As a seasoned analyst with over two decades of experience in financial markets, I find myself in awe of the dynamic nature of the cryptocurrency market. The recent rate cut by the U.S. Federal Reserve has undeniably stirred an impressive bullish momentum, leading to increased liquidations and heightened investor sentiment.

After the anticipated interest rate reduction by the U.S. Federal Reserve, there was a strong upward trend in the cryptocurrency market, resulting in more sell-offs or liquidations.

Based on information from Coinglass, there was a significant increase of approximately 46% in total crypto liquidations within the past day, amounting to nearly $200 million. A large proportion, about $126 million, of these liquidated positions are short positions, which can be attributed to the widespread bullish trends across the market.

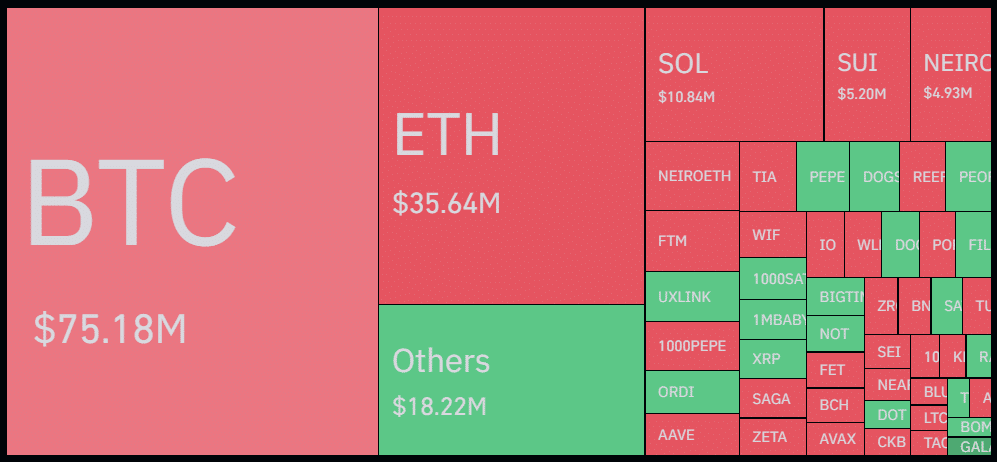

Bitcoin (BTC) tops the list with approximately $75 million worth of positions being closed after a 2.9% surge in its price. Currently, Bitcoin is being exchanged at about $62,000.

Remarkably, the most significant sale, valued at approximately $8.9 million in Bitcoin-U.S. Dollar pair, took place on the Bybit digital currency exchange, according to Coinglass’s data. In the last 24 hours, more than 66,000 traders have had their positions liquidated.

In simple terms, Ethereum‘s (ETH) liquidations exceeded $35 million when its value went past $2,400, securing the second position in the market.

Despite the increased liquidations, the total crypto open interest rose by 4% in the last 24 hours and is currently hovering at $58.7 billion.

Rising participation (open interest) often reflects a heightened sense of apprehension about being left behind (FOMO), which may amplify the number of liquidations and consequently cause substantial price volatility. At present, there’s a noticeable surge in investor enthusiasm.

Following the U.S. Federal Reserve’s announcement of a 0.5% reduction in interest rates at 6:00 PM Greenwich Mean Time on September 18, there was an uptick in liquidations. This was the first such rate cut by the Fed since March 2020.

Following this, the total crypto market capitalization climbed by 1.9%, amounting to $2.23 trillion according to CoinGecko data. Additionally, daily trading volume exceeded $120 billion. Furthermore, it’s worth noting that the U.S. stock market also experienced a surge in bullish trends.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-09-19 09:50