As someone who has closely followed the developments in the world of digital currencies and payments, I can’t help but express my reservations about the prospect of a central bank digital currency (CBDC) for the U.K., popularly known as “Britcoin.” While the idea of a cheaper, faster, and more modern way of making payments is appealing, I believe that there are significant concerns that need to be addressed before we can wholeheartedly embrace this concept.

The concept of a digital pound, which promises lower costs, quicker transactions, and a more contemporary payment method, has gained attention, yet not universally accepted.

I’ve observed the U.K.’s commitment to establishing itself as a leading crypto hub gaining momentum recently. Frustrated by regulatory uncertainties in other regions, companies have been eagerly attracted to this prospect. The U.K.’s determination to finalize these plans is palpable and they might be brought into fruition as early as this summer.

Another issue where the country is lagging behind is the decision to introduce a central bank digital currency (CBDC), colloquially referred to as “Britcoin.” Despite the similar-sounding name, CBDCs differ significantly from the unstable cryptocurrencies currently leading the market.

As an observer, I’ve noticed that the Bank of England has acknowledged the likelihood of introducing a digital pound in response to Britain’s growing cashless trend. However, they have not yet committed to creating one definitively. Discussions have been held to weigh the advantages and disadvantages of a Central Bank Digital Currency (CBDC). Economists are currently engaged in developing a prototype.

As an observer, I’d like to share some intriguing insights about the Bank of England’s proposition. They have presented a graphic to illustrate how digital currency could potentially supplant traditional coins and banknotes. By adopting this innovation, we stand to reap several advantages.

Additional advantages are recognized, such as quicker and more affordable transactions for both consumers and merchants. Moreover, this method ensures that payments are disbursed solely upon completion of product deliveries or rendered services.

With a general election expected to take place by January 2025, and the Conservatives appearing likely to lose power, it is essential to consider Labour’s stance on Britcoin since they are the frontrunners. In their recently published financial policy document, Labour expressed their views:

As an observer, I can tell you that I personally endorse the Bank of England’s efforts in addressing concerns related to privacy, financial inclusion, and stability. It is my belief that Labour shares this sentiment and aims to collaborate closely with the Bank to ensure that these important issues are adequately addressed and alleviated.

Labour Party

That sentence neatly touches on several major concerns that critics have about Britcoin.

I’ve noticed some concerns being voiced by certain MPs and industry experts regarding the potential creation of a digital pound. They fear that this new currency could be used to track consumer spending or even limit purchases, such as flights or red meat. In fact, the Electronic Money Association went so far as to submit written evidence to the House of Commons Treasury Committee, expressing their apprehensions.

In an open civilized community, it’s unsettling and futuristic that every transaction could be monitored, saved, and scrutinized indefinitely. Nonetheless, this possibility exists. Individuals deserve a degree of privacy in their daily lives. However, we may make concessions to this principle only when the risk of financial crime necessitates such transparency.

Electronic Money Association

Although some may view it as an alarmist tactic, China has demonstrated the effectiveness of this approach through real-world implementation. For instance, Beijing has taken a significant lead over developed economies with its digital yuan launch. The People’s Bank of China governor, Yi Gang, has confirmed that the e-CNY is designed to provide controlled anonymity.

Financial inclusion remains an important issue as more than three million British residents continue to heavily rely on cash for their daily transactions. However, access to ATMs has become increasingly limited with some merchants refusing to accept cash payments altogether. This situation may be disconcerting for older Britons, as over 2.7 million seniors aged 65 and above don’t use the internet, according to Age UK research. Although the Bank of England has assured that a Central Bank Digital Currency (CBDC) wouldn’t render cash obsolete, the shift towards digital payments could potentially expedite the transition to a cashless society.

The Treasury Committee’s report added a note of caution, stating that the consequences for financial stability are uncertain when it comes to Britcoin. There is a possibility that this digital currency could exacerbate the risk of bank failures by facilitating the swift transfer of funds away from distressed financial institutions. To mitigate this concern, some have proposed imposing restrictions on the amount of central bank digital currency (CBDC) balances that can be held.

In summary, there appears to be limited excitement surrounding Britcoin, raising questions about its unique advantages over existing contactless payment methods. The Treasury Committee’s investigation even expressed doubts about the necessity of this Central Bank Digital Currency (CBDC) in the first place.

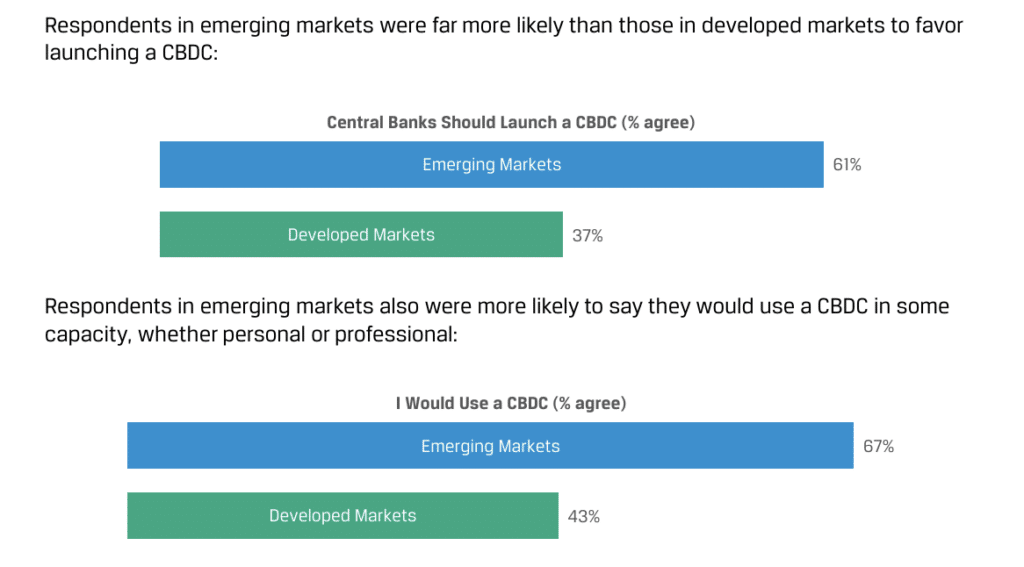

Worldwide, a recent poll conducted by the CFA Institute revealed that a large proportion of participants expressed opposition to their central bank introducing a digital currency, and indicated they would not utilize such an offering if it were made available.

It may be several years before we see the realization of Britcoin, or perhaps it will never come to pass. Obtaining widespread acceptance would necessitate a substantial publicity effort, significant financial investment in novel technology, and addressing the apprehensions of skeptics extensively.

If the U.S. and EU don’t firmly commit to launching digital currencies, there is a possibility that privately issued stablecoins will step in and become the leading players in the market instead.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-04-25 14:30