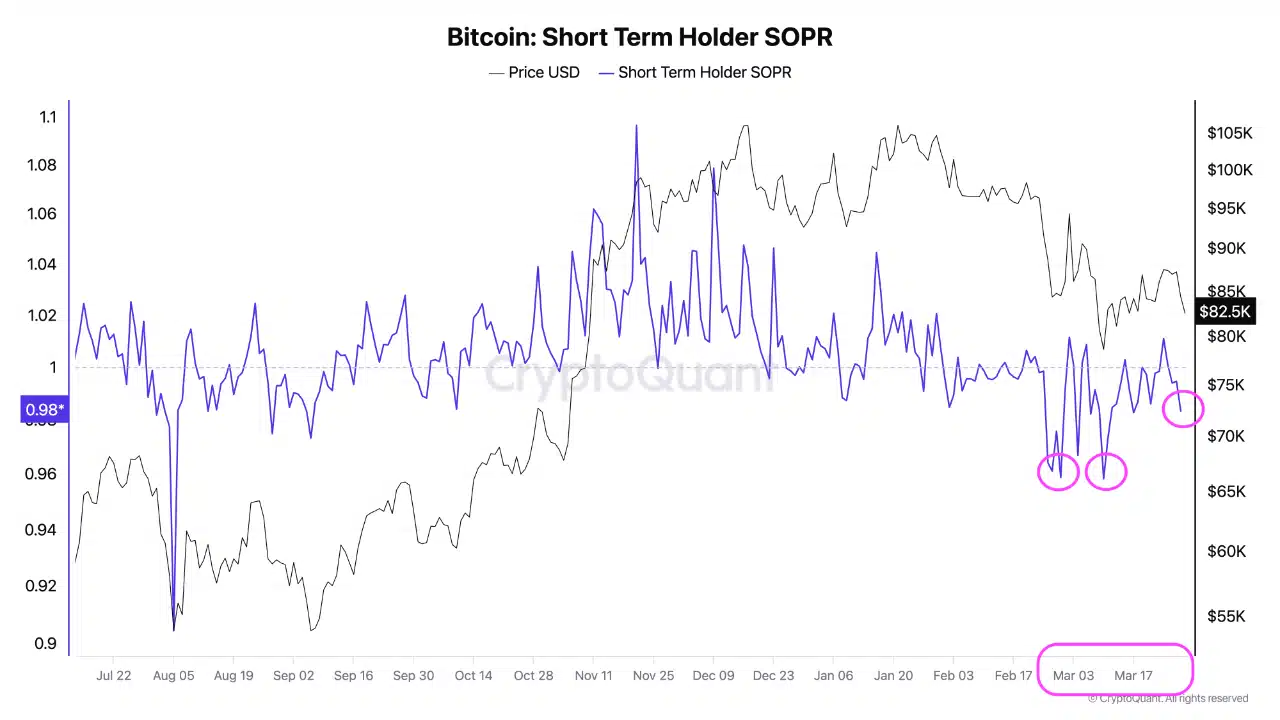

- STH SOPR dipping below 1 suggests short-term holders are selling like hotcakes that aren’t, you know, hot.

In the grand tapestry of cryptocurrency, Bitcoin’s [BTC] market shenanigans are painting a rather interesting picture. The annualized Sharpe Ratio is doing the limbo, dipping to levels so neutral they could host a peace summit.

Simultaneously, the STH SOPR has taken a tumble below the 1 mark, hinting that short-term traders are the first to jump ship in a game of musical chairs where the music stopped ages ago.

As sentiment flutters like a flag in a gentle breeze, traders are left scratching their heads, pondering whether these signals are a mere blip or the harbinger of something… something more.

The chart is whispering secrets, revealing Bitcoin’s current Sharpe Ratio has taken a vacation from previous highs, dipping into the neutral zone like it’s checking into a hotel with a very lackluster view.

This slide is déjà vu all over again, where neutral or near-zero levels have historically been the prelude to either a snooze fest or a slight market hangover before the party resumes.

As the ratio lounges around neutrality, a market siesta in the coming weeks seems as likely as a cat video going viral.

Short-term holders under the weather

Bitcoin’s STH SOPR is stuck below 1, a clear sign that many short-term investors are selling at a loss, presumably to fund their next brilliant investment: pet rocks.

The chart, like a strict teacher, shows that notable dips in early and mid-March coincided with price declines, a moment of ‘every man for himself’ among traders.

In the past, such STH SOPR drops have been a bit like a market rendition of ‘The Price is Right’—and the price was always wrong.

But history suggests that these dips below 1 often clear the way for a rebound, much like how a good nap can lead to a productive afternoon.

With Bitcoin’s price meandering between the 80k-85k range, investors are watching like hawks, or at least like people who really like watching hawks.

A sustained move above 1 in STH SOPR would be like a breath of fresh air, indicating that short-term holders might finally get a break from their losing streak.

Bitcoin price outlook: crystal ball or crystal clear?

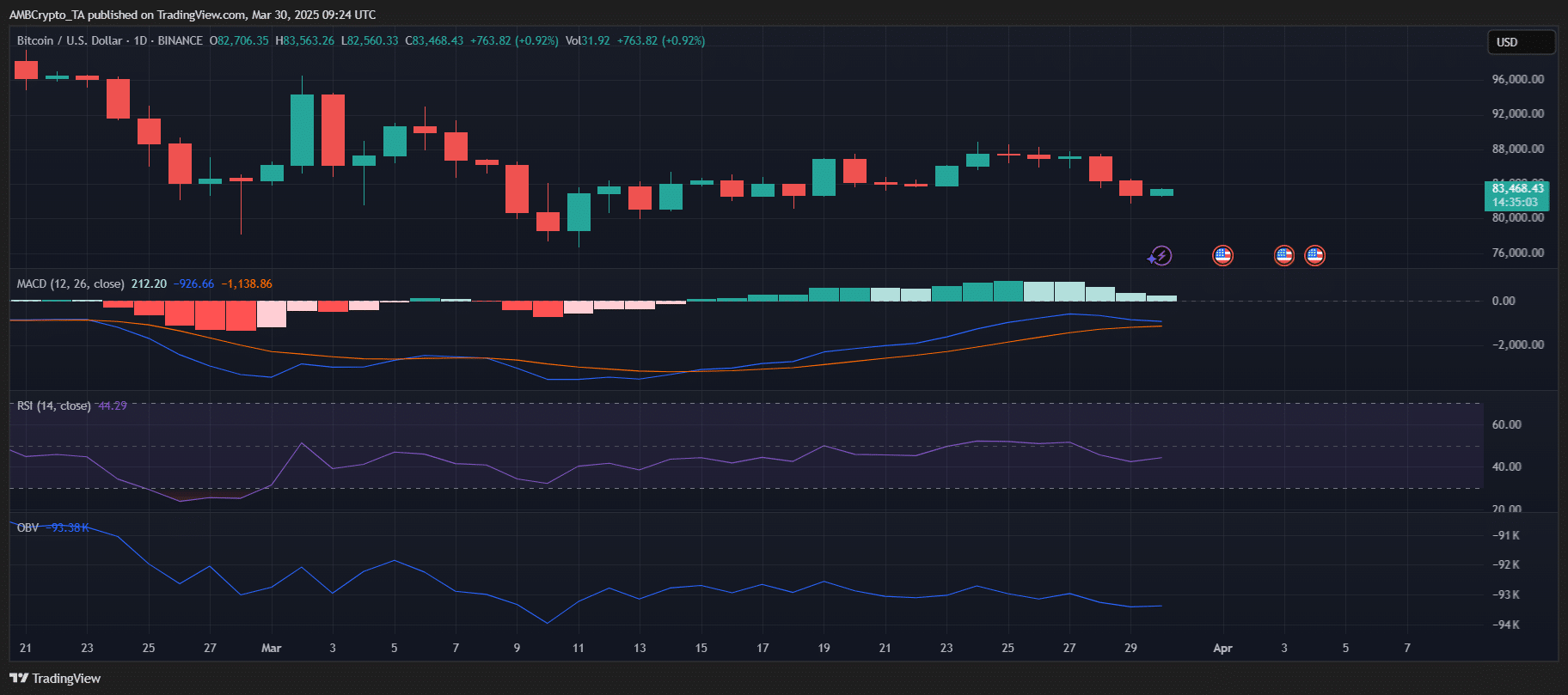

Bitcoin is currently in a phase that feels a bit like the calm before the storm, or maybe just the calm before more calm. Recent daily candles are showing signs of selling pressure, as if the market is having a yard sale and no one’s buying.

The MACD indicator is still positive but seems to be losing steam, much like a runner who’s considering taking a break to check their phone.

The RSI at 44.29 suggests a sentiment that’s as neutral as a beige wall, indicating Bitcoin is neither a hot potato nor a golden goose.

In the meantime, the OBV is declining like a deflated balloon, reinforcing the idea that buying pressure is about as intense as a snail race.

If the $83,000 support holds, Bitcoin might consolidate before trying to climb Mount Everest again. If not, it might be time to test the lower support near $80,000, where the only thing certain is uncertainty.

A potential MACD bearish crossover and RSI dipping below 40 could signal further downside, or it could just be a mirage. Only time—and a lot of luck—will tell.

But a breakout above $85,000 might just reignite the bullish flames, or at least the flames of hope for those still holding on.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-03-31 02:20