As a crypto investor, I’ve observed that the Bitcoin halving didn’t result in the bullish price action some anticipated. Instead, it seemed like a “sell the news” event for me. With ongoing uncertainties surrounding global interest rates, it looks like we might need to wait longer for another Bitcoin rally.

Two weeks have passed since Bitcoin underwent its halving, an uncommon occurrence in the cryptocurrency world. Contrary to the expectations of optimistic investors, or “bulls,” the price increase has not yet materialized in the immediate term.

A significant portion of Bitcoin’s price fluctuations might not be within its direct influence. External factors such as escalating conflicts in the Middle East can cause abrupt drops in crypto market values.

I was closely monitoring my crypto portfolio on April 19th, when suddenly Bitcoin took a nose dive and dipped below the $60,000 mark. This unexpected move came in response to breaking news about Israel’s military strikes against Iranian targets.

Despite a swift price rebound, additional turmoil or intensifications in this intricately developing dispute may generate more obstacles ahead.

On May 1st, the significant psychological barrier of $60,000 for Bitcoin was put to the test as prices dipped down to a low of $56,555.

Here are five things we’ve learned since the halving that could help us chart what happens next.

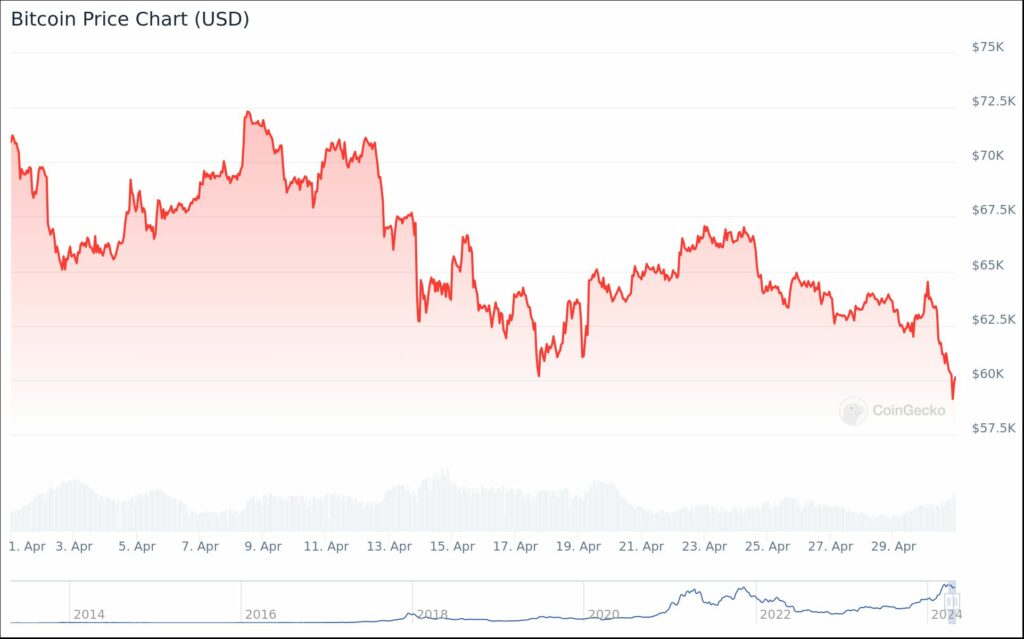

1. April was Bitcoin’s worst month in almost two years

For several weeks, the Crypto Fear and Greed Index indicated levels of Greed or Extreme Greed. However, traders were reminded of reality’s harshness at the beginning of May.

What caused Bitcoin to experience a significant decline in April? The cryptocurrency had reached an all-time high of $71,329.30 at the beginning of the month, but ended the month with a 14.95% decrease, closing at $59,228.70.

Despite values having bounced back, there remains apprehension regarding future developments. This represents a unique occurrence, as Bitcoin has previously reached a record peak prior to undergoing its halving event.

Some analysts maintain that this could represent the peak performance during the present bull market, while others are convinced it may take some time before another rally emerges.

“Left Curve”: The Case for Being More Crypto-Confident: Time to Buy the Dip and Hodl!

— Arthur Hayes (@CryptoHayes) April 23, 2024

2. Forecasts are mixed on Bitcoin’s prospects

Arthur Hayes, the ex-founder of BitMEX, predicted the Bitcoin downturn based on a combination of factors that unfolded perfectly:

Over the past two weeks, the U.S. tax season causing uncertainty, anxiety about the Federal Reserve’s actions, the Bitcoin halving serving as a significant selling point, and a deceleration in the growth of assets under management for U.S.-based Bitcoin ETFs came together to bring about a much-needed market correction.

Arthur Hayes

Despite holding the belief that Bitcoin has reached its current bottom, he anticipates limited price fluctuations between the ranges of $60,000 and $70,000 until August.

As an analyst, I would rephrase it as follows: I’ve observed that Standard Chartered has strongly asserted its belief that Bitcoin could hit $150,000 by year-end. However, it’s important to note their caution about a potential drop in price, which could bring BTC down to around $50,000.

According to Bloomberg Intelligence’s senior commodity strategist Mike McGlone, a note he shared with crypto.news carries a warning of caution. McGlone asserts that persistent inflation might be linked to inflated Bitcoin and equity prices. It seems that the Federal Reserve may still take some time before considering reducing interest rates.

If the S&P 500 begins to pull back from its nearly vertical ascent since October, cryptocurrencies could be affected. We believe the Federal Reserve will maintain its current stance and not ease monetary policy until inflation forces their hand. This could lead to headwinds for stocks in general, while gold may benefit from these conditions.

Mike McGlone

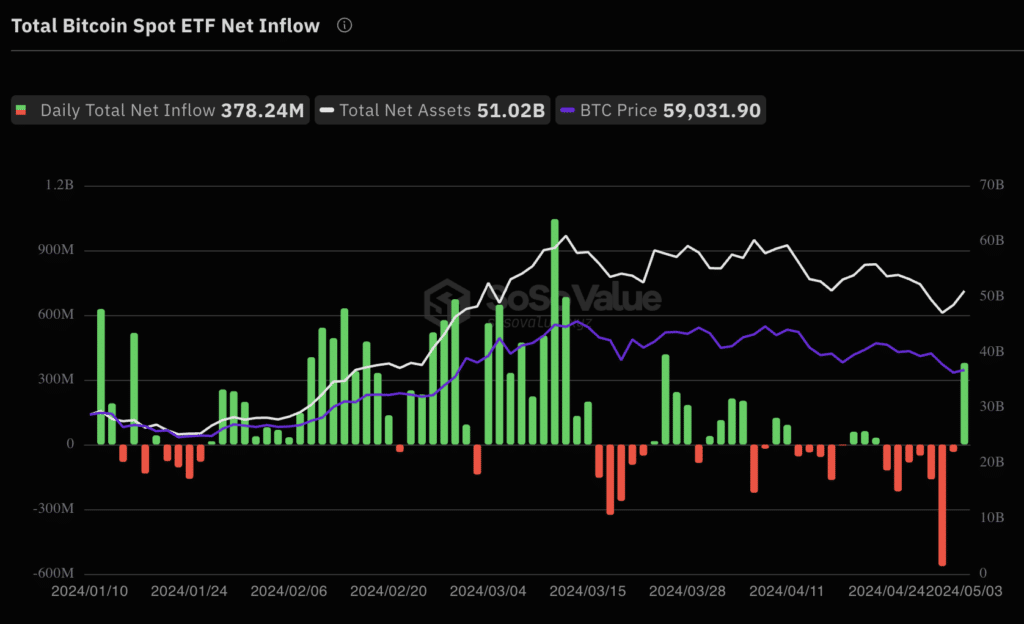

3. Times are tough for Bitcoin ETFs

Following the initial excitement after the U.S. Securities and Exchange Commission’s approval of Bitcoin ETFs in January, the demand for these exchange-traded funds based on Bitcoin’s current market price seems to be decreasing.

According to SoSo Value’s data, a staggering $563 million was withdrawn from Bitcoin ETFs on May 1, marking the end of a six-day streak of continuous outflows. However, on May 3, there were inflows totaling $378 million, breaking this trend. Bloomberg Intelligence analyst James Seyffart noted that such fluctuations in investments are typical for an Exchange-Traded Fund (ETF).

Despite high expectations that the introduction of Bitcoin and Ethereum ETFs in Hong Kong would result in significantly larger trading volumes than their Wall Street debuts, the launch proved to be underwhelming.

On the inaugural day, Bitcoin ETF trading volumes in the United States amounted to only $8.5 million – a staggering 98.6% decrease compared to the $628 million recorded during their initial arrival. However, according to JAN3 CEO Samson Mow, Bitcoin ETFs in Asia require more time to gain traction:

The potential impact of Bitcoin ETFs in Hong Kong is substantial, though it may not be immediately noticeable. With limited investment options available for Chinese investors presently, these ETFs could attract significant interest in the long run.

— Samson Mow (@Excellion) April 29, 2024

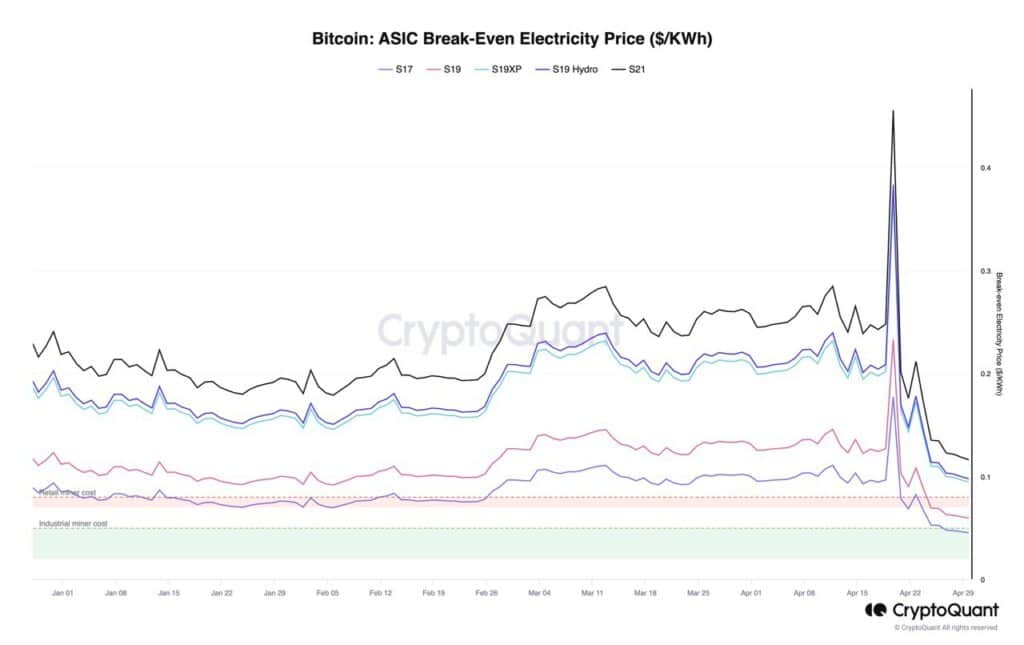

4. A nervous wait for miners

According to a recent report from CryptoQuant, Bitcoin miners may encounter considerable difficulties if bitcoin prices do not rebound soon. The increase in electricity expenses and decreased block rewards are putting pressure on the mining sector. As reported by crypto.news, Julio Moreno, the Head of Research at CryptoQuant, made this observation.

If the market does not experience a notable price increase this summer, it’s quite probable that miners will give up and sell off their holdings in larger quantities – a phenomenon referred to as “miner capitulation.” This is particularly concerning given the current downward trend in hashprice, which represents the average revenue earned by miners per hash rate unit, and has recently reached new lows.

Julio Moreno

During the summer season, trading activity usually decreases across all markets, including Bitcoin, which often underperforms from June through September.

#Bitcoin Emerges

— Michael Saylor⚡️ (@saylor) May 4, 2024

5. Keep an eye on these two

Undeterred, some executives are continuing to get their hands on as much Bitcoin as they can.

MicroStrategy currently holds approximately 214,400 Bitcoins, with an average purchase price of around $35,180 per coin. At present, Bitcoin is valued at $63,600. Consequently, Michael Saylor’s substantial investment translates to a paper profit for the company amounting to approximately $8.1 billion.

Currently, Block, previously known as Square and headed by ex-Twitter CEO Jack Dorsey, is setting aside a portion of its earnings to purchase more Bitcoin.

It’s uncertain where Bitcoin will go next, but there are signs pointing towards potential positivity.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-05-06 14:10