As a researcher with experience in the crypto market, I find the recent warnings from CryptoQuant about potential challenges for Bitcoin miners during the summer months to be of great interest. Based on the interview with Julio Moreno, head of research at CryptoQuant, it seems that while some miners are still profitable, others, particularly those using older ASIC models and facing higher electricity costs, may be experiencing negative profits.

As the heat of summer approaches, I, as an analyst, would like to draw your attention to a potential challenge for Bitcoin miners, according to CryptoQuant’s latest warnings. If Bitcoin prices do not bounce back considerably during this season, miners could face significant difficulties.

Although Bitcoin’s price dropped below $58,000, causing some investors to sell, Bitcoin miners have not yet shown significant signs of giving up. According to CryptoQuant’s head of research Julio Moreno in an interview with crypto.news, the network’s hashrate remains slightly above pre-halving levels. Miners can still turn a profit using energy-efficient equipment.

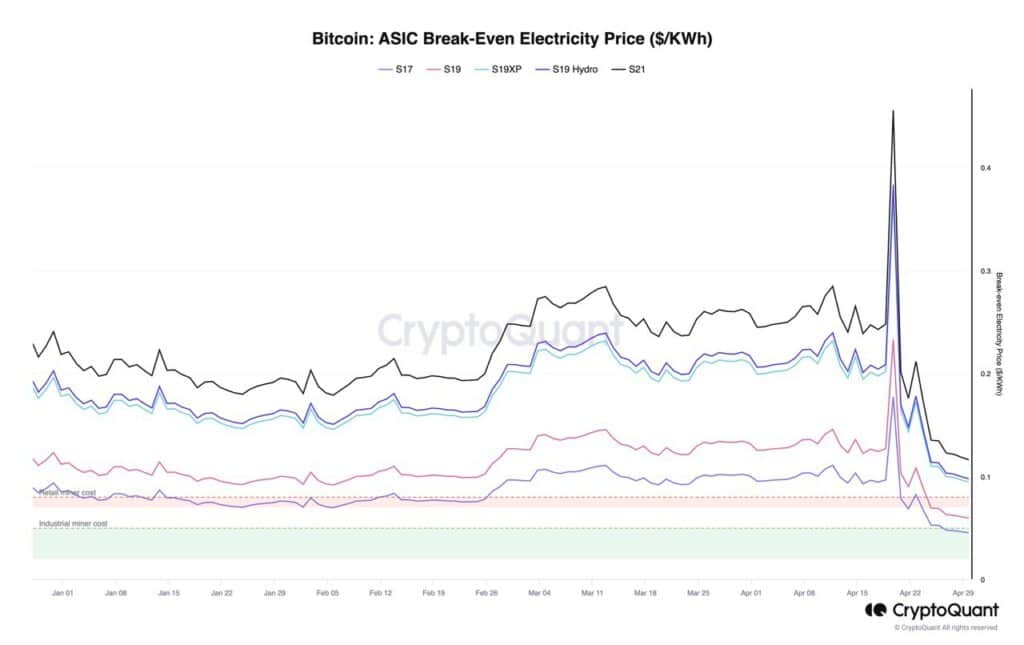

Moreno points out that the ASIC models S19 and S21 from Bitmain continue to generate profitability based on their break-even electricity prices, which exceed the electricity expenses of major industrial-scale miners (represented by the green area).

He pointed out that certain retail miners, especially those relying on older ASIC models such as S17 and S19, have been encountering losses because of increased electricity expenses. The occurrence of a capitulation event hinges on the future developments of Bitcoin’s network hashrate and market prices over the next few weeks.

During the summer trading lull, concerns have been raised about Bitcoin’s price instability. In response, Moreno pointed out that miners usually react to market fluctuations instead of causing them. However, he didn’t completely dismiss the likelihood of increased selling pressure for Bitcoin over the next few months.

If the market does not experience notable price improvements during the summer, there’s a higher chance of miners giving up and selling their cryptocurrency holdings, given that the average miner revenue per hash (hashprice) is reaching new lows.

Julio Moreno

Based on a previous report by crypto.news, Bitcoin miners continue to hold onto their cryptocurrency despite a significant drop in revenue. This decline, according to CryptoQuant CEO Ki Young Ju, can be attributed to the recent halving that reduced fixed block rewards from 6.25 BTC to 3.125 BTC. Miners now face two choices: either give up (capitulate) or remain patient and hope for an increase in Bitcoin’s price, which currently hovers below $58,000.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-02 12:10