As a researcher with extensive experience in the crypto industry, I’m closely monitoring the recent downturn in Ethena (ENA) price and the wider crypto market. The fear and uncertainty that has gripped the industry is palpable, with ENA joining other major cryptocurrencies in a sharp sell-off.

The cost of Ethnea has plummeted significantly this week, sparking apprehension within the cryptocurrency market.

As an analyst, I’ve observed that ENA has experienced eight straight days of losses, which represents a new unfortunate milestone for the company. The stock reached its nadir on Tuesday at $0.07400, dipping to a level not seen since May 20th. Over the past year, more than half of ENA’s value at its highest point has been erased.

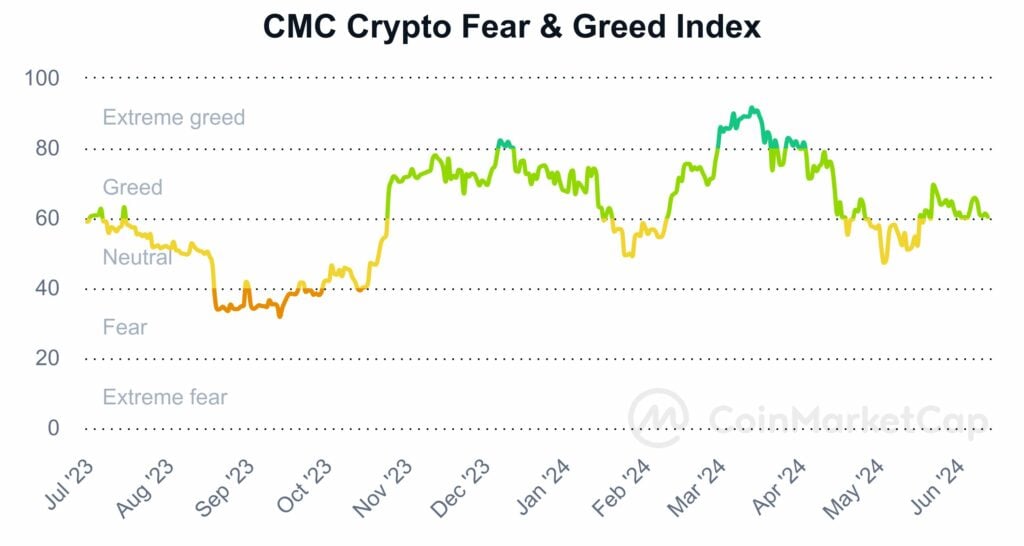

Crypto fear and greed index slips

As a researcher observing the cryptocurrency market, I’ve noticed that Ethereum, among other digital currencies, has experienced a significant decline in value recently. Bitcoin, the leading crypto, has dropped from its peak of around $72,000 this month to currently hovering at $67,000. Ethereum’s price has dipped down to $3,500. Additionally, the market capitalization of all digital coins combined has retreated to approximately $2.4 trillion.

The crypto fear and greed index has seen a decrease at this retreat, dropping from its peak of 64 this week down to the “greed” level of 60.

In recent weeks, Bitcoin ETFs have amassed significant assets without triggering any direct selling. Consequently, market participants are bracing for a more aggressive monetary policy from the Federal Reserve during its upcoming meeting on Wednesday.

The cost of Ethena has decreased, but its ecosystem continues to thrive. As reported by DeFi Llama, the total worth secured in the system has reached a new peak of more than $3.38 billion due to heightened demand for Ethena’s USDe stablecoin.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development with USDe. This stablecoin has managed to establish itself as the fourth-largest player in the industry, surpassing the likes of other well-known players except for Tether, USD Coin, and Dai. The number of USDe holders has grown substantially, exceeding 212,000, driven primarily by its attractive yield of 27.5%. This yield is notably higher than what Terra Luna used to offer during its peak period.

There are some issues worth noting regarding USDe. To begin with, a bill introduced by Cynthia Lummis in the United States aims to prohibit algorithmic stablecoins from operating within the country. Additionally, there is a potential risk that USDe could lose its peg during significant crypto market volatility.

As an analyst, I’d explain it this way: Differing from traditional stablecoins like Tether and USDC, USDe does not rely on fiat currency as collateral. Instead, its creators have characterized USDe as a “delta-neutral synthetic dollar” that is backed by assets outside the banking sector. The coin maintains its stability through hedging the delta of the underlying assets during the minting process.

Ethena price forecast

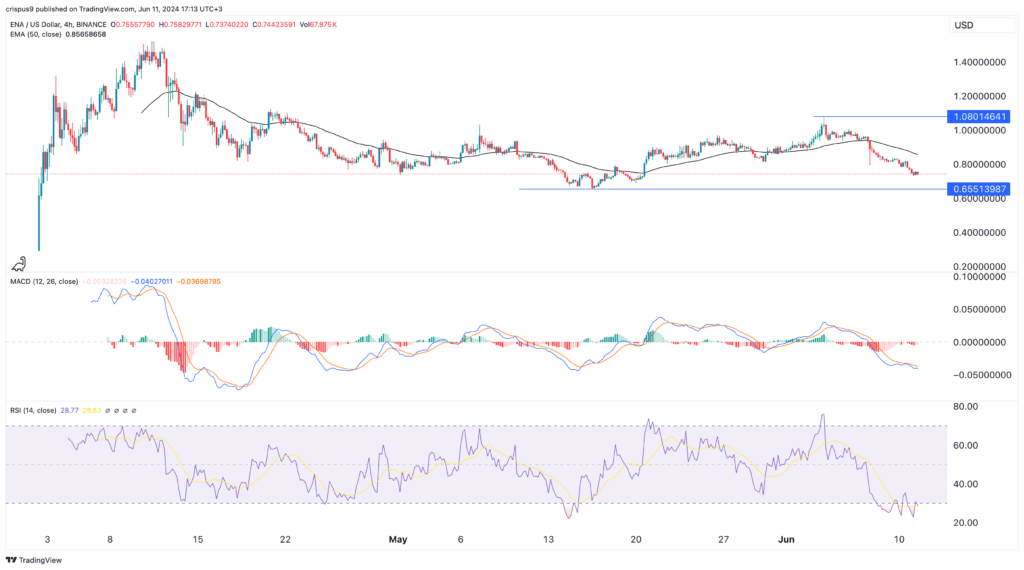

Ethena’s hourly chart

As a crypto investor, I’ve been closely monitoring the Ethana token’s price action on the 4H chart. Unfortunately, the token has taken a bearish turn after reaching a peak of $1.0800 last week. This trend is now evident as the price has dipped below the 50-period moving average. Furthermore, the MACD indicator, which I use to identify trends and potential buy and sell signals, has fallen beneath the neutral level. These technical indicators suggest that it may be prudent for me to consider taking profits or reducing my exposure to Ethana at this time.

The Relative Strength Index (RSI) has shifted from a reading of 75, which indicated an overbought condition, to the present level of 30. Consequently, the most likely direction for the token’s price movement is downward. A key milestone to monitor in this bearish trend is the $0.6550 mark, which represents the token’s lowest swing on March 16th.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-11 17:42