As a seasoned researcher with over two decades of experience in financial markets, I have witnessed the incredible transformation of technology and finance, from the dot-com boom to the rise of cryptocurrencies. I must admit that when I first learned about Bitcoin a decade ago, it seemed like an esoteric concept, far removed from traditional finance. However, watching its growth over the years has been nothing short of fascinating.

The surge in institutional investment via Bitcoin ETFs is a testament to the maturation and legitimization of cryptocurrencies as a viable asset class. I have seen firsthand how regulatory approvals can open floodgates for institutional money, propelling assets to new heights. The same was true with tech stocks in the late 90s, and now it appears Bitcoin is following suit.

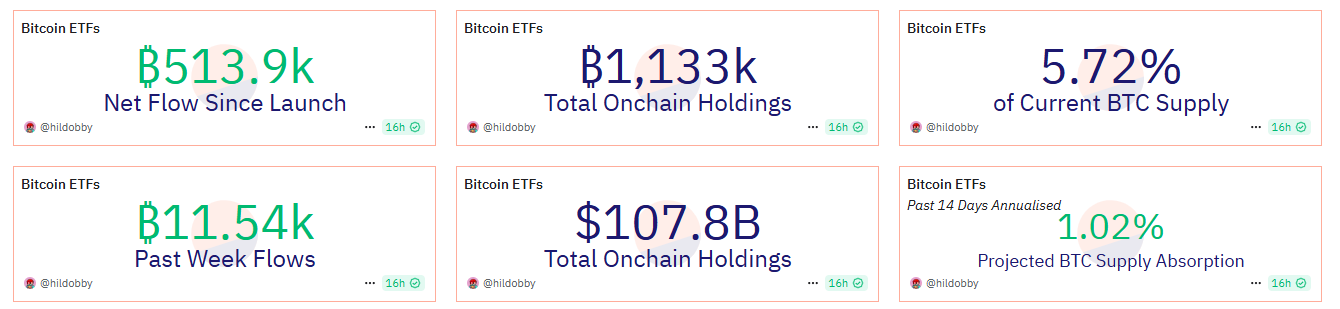

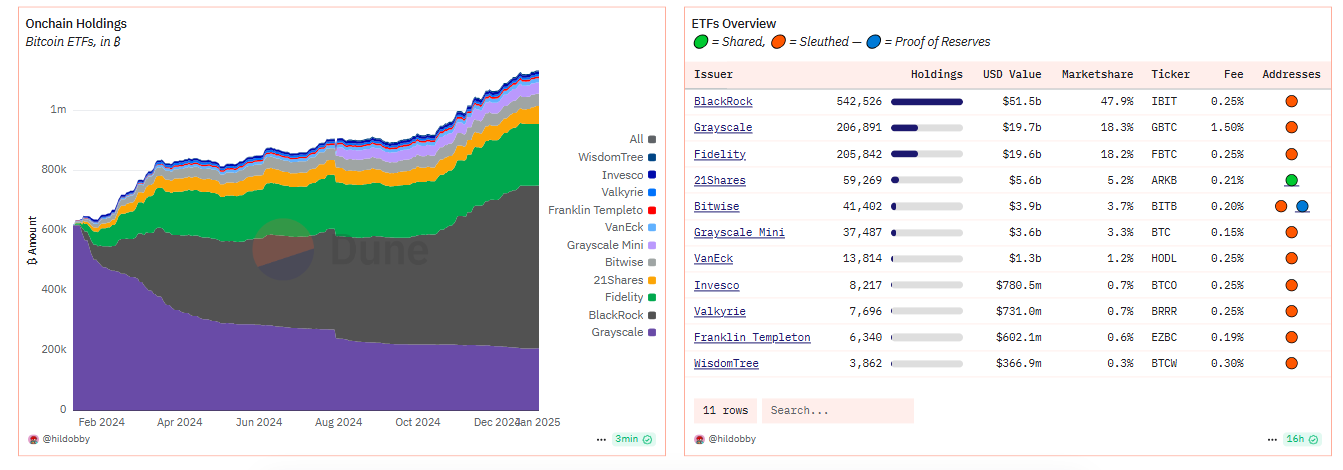

The rapid growth of US-based Bitcoin ETFs, nearing $110 billion in cumulative holdings, is a clear sign that institutions are increasingly bullish on Bitcoin’s potential. The fact that BlackRock, the world’s largest asset manager, holds over 542,000 BTC through its iShares Bitcoin Trust ETF underscores this trend.

Analysts predicting a $200,000 price for Bitcoin by 2025 may seem audacious, but when you consider the exponential growth of Bitcoin since its inception, it’s not entirely implausible. Of course, as with any investment, there are risks and uncertainties that must be considered, such as regulatory developments, market dynamics, and broader economic conditions.

In terms of short-term challenges, Bitcoin needs to overcome the $99,000 resistance level, which could lead to a significant price surge if successful. But as they say in the markets, “the trend is your friend,” and Bitcoin’s long-term trajectory remains positive.

As for a joke, let me share one I heard on a recent podcast: “Why did Bitcoin cross the road? To get to the other side of its all-time high!” It might not be funny to everyone, but as a financial analyst, I found it amusing. After all, humor helps us keep things in perspective during these exciting times!

Institutional investment in Bitcoin through ETFs is consistently increasing, with experts estimating that Bitcoin’s value could reach $200,000 by 2025. Although this seems unrealistic at first glance, it’s important to remember that when Bitcoin was valued at $10,000, the idea of it being worth $100,000 seemed out of this world too.

With Bitcoin surpassing the $100,000 threshold, analysts now have a basis for even greater projections. The recent approvals of Bitcoin ETFs have allowed institutional investors to invest significantly in it, making such heights attainable. So, why should we stop there?

2024 has seen a phenomenal surge in the growth of U.S.-based Bitcoin exchange-traded funds (ETFs) I’ve been investing in, with their collective holdings edging ever closer to an impressive milestone of $110 billion. It’s truly exciting to be part of this remarkable journey!

At present, U.S.-based Exchange-Traded Funds (ETFs) control approximately 5.7% of the total Bitcoin supply, a significant amount indicating increasing institutional interest in cryptocurrency. According to Dune Analytics, these ETFs are close to reaching a $110 billion mark, with only $2.2 billion left to go.

BlackRock, known as the world’s biggest asset manager, has become a significant force in the U.S. Bitcoin Exchange-Traded Fund (ETF) sector. Their iShares Bitcoin Trust ETF currently owns more than 542,000 Bitcoins, which equates to around $51.5 billion in value.

The sizeable percentage (47.9%) shows that BlackRock dominates nearly half of the US Bitcoin ETF market, reinforcing its role as a major influencer in institutional Bitcoin investments. Importantly, BlackRock’s Bitcoin ETF ranks 34th globally in terms of total assets, combining both digital cryptocurrency and traditional finance holdings, based on data from ETF Database.

The surge of funds into Bitcoin Exchange-Traded Funds (ETFs) has been instrumental in driving up Bitcoin’s recent price surge. By February 15, 2024, it was found that around three-quarters of new investments in Bitcoin were coming from US spot ETFs, pushing its value above $50,000. This clearly shows the substantial influence these investment tools can have on market trends.

$200,000 Bitcoin by 2025?

As a seasoned investor with over two decades of experience under my belt, I have witnessed numerous market trends come and go. However, the recent surge in optimism surrounding Bitcoin’s future price trajectory has piqued my interest more than any other. This optimism stems from the continued expansion of Bitcoin ETFs, a development that provides greater accessibility to institutional investors.

Having seen how such vehicles have revolutionized traditional markets, I believe that the growing presence of Bitcoin ETFs could mark a significant turning point for the world’s most popular cryptocurrency. The ease of investment they offer could potentially attract massive inflows of capital, thereby driving up its price and solidifying its position as a viable asset class.

However, it is essential to approach this investment with caution. Cryptocurrencies are notoriously volatile, and Bitcoin’s success is far from guaranteed. I always advise investors to diversify their portfolios and never invest more than they can afford to lose. Nevertheless, the potential for growth in the Bitcoin market is undeniably exciting, and I am eagerly watching developments unfold.

According to Ryan Lee, the head of research at Bitget, it’s expected that BlackRock’s Bitcoin Exchange-Traded Fund (ETF) could significantly boost institutional investment in 2025, as this specific ETF would make it easier for big investors to gain access to Bitcoin.

Lee predicts that the ongoing surge in ETF adoption, along with BlackRock’s expanding power, might drive Bitcoin’s value to reach $200,000 by 2025. Essentially, he said, “Long-term predictions indicate continuous growth for Bitcoin, with some estimations setting its worth at $200,000 in 2025.” However, it’s important to note that numerous aspects, such as regulatory changes, market trends, and overall economic situations, will significantly impact this trend.

As an analyst, I find myself in a position where I’m optimistic about Bitcoin’s future prospects but mindful of the obstacles it encounters in the immediate term. To surpass the psychologically significant price point of $100,000, Bitcoin must rally by 4.1%. However, according to CoinGlass data, we encounter notable resistance at both $97,600 and $99,000.

Beating the $99,000 barrier might cause the termination of over $1 billion in highly-leveraged short positions, possibly resulting in a substantial price increase.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-01-02 21:09