For exchanges and ETFs, it could mean a significant decrease in revenue at the box office, or a major setback. However, this situation may bring disappointment and struggle for miners and competing cryptocurrencies.

The Bitcoin halving is just around the corner, and some early investors are excited about it due to Bitcoin’s recent price surge. However, the upcoming reduction of block rewards by half isn’t a cause for celebration for everyone.

What are the teams or parties that have emerged victorious and which ones have suffered losses after this unusual occurrence? How could this impact the market trends in the future?

The winners

Individuals with extensive experience in Bitcoin, often referred to as “early adopters” or “OGs,” reap the greatest rewards due to their lengthy exposure. The Bitcoin halving event reduces the daily creation of new coins to approximately 450. However, this development has minimal impact on those who have been accumulating Bitcoin for years.

An individual who bought and held Bitcoin back in November 2012 when the first halving occurred would have experienced a remarkable increase of over fifty thousand percent (502,693%) in value. Bitcoin, the most well-known cryptocurrency, has undergone significant growth since the second halving eight years ago, with an impressive rise of nearly ten thousand percent (9,578%). Following the latest halving during the coronavirus pandemic in May 2020, its value has increased by approximately six hundred percent (607%).

Exchanges

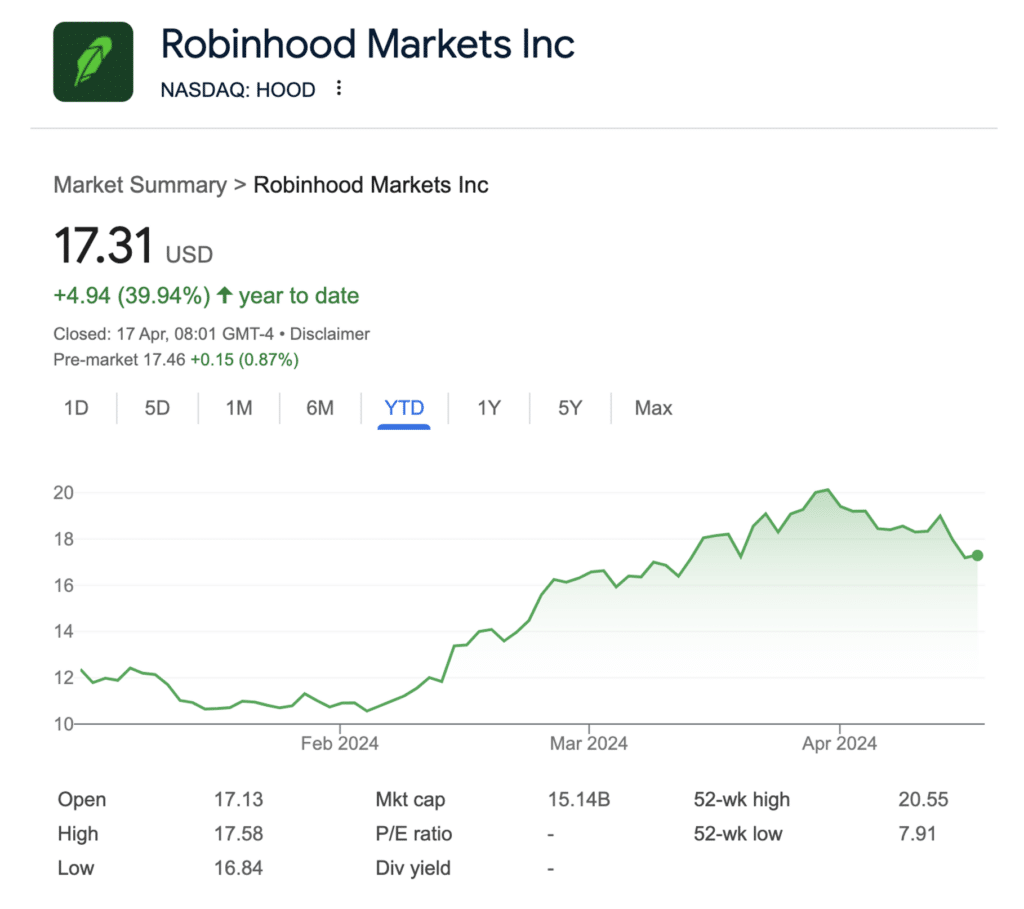

Platforms such as Robinhood and Coinbase are anticipatingwith excitement the onset of the halving event, as they expect a surge of new sign-ups from intrigued individuals wanting to join the buzz. Additionally, heightened trading activity among experienced traders will result in substantial revenue for these platforms through increased transaction fees.

The shares of these two businesses have experienced significant growth in value since the beginning of the year, as they are currently traded on the stock exchange.

Firms are gradually increasing their marketing budgets for crypto businesses again, even though we’re not experiencing the frenzy of the last bull market where crypto exchange ads took over the Super Bowl. Grayscale recently debuted a new commercial, and Coinbase has been airing ads during major basketball games. To highlight Bitcoin’s enduring value, they use an engaging food analogy for Bitcoin Day.

ETFs

In January, the United States granted approval for exchange-traded funds (ETFs) linked to Bitcoin’s current value. These ETFs have contributed significantly to Bitcoin reaching a new record price, surpassing its previous all-time high, prior to the upcoming halving event.

The iShares Bitcoin Trust by BlackRock has gained prominence in the crowded Bitcoin market, managing an impressive $17.1 billion in assets. Should the upcoming halving event lead to increased interest from individual and institutional investors, this trust could significantly benefit.

Michael Saylor

Someone else who comes out of the halving smelling of roses is Michael Saylor.

In August 2020, the founder of MicroStrategy made a bold move by purchasing large amounts of Bitcoin for their company’s reserves.

Currently, MicroStrategy holds approximately 214,000 Bitcoins, which they purchased for an average price of $33,706 each. This accumulation equates to one percent of the total supply of Bitcoin that will ever be mined. Consequently, their current paper profits amount to around $6.5 billion.

During the challenging bear market in 2022 when Bitcoin dropped to a low of $16,000, Saylor’s significant investment faced substantial losses and was financed through high amounts of debt.

Instead of “Saylor has now taken a step back as CEO and is now MicroStrategy’s executive chairman, giving him more time to advocate for Bitcoin. He does a lot of that on X,” you could try:

Elevate your thinking. #Bitcoin

— Michael Saylor⚡️ (@saylor) April 17, 2024

Journalists

Crypto reporters are an essential addition to any roster of Bitcoin halving victors. After all, we’ve got a lot on our plates covering each development in the crypto sphere for crypto.news.

The losers

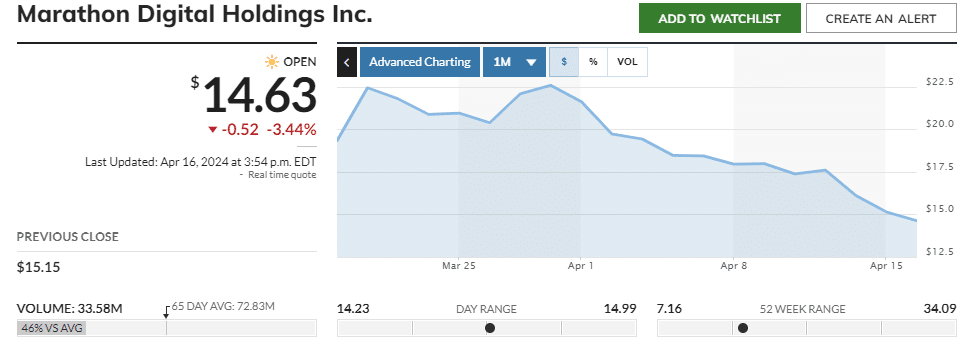

It won’t come as a shock that miners will experience significant reductions in their rewards following the halving event. Specifically, the amount they earn for maintaining the network’s security will decrease from 6.25 to 3.125 Bitcoins per block, translating to approximately $197,000 less in cash value.

Miners in energy-expensive areas and those with outdated equipment may struggle financially to continue, while shares in Marathon Digital Holdings and Riot Platforms – major mining companies – have plummeted by 35% in the last month due to concerns about the halving’s potential financial consequences.)

Other cryptocurrencies

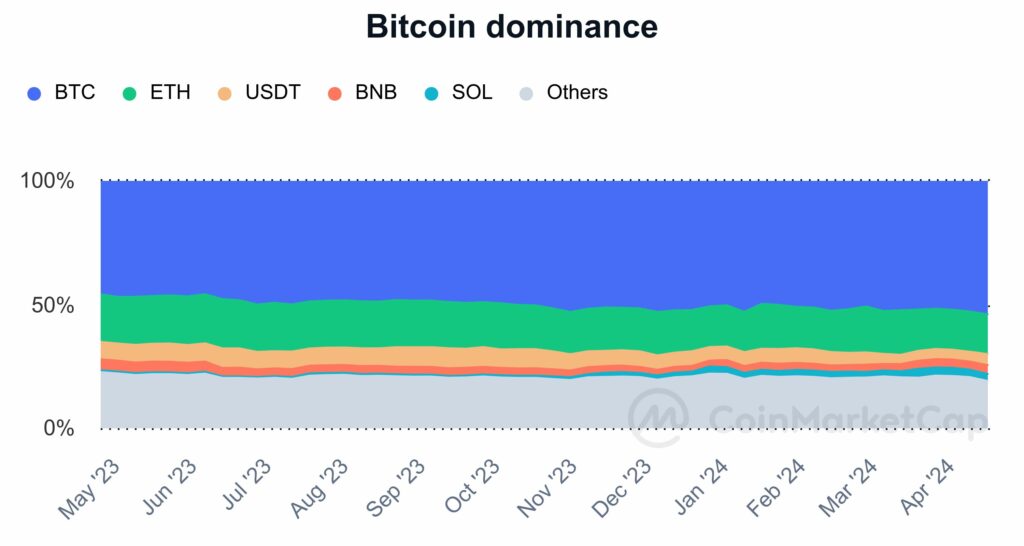

Bitcoin’s dominance now stands at 54.2%, compared with 45.8% a year ago.

The increase in BTC’s market share has been at the expense of Ether and smaller altcoins.

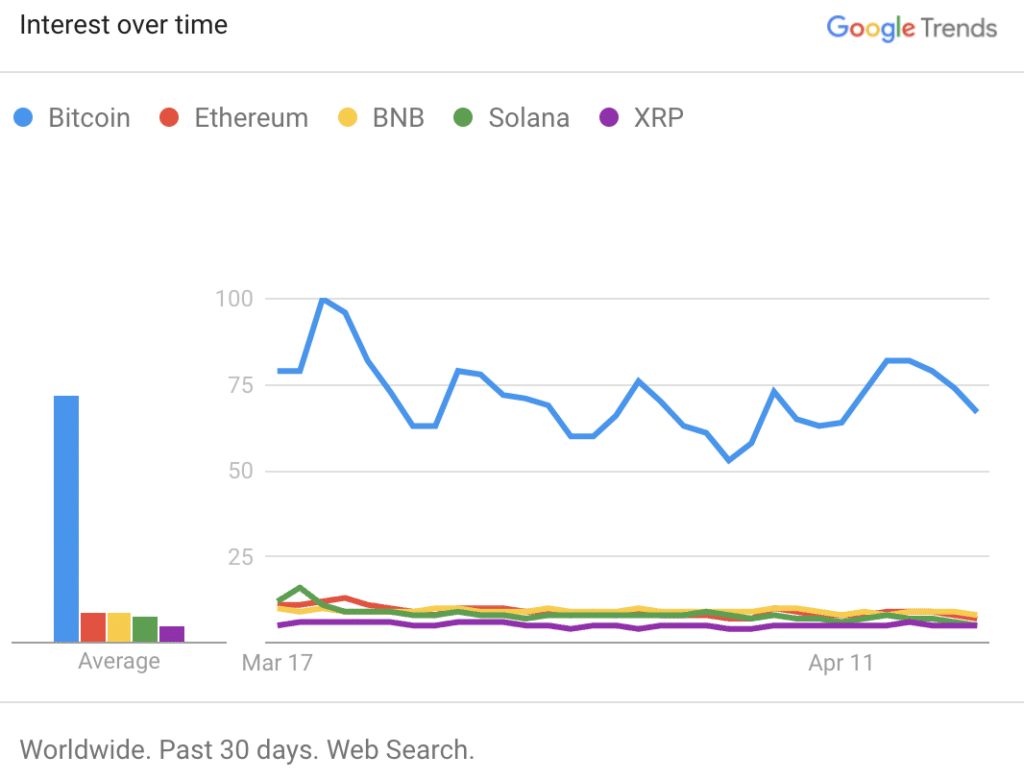

Instead of merely putting money into investments, investors are displaying strong interest in Bitcoin based on Google Trends data, indicating that this cryptocurrency is currently dominating the market’s attention over its rivals.

Analysts

Many experts are ready and eager to share their bold forecasts about the future direction of Bitcoin’s price.

Some experts, such as JPMorgan, predict that Bitcoin could experience a price drop to around $42,000 following its halving event. In contrast, Tom Lee from Fundstrat Global Advisors is optimistic and believes that Bitcoin’s price may reach new heights of $150,000 within the next year.

It’s not possible for everyone to be correct, and by the end of the year, certain analysts who made overly optimistic forecasts will find themselves with unwanted eggs on their faces as mistakes come to light.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-17 16:49