As a seasoned researcher with years of experience tracking cryptocurrency markets, I’ve seen my fair share of rollercoaster rides. The recent surge in Bitcoin’s price above $95,000 is no exception. The data points to an unprecedented accumulation phase among retail investors, which was further fueled by the influx of funds into U.S. spot BTC exchange-traded funds.

The surge of Bitcoin beyond $95,000 sparked a significant accumulation period for individual investors, indicating increased buying activity.

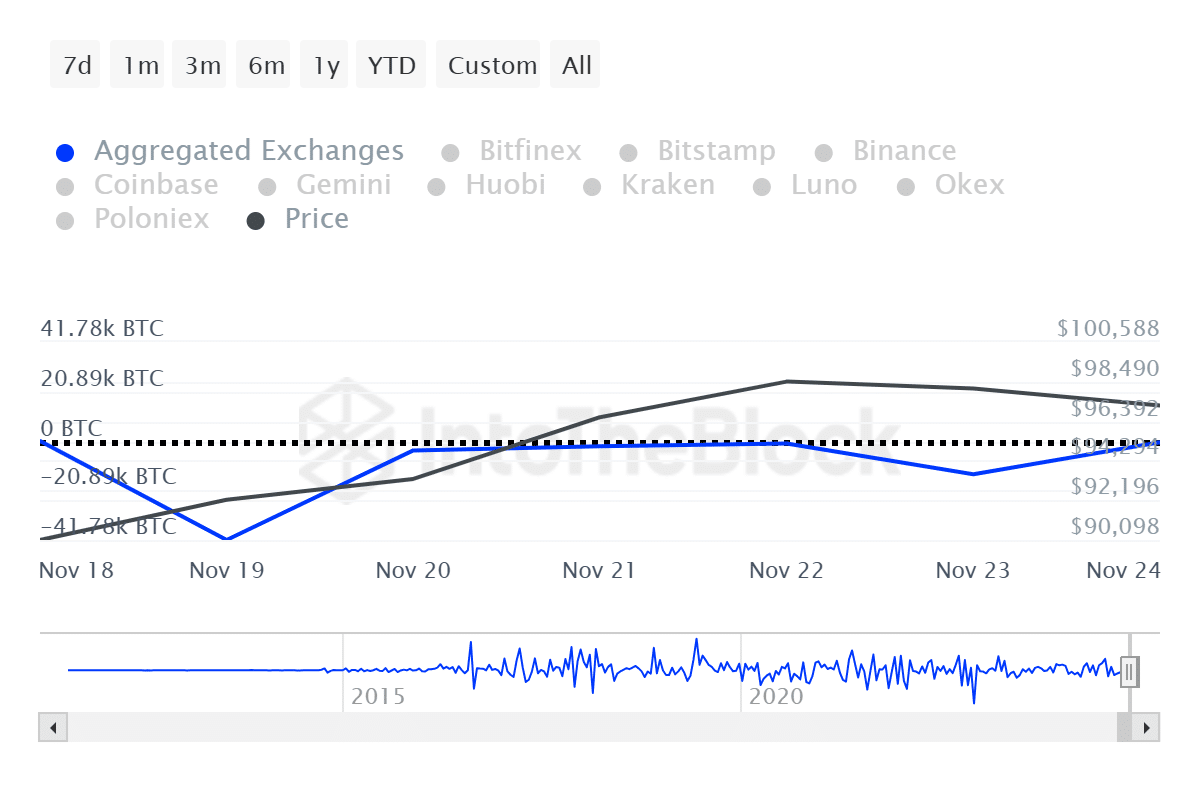

Over the past week, Bitcoin (BTC) experienced a net exchange outflow worth approximately $6 billion, with $3.9 billion leaving on November 19th alone, as indicated by IntoTheBlock’s data. This significant accumulation trend propelled Bitcoin to reach an unprecedented high of $99,655 on November 23rd.

In recent times, a significant contribution towards Bitcoin’s rise near the $100,000 level was made by the substantial weekly inflow of approximately $3.38 billion into Bitcoin exchange-traded funds (ETFs) based in the U.S. These ETFs, operating on the spot market, have played a pivotal role in this price surge.

Conversely, whale activity related to Bitcoin seemed to decrease prior to the price reaching its all-time high.

As an analyst examining data from ITB, I noticed a significant decrease in large Bitcoin transactions valued at least $100,000. In the span of four days, from November 21st to 24th, the number of such transactions dropped from approximately 32,000 to 19,500. This decline also corresponded with a dramatic decrease in the total volume transacted, falling from around $136.4 billion to $53.6 billion within that timeframe.

Last week, Bitcoin recorded a total of $243.67 billion in whale transactions.

The movements show that retail investors have been more active than large holders.

As a crypto investor, I’ve noticed an interesting shift in Bitcoin’s large-holder dynamics based on ITB data. Whereas there was a net outflow of 9,190 Bitcoins earlier, surprisingly, that trend reversed on Sunday, November 24, with a net inflow of approximately 4,090 Bitcoins into the hands of large holders.

An increase in the number of whales (large investors) holding whales (Bitcoin) might provoke a sense of urgency or FOMO (Fear Of Missing Out) among market participants, especially if the price surpasses $100,000. This could lead to an escalation in purchasing activity from both small and large Bitcoin owners alike.

Over the past 24 hours, I’ve noticed Bitcoin holding steady around the $98,000 area. Interestingly, despite this consolidation, its daily trading volume experienced a significant jump, climbing up to approximately $55 billion – a notable 27% increase.

Over the past 24 hours, the overall value of the cryptocurrency market dropped by approximately 2.3%, settling at about $3.47 billion. Furthermore, due to Bitcoin falling below $98,000 earlier today, liquidations totaled $494 million. This event sparked a broad market decline, particularly impacting smaller altcoins significantly.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-25 10:54