As a seasoned crypto investor with a background in decentralized finance (DeFi), I’ve witnessed the dynamic nature of this space firsthand. The recent resurgence of Solana (SOL) has been particularly noteworthy, as its native exchanges have taken center stage in DeFi activity.

Traders and investors looking for profits have found renewed interest in Solana this year, which in turn has brought SOL-specific decentralized finance (DeFi) exchanges into the limelight, driving a surge in DeFi-related activity.

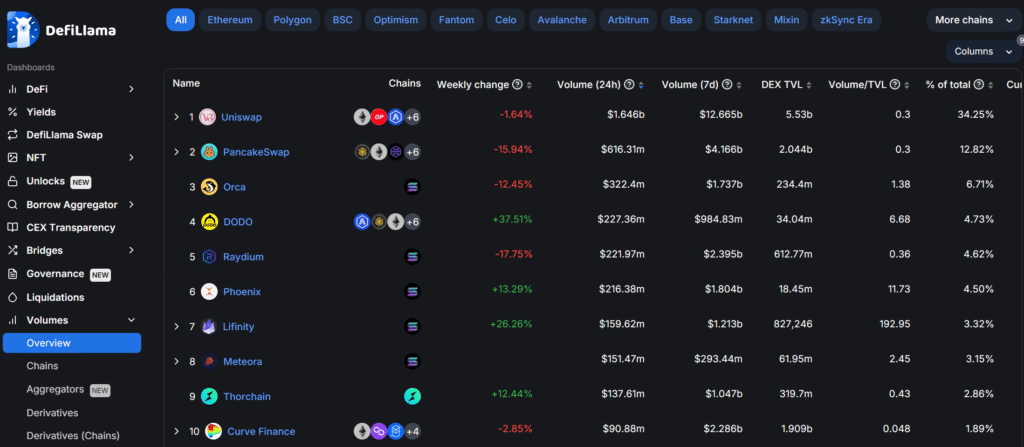

Five Solana-based protocols have emerged among the leading 10 decentralized exchanges (DEXs) in terms of trading volume over the last 24 hours, according to DefiLlama’s data.

As a crypto investor, I’d describe a Decentralized Exchange (DEX) as an open marketplace on the blockchain where users like myself can transact and exchange various cryptocurrencies directly, without intermediaries. Additionally, by supplying liquidity to these DEXs, I can earn returns through yield farming or passive income generation, which in turn supports the trading ecosystem with my capital.

Top 5 Solana DEX providers

In the decentralized exchange (DEX) market, Uniswap and PancakeSwap dominate with daily trading volumes of approximately $1.6 billion for Uniswap and $616.3 million for PancakeSwap. Orca on Solana’s platform follows closely behind with around $322.4 million in daily transactions. DODO, which operates on the Arbitrum platform, reported $227.3 million worth of trades in the previous day. Lastly, Raydium, the largest decentralized exchange by total value locked on Solana, recorded approximately $221.9 million in daily trading volume.

As a crypto investor, I’d say: Among the leading 10 Decentralized Exchanges (DEXs) according to DefiLama’s volume ranking, there are Phoenix, Lifinity, and Meteora, which are all built on Solana. These exchanges reported volumes of approximately $216.3 million, $159.6 million, and $151.4 million respectively. Thorchain and Curve Finance complete the top 10 list in this category with respective volumes of around $128.7 million and $111.9 million.

I’ve noticed an increasing interest in SOL-native protocols during this memecoin craze. According to crypto.news, the SOL ecosystem has emerged as the go-to platform for meme token trading. Notably, reputable institutions such as Franklin Templeton and venture capitalists like Andreessen Horowitz have also acknowledged the potential of the entire blockchain.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-07 19:48