As a seasoned crypto investor with a keen interest in the latest developments in the industry, I’m excited about Ripple’s plans to enter the stablecoin market. With the growing demand for access to U.S. dollars and an efficient global payment system, it makes perfect sense for Ripple to capitalize on this trend.

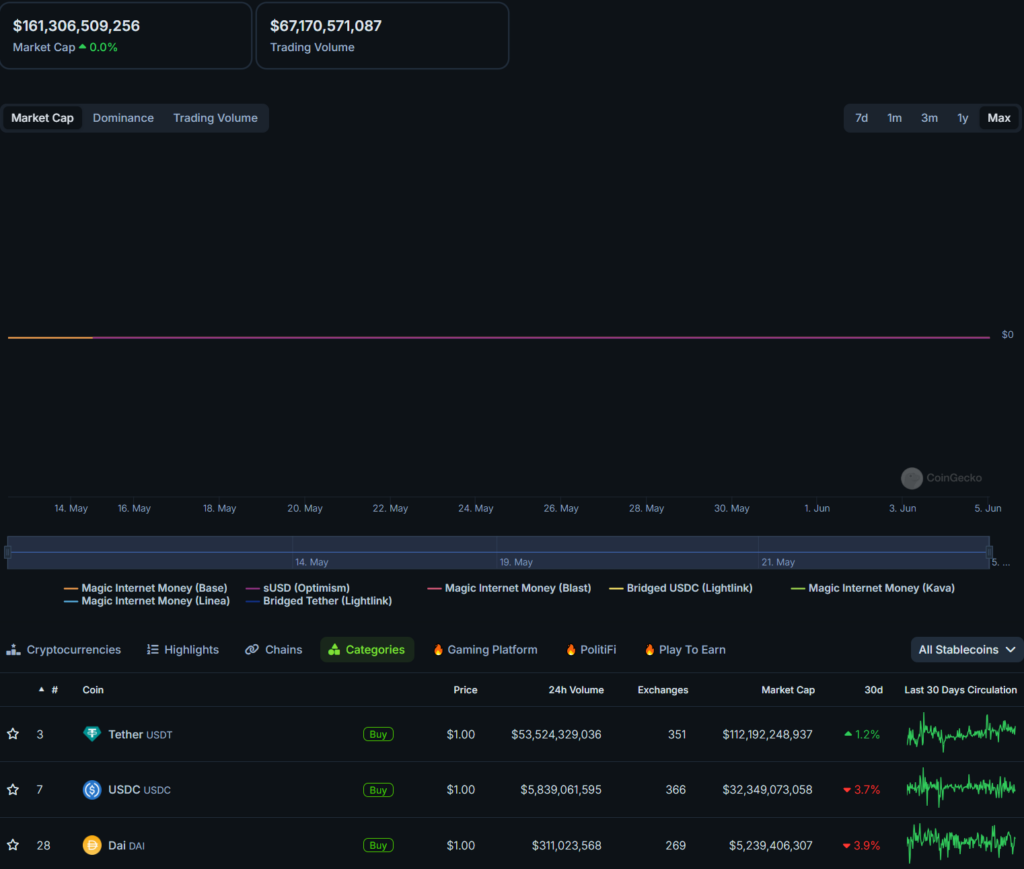

Monica Long, president of Ripple, expressed her belief that the entity behind XRP is strong candidates to join the $161 billion stablecoin sector prior to the year’s end.

As a crypto investor, I’m thrilled to witness the explosive growth of the stablecoin market. Experts believe that this sector will expand significantly in the coming years, potentially reaching a multi-trillion dollar ecosystem for U.S. dollar-pegged tokens. Ripple’s CEO, Brad Garlinghouse, shared this perspective during an interview with CNBC at Money 20/20 in Amsterdam.

As a researcher examining the dynamic trends in the stablecoin market, I have observed that the primary force fueling its growth stems from the high demand for seamless access to U.S. dollars and an advanced global payment infrastructure. This infrastructure is underpinned by the revolutionary technology of blockchain, enabling swift and efficient fiat-denominated transactions on a decentralized platform.

As a researcher delving into the latest developments in the digital currency sphere, I’m excited to report that Ripple, the issuer behind XRP, is making significant strides towards introducing a stablecoin to the market. This undertaking involves addressing regulatory requirements and forging institutional partnerships to ensure a successful launch. The target debut date for this innovative offering? 2024. Meanwhile, Ripple’s CEO, Brad Garlinghouse, echoed similar sentiments at Consensus last week without disclosing an exact timeline.

Long expressed the significance and continued value of XRP in the stablecoin market, despite recent involvement. She underlined that keeping XRP as a connecting currency for various currency pairs is a strategic move with long-term potential. The decentralized ledger will persistently offer liquidity and drive real-world asset tokenization, an area seeing increasing attention from financial players.

Crypto ETFs capturing investor interest, says Ripple exec

After the achievement of Bitcoin (BTC) ETFs in the United States, proposals have been made for ethereum (ETH)-backed ETFs, aiming to replicate their success.

There are ongoing debates about the potential success of Ethereum-based ETFs compared to Bitcoin’s. Some people believe that Ethereum being the second most popular cryptocurrency may make it more challenging for investors, whether retail or institutional, to fully grasp its complexities.

With enhanced cryptocurrency knowledge becoming more widespread and influential figures like BlackRock championing the cause, Long is convinced that concerns regarding the failure of Ether spot ETFs are unwarranted.

Long has expressed the view that the approval of an Ethereum Exchange-Traded Fund (ETF) tracking spot markets could serve as a major catalyst for crypto adoption. The reason being is that Ethereum, with its capability to tokenize securities and facilitate decentralized finance, is well-positioned to absorb substantial capital inflows in the securities and finance sectors.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-06-05 18:54