So, the SEC is basically playing hard to get with 72 altcoin ETF proposals just chilling in their inbox. Meanwhile, Bitcoin is like that overachiever who hogs 90% of all crypto ETF investments. Sorry altcoins, it’s tough being the popular kid when Bitcoin’s showing up with a marching band 🙄.

New listings definitely stir the pot, bringing fresh money and hype—Ethereum’s ETF options got a solid applause, if you were wondering. But let’s be honest, no altcoin is about to dethrone Bitcoin’s ETF crown anytime soon. It’s like trying to dethrone Beyoncé with a garage band. Cute, but unlikely.

Bitcoin: The Big Cheese of ETFs 🧀

Bitcoin ETFs have basically been on a Netflix-drama-level rollercoaster lately, but somehow they’re still killing it. In the US, net assets are sitting pretty at $94.5 billion despite some people making the classic “sell everything” move recently. Slow down, drama queens.

Because Bitcoin had such a bang-up launch, crypto issuers are now spam-sending the SEC with applications like they’re begging for VIP passes to a really exclusive party.

How exclusive? Try 72 proposals waiting for the SEC’s “thumbs up”:

“There are now 72 crypto-related ETFs sitting with the SEC awaiting approval to list or list options. Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x MELANIA and everything in between. Gonna be a wild year,” said ETF whisperer Eric Balchunas. Penguins??? Seriously?

The regulatory vibe has shifted from “We don’t even want to talk about crypto” to “Okay, maybe we can give this a shot.” So, of course, everyone wants a slice of this Bitcoin-sized pie.

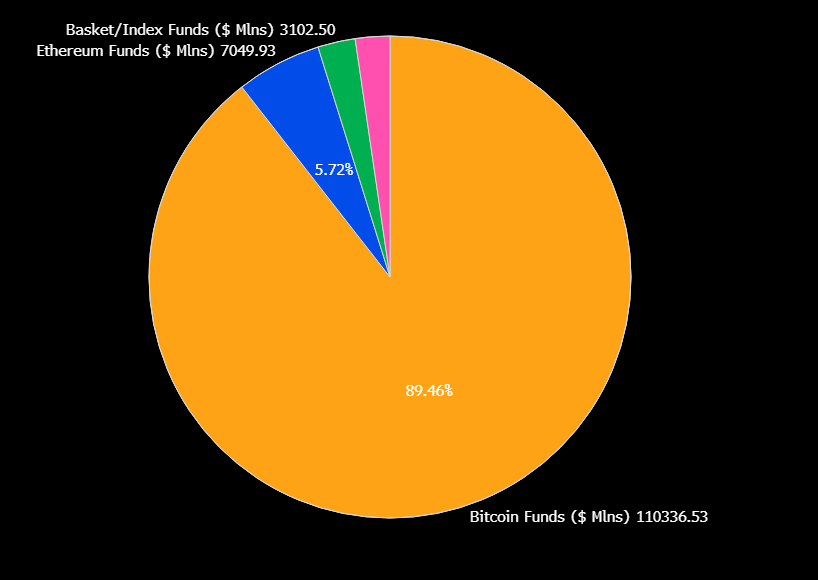

But Bitcoin has a head start longer than your last Netflix binge, and it’s hard to see any newbie stealing more than a tiny nibble of its 90% market share.

To put this in perspective: BlackRock’s Bitcoin ETF was hailed as “the greatest launch in ETF history,” which, let’s be real, is like calling your PB&J sandwich the best meal ever—it’s that big. Altcoin ETFs basically have to do backflips and sing karaoke just to get some attention.

Ethereum ETFs brought in some fresh money and eyeballs, but Bitcoin’s still the cool kid at the institutional market party.

Out of those 72 proposals, only 23 are about altcoins other than the usual suspects—Solana, XRP, or Litecoin—and a lot are just remix versions of existing ETFs. Because why create something new when you can just slap a fresh label on a remix? 🎶

Experts say these altcoin ETFs collectively won’t come close to taking more than 5-10% of Bitcoin’s ETF throne. If Bitcoin sneezes, the whole crypto market catches a cold, so don’t expect any sudden royal upheavals.

That said, these altcoin ETFs aren’t total dead-ends. They keep pumping in interest and money into their tokens, especially when issuers are going full squirrel and hoarding token stockpiles.

Still, let’s keep it real: XRP and Solana ETFs might kick off some altcoin hype cycles, but Bitcoin will probably keep flexing its ETF muscle like the undefeated champ it is, proudly called the “store of value,” which is just a fancy way of saying “I’m the gold standard, but digital.” 💰

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-04-21 22:37