As a seasoned crypto investor with a keen interest in the NFT market, I’ve been closely monitoring the latest trends and sales data. Over the past week, I’ve noticed a concerning downturn in the NFT market, with overall sales dropping by over 9% to $145 million. This decline has continued a trend of falling sales over recent weeks, with four out of the top five blockchains experiencing decreases.

As a crypto investor, I’ve observed that the NFT market experienced a significant decrease in sales over the past seven days. Specifically, we saw a total of approximately $145 million worth of transactions, which represents a decline of more than 9% compared to the previous week.

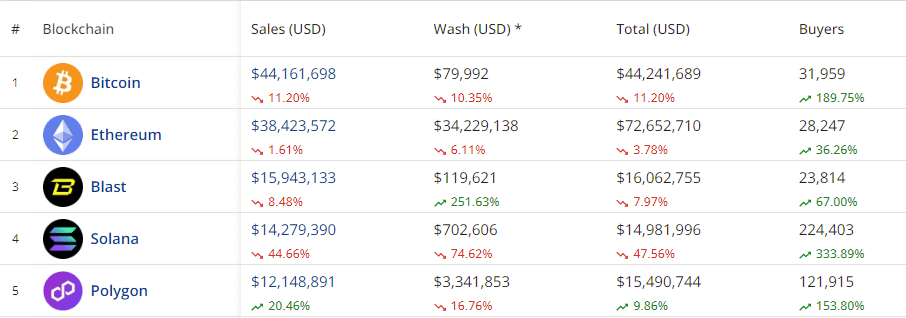

Over the past few weeks, there’s been a persistent decline in sales for four out of the top five blockchains based on sales volume.

Last week, according to crypto.news, there was a significant decrease of over 11% in digital collectibles sales, amounting to approximately $130.59 million. In contrast, this week saw a further decline of nearly 10%, resulting in sales of around $120.48 million, as indicated by CryptoSlam’s data.

Bitcoin leading the pack

In recent weeks, Bitcoin (BTC) has been the frontrunner in weekly NFT sales, outpacing major competitors Ethereum (ETH) and Solana (SOL) consistently.

As an analyst, I’ve observed some noteworthy trends in the blockchain world over the past week. Specifically, the Bitcoin network has reportedly recorded the highest NFT sales volume among all other blockchains, amassing approximately $44.1 million in transactions, based on data from CryptoSlam.

However, despite the impressive figures, it still marked an 11% drop from the previous week.

Ethereum reported sales of approximately $38.4 million, representing a 1.59% decrease from the previous amount. Notably, around $34.2 million of these transactions are identified as wash trades – activities where the same or colluding parties execute buy and sell orders to give an illusion of increased demand for specific NFTs.

As a data analyst, I’ve calculated the total NFT sales volume for Ethereum network by adding the actual and wash trading figures for the week. The resulting amount surpasses $72 million, making it the highest among all other networks during this period.

As an analyst, I’d rephrase that as follows: I discovered that Blast, a relatively new entrant in the top five NFT sellers, brought in a total of $15.943 million worth of transactions, representing a 8.48% decrease compared to their previous sales.

Fourth place went to Solana, reporting sales of $14.26 million within the last seven days. This represented a significant decrease of 44.73% compared to the previous week. Only Arbitrum (ARB), Tezos (XTZ), and Fantom (FTM) recorded steeper percentage declines in sales volume, with Arbitrum experiencing a 51.71% drop, Tezos suffering a 62.09% decrease, and Fantom recording a 69.21% reduction.

At number 5, Polygon (MATIC) defied the downward trend by recording sales amounting to $12.14 million – marking a substantial 20.37% growth in comparison to the preceding week.

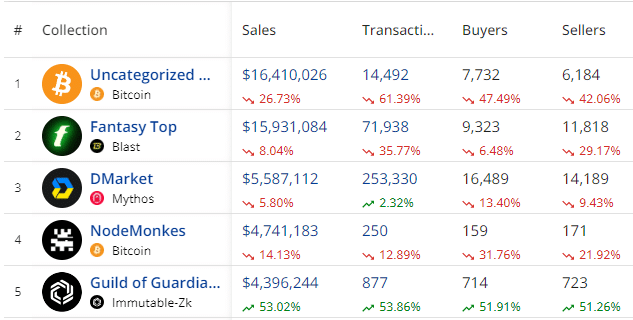

Uncategorized Ordinals records highest weekly sales volume

In the realm of NFT collections, Uncategorized Ordinals remained at the forefront with a sales volume of $16.4 million, although this represented a 26.73% decrease from the previous week. Meanwhile, Blast’s Fantasy Top came in second place with $15.93 million in sales.

As a researcher examining the data, I found that Mythos’ Dmarket recorded sales worth $5.58 million, placing it in third position. Bitcoin’s Nodemonkes came in fourth with approximately $4.74 million in transactions. Surprisingly, Immutable-Zk’s Guild of Guardians experienced a significant increase in sales, reaching nearly $4.4 million to take the fifth spot and overtake Core’s BRC20s.

CryptoPunk NFT fetches $792,000

Last week, the most costly NFT sale occurred with Cryptopunk number 741 being purchased for a substantial sum of $792,046. Surprisingly enough, an Ordinal inscription followed closely behind with a price tag of $681,497.

Notable sales included Earthnode #184 from Cardano, fetching a price of $56,026; a PepperMints NFT from Solana changing hands for $40,384; and a Blast Chain NFT selling for slightly under $40,000.

In total, there was a notable surge in both NFT buyers and sellers last week. Specifically, CryptoSlam reports that the number of NFT buyers jumped by over 166% compared to the previous week, while the number of NFT sellers grew by approximately 139%. However, despite this increase in buying and selling activity, there were fewer transactions overall, with a total of 1,583,262 NFT transactions representing a 27.58% decrease from the previous week’s figure.

Currently, Italian fashion brand Dolce & Gabbana and the digital asset platform UNXD are involved in a class-action lawsuit due to reportedly delayed deliveries of promised NFT (Non-Fungible Token) products, as per Bloomberg’s reports.

The company’s digital assets plummeted 97% in value.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-19 17:24