As a seasoned crypto investor with a knack for spotting trends and deciphering market signals, I must say this recent development has piqued my interest once again. The shift from inflows to outflows from centralized exchanges, coupled with the increasing whale accumulation, paints a bullish picture that I can’t help but find appealing.

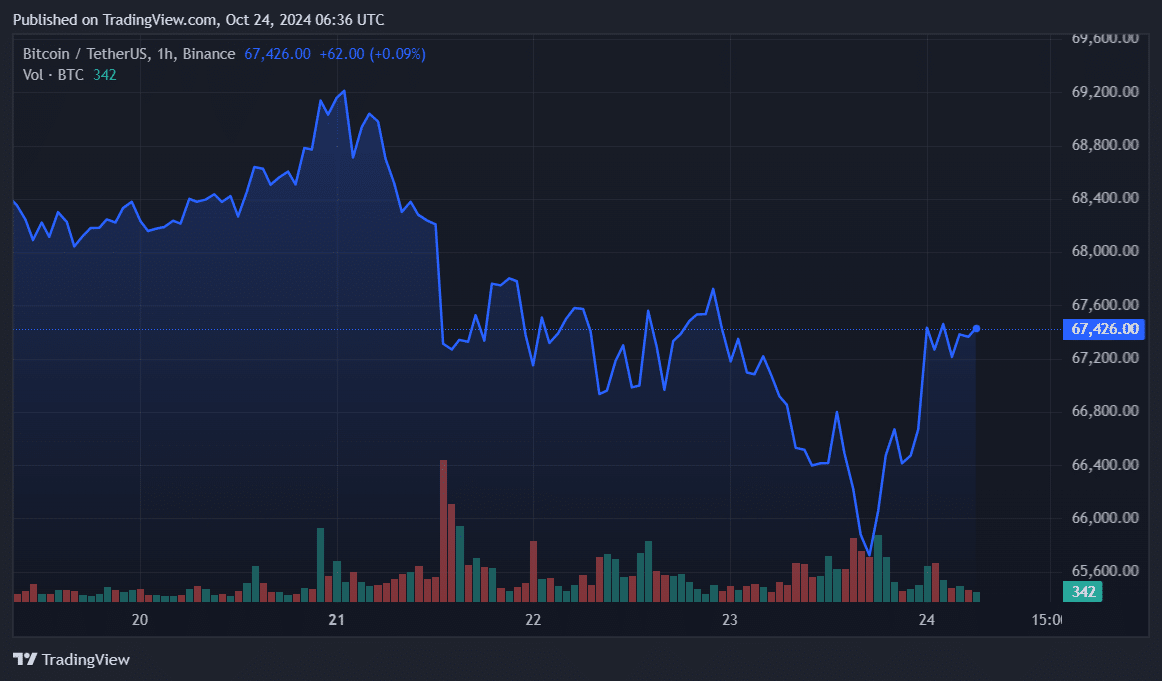

Bitcoin‘s withdrawal from centralized exchanges by large investors (whales) and their increased accumulation led to its price soaring past $67,000 once more.

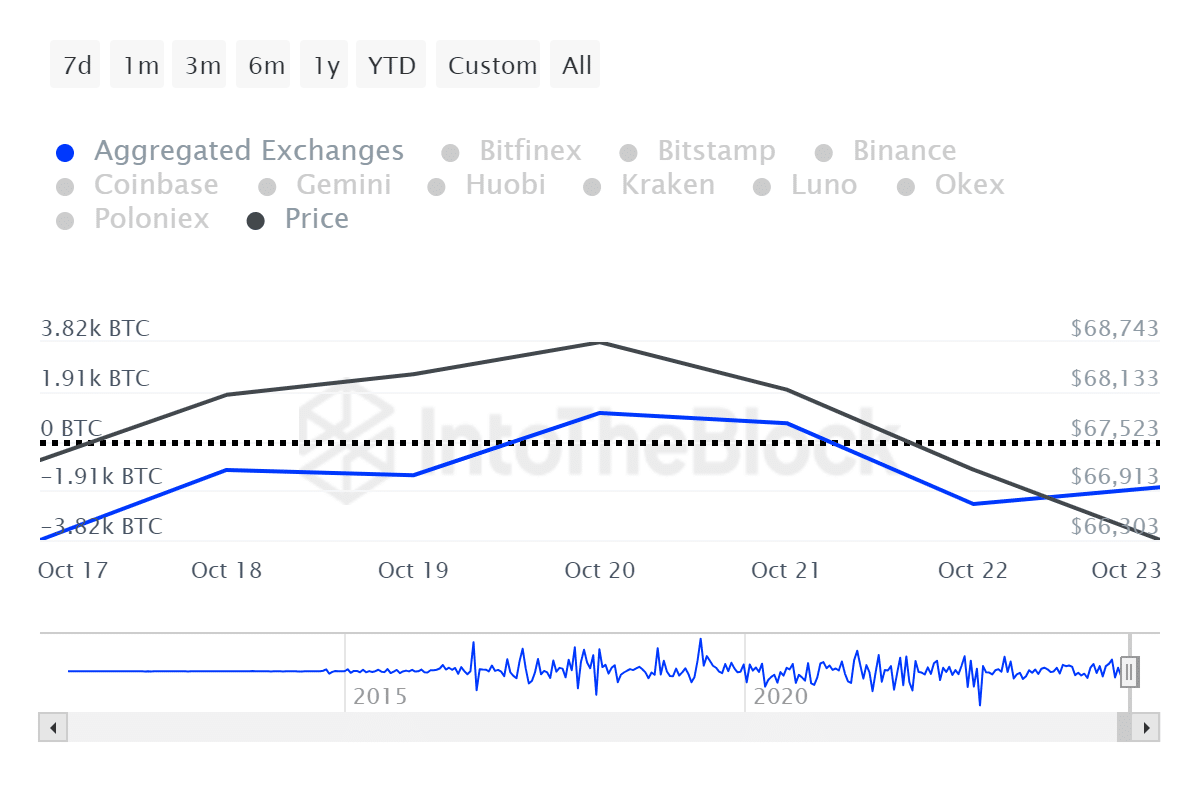

Based on information from IntoTheBlock, there were two consecutive days (Oct. 20 and 21) where Bitcoin (BTC) exchange net flows showed inflows. This led to a decrease in the price, which had peaked at a local high of $69,400.

From October 22nd to the 23rd, there was a reversal in this trend towards outgoing transactions. According to ITB’s data, Bitcoin experienced a net outflow of approximately $581 million over the past week, indicating an amassing or accumulation phase.

Whales join the accumulation

On October 21st, it was noted that whales (large Bitcoin holders) had begun selling Bitcoin as well. Interestingly, approximately 94% of these holders were already in profit. Moreover, recent data indicates a decrease in the selloff among such large Bitcoin holders.

Bitcoin whale addresses recorded a net inflow of 165.5 BTC, worth $11.15 million, yesterday.

Remarkably, the value of Bitcoin transactions by ‘whales’ (individuals or entities controlling large amounts of BTC), exceeding $100,000 each, has crossed the $100 billion threshold during the last seven days.

High whale activity and accumulation could trigger a market-wide FOMO.

In the last 24 hours, Bitcoin has experienced a 0.3% increase and is currently valued at approximately $67,350 per unit. At this moment, its total market capitalization stands at an impressive $1.33 trillion. Notably, its daily trading volume has seen a significant surge of 18%, amounting to around $35 billion.

On Wednesday, another positive factor was the surge in investments into Bitcoin exchange-traded funds (ETFs) in the U.S. As per a report from crypto.news, these investment products recorded a net inflow of approximately $192.4 million on October 23, with BlackRock’s iShares Bitcoin Trust ETF leading the way.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-24 10:05