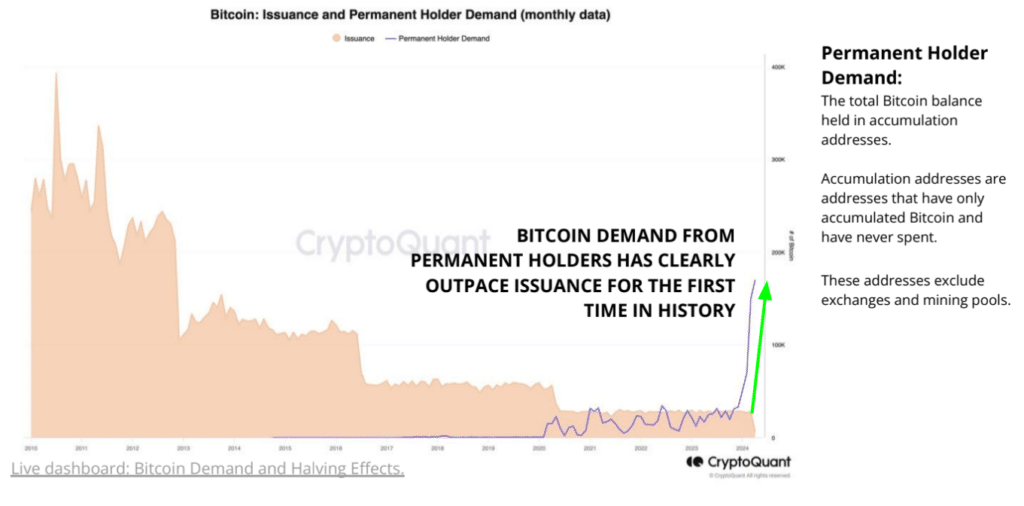

According to CryptoQuant’s analysis, the desire for Bitcoin among long-term investors, or “permanent holders,” surpassed its supply growth for the initial time ever. This could be a significant indicator boosting the likelihood of an increase in Bitcoin‘s value.

According to a study by CryptoQuant, the desire for Bitcoins among long-term investors currently exceeds the rate at which new coins are being released into circulation for the first time ever.

Long-term investors are currently buying roughly 200,000 Bitcoins every month, according to analysts’ estimates. This rate significantly surpasses the monthly supply increase of approximately 28,000 new Bitcoils generated through mining.

According to CryptoQuant’s analysis, the upcoming Bitcoin halving will decrease the monthly supply by approximately 14,000 units. This reduction signals a notable change in the bitcoin market’s supply-demand balance.

Regarding the imminent halving, Arthur Breitman, Tezos’ co-founder, referred to it as a “decrease in the security expense.” This reduction in rewards for Bitcoin miners could bring advantages to the network in the near term by possibly correcting overcompensation for security. However, Breitman emphasized that ongoing adjustments to emission policies will be necessary to preserve security in the long run.

“Currently, Bitcoin’s high security costs may seem beneficial, but it serves as a warning that its emission policy eventually needs adjustment to preserve security. Predictions regarding Bitcoin’s financial future based solely on halving events should be viewed with skepticism.”

Arthur Breitman

Although Breitman issued a warning, crypto industry leaders have varying perspectives. Arthur Hayes, ex-CEO of BitMEX, forecasts Bitcoin’s price drops preceding and following the halving, explaining it by the scarcity of dollar liquidity during that time. In contrast, Fred Thiel, Marathon CEO, posits that the halving’s effects might have been factored in, referencing the approved spot Bitcoin ETFs.

Bitcoin miners are getting ready for a decrease in their rewards as the upcoming halving in mid-April reduces rewards from 6.25 to 3.125 BTC per block. This happens automatically when the Bitcoin network reaches a predetermined height in its blocks. The goal of mining all 21 million Bitcoins is predicted around 2140, after which miners will solely depend on transaction fees for their compensation.

Read More

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-04-11 14:57