As an experienced financial analyst, I believe that the recent FOMC minutes and subsequent market reactions highlight the ongoing tension between inflation concerns and the desire for economic growth. The U.S. stock market’s downward trend in response to the FOMC’s decision to maintain interest rates is a reflection of investors’ uncertainty regarding the future of monetary policy.

As an analyst, I would describe the situation as follows: After the release of the FOMC (Federal Open Market Committee) minutes, cryptocurrency prices remained relatively stable. However, in contrast, U.S. stocks experienced a downturn based on the minimal possibility of hawkish decisions from the Federal Reserve due to ongoing inflation concerns.

Although the Consumer Price Index showed improvement in April, Federal Reserve officials are reluctant to lower interest rates based on this data alone, as they are not yet convinced that sufficient headway has been made in taming inflation.

Based on the most recent FOMC meeting records, this year’s inflation rates have persistently surpassed the Federal Reserve’s desired 2% mark due to current price trends.

At the policy meeting, while certain stakeholders suggested the possibility of increasing rates, Fed officials, including Chair Jerome Powell, signaled against implementing stringent economic policies. Previously, Federal Reserve Governor Christopher Waller had stated that the central bank would need to observe successive months of positive inflation figures before adopting a more accommodative stance and reducing interest rates.

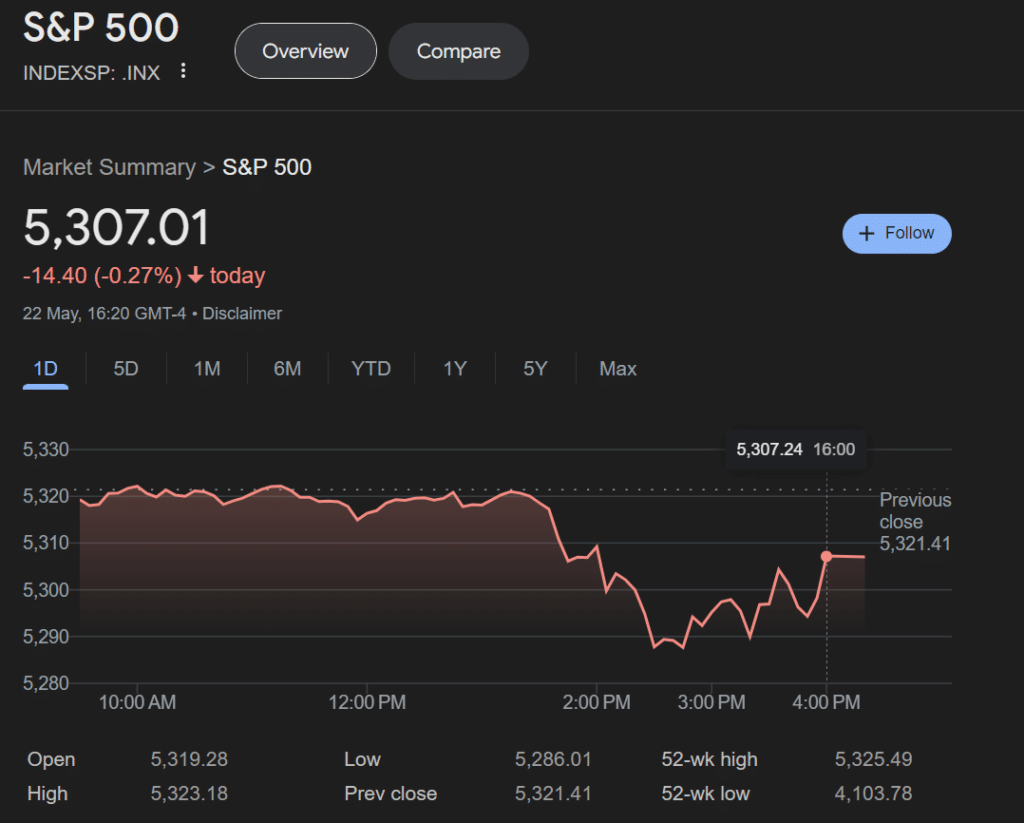

As a crypto investor, I’ve noticed that the Federal Open Market Committee (FOMC) chose to keep the short-term lending rate steady at 5.25%-5.5%. This decision led to a slight dip in U.S. stocks. According to Google Finance, the S&P 500 experienced a decrease of approximately 0.27%.

Nigel Green, CEO of deVere Group, holds a contrasting view regarding the Federal Reserve’s influence on investor sentiment in the upcoming months. In a note obtained by crypto.news, he expressed his belief that the ongoing bull market, which has propelled Wall Street’s major indexes to record highs recently, will persist. Green attributed this trend to a robust earnings season, recuperation in China and Europe, and anticipated interest rate reductions if the U.S. economy manages a soft landing.

Flat crypto market not indicative of Bitcoin hedge status

Bitcoin (BTC) has frequently been championed by the cryptocurrency community as a viable hedge against inflation due to its analytical support, earning it the moniker of “digital gold.”

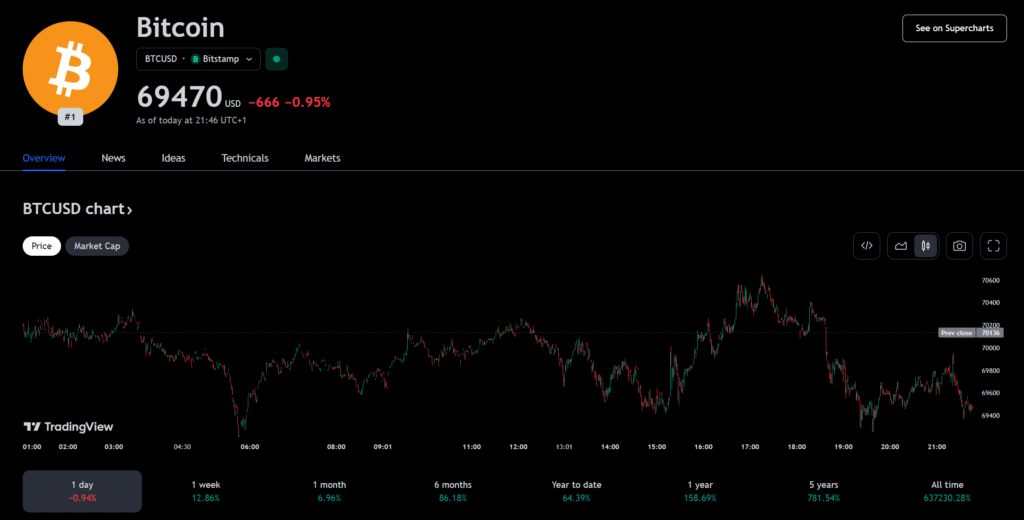

So far this year, crypto’s leading token has experienced a notable surge, approximating a 65% rise. This asset has gained significant traction following the launch of spot Bitcoin Exchange-Traded Funds (ETFs). Additionally, analysts postulate that the Bitcoin halving has resulted in a substantial decrease in supply, thereby potentially fueling further price increases.

As an analyst, I’ve observed some intriguing differences between the S&P 500 and Bitcoin over the past few years. In the current bull cycle for U.S. equities, the S&P 500 has seen a growth of 11.9%. But if we extend the timeframe back five years, the gap between their performances becomes even more pronounced. The S&P 500 has only managed to grow by 87.7% since 2019. In contrast, Bitcoin has experienced an astonishing increase of 781.3% during the same period.

As a researcher studying the development of Bitcoin, I can tell you that during its first fifteen years, this cryptocurrency primarily existed outside the realm of the U.S. financial market. However, its reputation as an effective inflation hedge has grown significantly over the years. This recognition has led esteemed financial institutions like MicroStrategy and BlackRock to explore the potential of Bitcoin in their investment portfolios.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-23 00:44