Uncover methods for financing blockchain initiatives. Ranging from self-funding to Initial Coin Offerings (ICOs), gain knowledge on procuring resources for your business and boosting its growth.

Table of Contents

In the realm of entrepreneurship, be it traditional business or crypto economy, the availability of financial resources significantly impacts the outcome of a startup. Even the most groundbreaking and revolutionary ideas can’t survive without sufficient funds. When the money runs out, so does the venture.

Luckily, in today’s world, there are numerous methods to finance your blockchain initiative without relying on a bank loan. In this article, we will explore five common alternative funding strategies for your blockchain business that could determine its success or failure.

What is a blockchain fund, and how does it work?

Above it has been explained that a blockchain fund refers to the financial resources allocated for initiatives, projects, or businesses based on blockchain technology. The significance of this financing lies in its role in advancing blockchain technology through research, innovation, and wider implementation.

This method typically operates by utilizing decentralized systems, intelligent contracts, and digital currencies to manage fundraising and investment procedures. The majority of financing channels involve generating and distributing tokens along with investor authentication following the guidelines of know-your-customer (KYC) and anti-money laundering (AML) laws.

Ways to fund your blockchain project

Financing blockchain initiatives can be accomplished through various methods such as self-funding (bootstrapping), investments from venture capitalists, crowdraising via crowdfunding platforms, peer-to-peer lending, and initial coin sales (ICOs).

Let us now take a closer look at each of these blockchain funding methods:

What is bootstrapping?

In the realm of blockchain technology, bootstrapping means helping launch a new initiative or providing crucial support during its early phases, enabling it to eventually operate independently with its own resources.

For some people, this method might be the most convenient and trouble-free option for financing your new business, particularly if you and your team have the resources to combine your funds and initiate the project right away.

Funding your own startup means you don’t need to report to external shareholders or investors. Plus, by self-financing, you keep full ownership of the company, which could become valuable in the future.

Bootstrapping starts with using personal savings, credit cards, or income from a day job to finance the initial stages of the crypto project. It also prioritizes essential expenses and minimizes unnecessary costs.

Crypto projects that are self-funded, also known as bootstrapped, run efficiently with minimal resources. They remain agile in response to shifting market conditions. Typically, they initiate with a basic version of their product (minimum viable product or MVP) and collect customer input for continuous enhancement.

Furthermore, they place great importance on earning income right from the start to finance future expansion and progress. This expansion occurs naturally via word of mouth, referrals, content marketing, and affordable techniques.

With increasing earnings from the project, self-funded entrepreneurs (bootstrappers) have the opportunity to progressively enhance their business operations. They can do this by bringing on new employees, devoting resources to advertising, or broadening their product range.

What is venture capital?

Private equity financing, specifically venture capital, supports the growth of new businesses and emerging companies showing great promise. It’s a widely adopted method in conventional financial markets and is now gaining traction within the burgeoning blockchain industry.

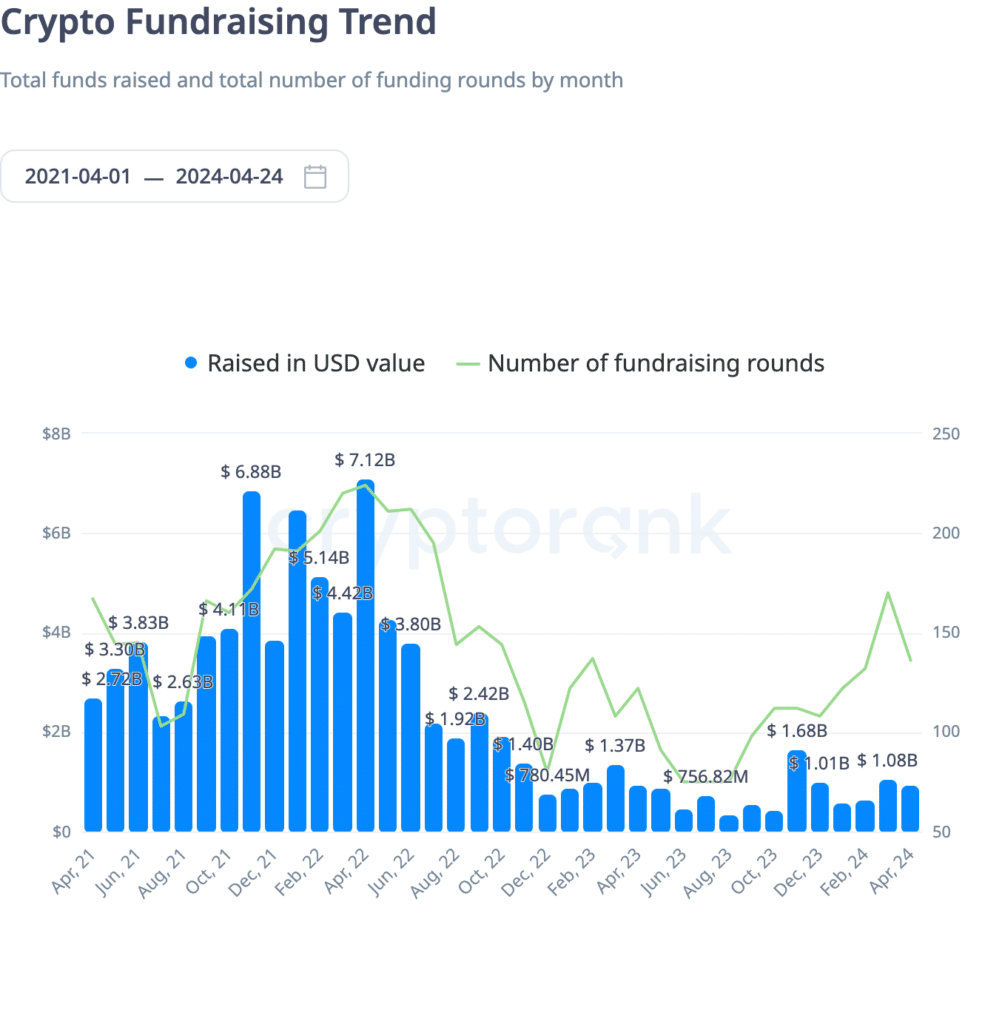

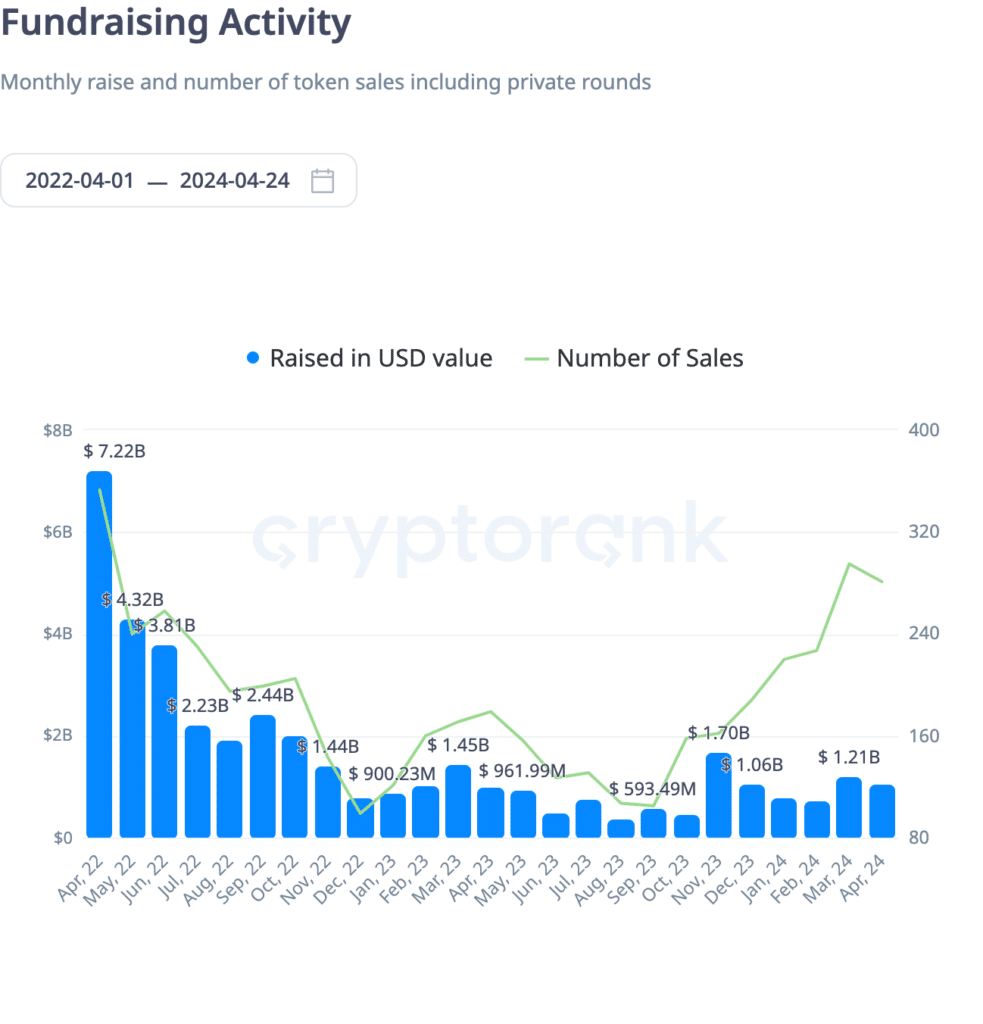

Over the past few years, there’s been an increase in venture capital investment for web3 startups. To put it into perspective, venture capital firms amassed over $11 billion in the first quarter of 2022 alone, as per a Pitchbook report, to fund around 900 blockchain and crypto projects.

In the following quarters, there was a decrease in available financing. This decrease could primarily be blamed on the dismal state of the bear market. The collapse of notable cryptocurrency companies such as Terra, Celsius, and FTX significantly impacted the crypto venture capital sector’s pace.

In Q4 2023, there was a significant increase in venture capital investment for crypto projects. This surge can be attributed to two main factors. First, the SEC’s approval of spot Bitcoin ETFs in the US. Second, the emergence of new blockchain applications like real-world asset tokenization and Decentralized PIN networks, which have contributed to this funding boom.

With venture capitalists as your backers, you’ll need to turn a profit faster than expected since they seek significant returns on their investment. Furthermore, certain VCs might prefer active involvement in managing their investments, giving them more decision-making power over your company as the founder.

VC investors typically evaluate a project’s promise based on its team, technology, market suitability, and overall potential before making an investment decision.

The investment process often broadly follows these steps:

Before investing in a startup, venture capital firms carefully examine various aspects of the business. They assess the potential success of the project, the advancedness and uniqueness of its technology, current market conditions, and the competitive scene.

When a venture capital firm finds a potential project that matches their investment goals or philosophy, they then work out the specifics of deals including valuation, ownership shares, or token distribution with the start-up company.

After reaching a deal, a Venture Capital firm contributes financing to a cryptocurrency company. In essence, they invest money. Subsequently, they obtain shares or tokens as compensation.

In addition to financial backing, venture capital firms provide valuable assistance through mentoring, shrewd counsel, and access to a broad network of industry connections, all aimed at fostering a thriving startup environment.

What is crowdfunding?

Crowdfunding allows crypto initiatives to garner financial support by amassing smaller donations from numerous individuals, usually via the internet. This is similar to traditional fundraising but with a digital twist: people combine their funds to back concepts or endeavors they are passionate about.

In crypto crowdfunding, unlike with conventional venture capital or angel investments, there’s no requirement for a middleman. Instead, investors have the opportunity to connect and invest directly.

There are three main types of crowdfunding: reward-based, donation-based, and equity-based.

In simpler terms, rewards-based crowdfunding is a method where supporters receive incentives in return for their financial contributions to a project or business launch. A well-known platform for this type of funding is Kickstarter, based in the United States.

In the realm of fundraising, particularly within the non-profit sector, there exists a method known as donation-based crowdfunding. This approach allows individuals or non-governmental organizations to collect funds from a large number of people for initiating a charitable project. The use of donation-based crowdfunding is less common in the profit-driven industry.

Through equity-crowdfunding, investors acquire tiny ownership stakes in the businesses they support. Consequently, startups have the option of utilizing online equity-crowdfunding platforms like Crowdfunder, CircleUp, and WeFunder for fundraising as an alternative to going public, allowing them to secure investments from private backers.

The crowdfunding process generally follows these steps:

Creating acrypto project: An individual or team with a promising idea for a cryptocurrency initiative launches a funding campaign on popular platforms like Gitcoin or CoinStarter.

Project Explanation: The initiator provides information about the project such as its aim, objectives, schedule, and how the collected funds will be allocated. In addition, they might provide enticing rewards or incentives for various donation amounts to attract more supporters.

After that, the person in charge of the campaign shares their crowdfunding project on various platforms such as social media, email networks, and by word-of-mouth to expand its reach and capture the attention of possible supporters.

Interested individuals in the crypto project have the option to support it through the crowdfunding site. The amount of contribution varies, allowing both smaller and larger investments based on each supporter’s level of interest and financial capabilities.

Funding objective: A campaign typically sets a specific financial goal that is essential for accomplishing the project’s intended outcomes. Different platforms employ distinct financing methods; some follow the “take it or leave it” approach, where the project can only secure funds if it reaches its goal, while others provide flexible funding, enabling the project to retain all pledged contributions regardless of whether the target is met.

Length of Campaign: The usual duration for crowdfunding campaigns is around 30 to 60 days. During this phase, the campaign organizer interacts with supporters, shares progress reports, and motivates them to increase their pledges, aiming to surpass or hit the financial target.

Fund distribution: Reaching the funding target for your campaign triggers the crowdfunding site to handle contributions and transfer the funds to you, less any platform fees. You subsequently employ these funds to carry out the project according to the campaign’s plan.

What are peer-to-peer loans?

P2P lending, also known as marketplace lending, refers to the process of individuals borrowing and lending money directly to one another outside of conventional financial institutions such as banks.

For individuals who prefer keeping full control of their business without bringing in external investors, and are capable of managing debt to finance their undertaking, this approach is highly suitable.

If you’d like to borrow money through a peer-to-peer lending system, submit your request for the desired loan amount on platforms like LendingClub or Prosper for potential investors to consider.

After the funding needs and conditions are finalized between the startup and the P2P lending site, the loan is made available for investors to fund. Once the required investment amount is reached through blockchain transactions, the funds are transferred to the startup. The startup then repays the principal amount along with pre-set interest installments throughout the loan period, all managed by the peer-to-peer lending platform.

For individuals or businesses, such as crypto startups, who have difficulty obtaining traditional bank loans or wish to retain ownership of their company, peer-to-peer lending offers a viable solution.

What is an initial coin offering?

In the end, a common approach for financing a fresh blockchain undertaking is by means of an Initial Coin Offering (ICO). This is a way crypto initiatives collect funds from investors by offering them digital coins or tokens in exchange.

Digital tokens serve as proxies representing investor involvement in the project and provide insights into the startup’s progress. In essence, ICOs share resemblance with traditional stock Initial Public Offerings (IPOs), but instead of owning company shares, investors acquire digital tokens that are connected to the project’s performance indirectly.

With TokenMarket leading the way, releasing a digital token becomes less intimidating. They manage the entire procedure for a charge, enabling easy access to ICO fundraising for those initiating a fresh blockchain undertaking.

To organize an Initial Coin Offering (ICO), you initially develop a new digital token on a blockchain system, frequently relying on Ethereum‘s ERC-20 template. These tokens symbolize ownership, functionality, or other privileges within the project’s community.

After that, release a comprehensive report outlining the goals, technology, personnel, economic model, potential applications of the token, timeline, and other important details of your project. This whitepaper functions as an investment proposal or company blueprint for possible backers.

Subsequently, share the details of the ICO for the token, which includes the commencement and conclusion dates of the token offering, the entire token supply available, the cost of each token, the supported cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), and any rewards or advantages for early investors.

After completing that step, interested investors have the opportunity to buy the project’s tokens during the Initial Coin Offering (ICO). They make their investments by transferring their cryptocurrencies to the designated wallet address given by the ICO.

Once the ICO is over, the project will transfer the acquired tokens to investors’ digital wallets according to the cryptocurrency amount they invested and the token distribution outlined in the ICO conditions.

After securing the necessary funds through the sale, the project will proceed with creating and launching its platform, technology, or offerings as detailed in the whitepaper. Token owners have the opportunity to join the project community, utilize services, collect incentives, or take part in decision-making processes based on their token’s function.

After the ICO is finished and tokens have been allocated, the project could attempt to list those tokens on cryptocurrency exchanges. This would enable token owners to buy and sell their tokens, thus creating a marketplace and possibly boosting the token’s worth depending on market interest.

Final thoughts on funding blockchain

Providing finance for blockchain initiatives is essential for their prosperity because liquidity plays a significant role in keeping entrepreneurial businesses thriving, particularly within the crypto marketplace.

Each funding method, such as bootstrapping, venture capital, crowdfunding, peer-to-peer loans, and ICOs, comes with distinct benefits and challenges.

Bootstrapping grants autonomy with the condition of providing one’s own finances and carefully managing resources. On the other hand, venture capital offers valuable knowledge and abundant resources but comes with the consequence of sharing decision-making authority and achieving specific financial goals.

Crowdfunding makes it possible for everyone to contribute to funding a project, but it’s essential to market effectively and engage with backers successfully. Peer-to-peer loans provide an alternative financing option without giving up equity, but borrowers must ensure timely repayments. ICOs offer the chance for widespread investment, but careful planning and adherence to regulations are necessary.

Based on your project aims, available resources, and tolerance for risk, selecting the most suitable funding method is essential. Conduct thorough investigation into various options for financing your cryptocurrency initiative to determine the most fitting choice.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-24 15:39