As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of price rallies and subsequent corrections in the market. While Livepeer (LPT) has undeniably made impressive strides in the past 24 hours, reaching new heights and entering the top 100 cryptocurrencies by market cap, I remain cautious about jumping on the bandwagon just yet.

live peer (LPT) has become the leading generator of gains among the top 100 cryptocurrencies following the latest surge in prices. Yet, there’s a risk of a significant reversal due to profit-taking actions.

LivePeer’s price has increased by 17.7% over the last 24 hours and is now valued at $24.5 per token. Earlier in the day, the asset reached a peak price of $26.16. This price surge propelled LivePeer’s market capitalization above $800 million, placing it among the top 100 cryptocurrencies with a current ranking of 95th position.

Moreover, the daily trading volume of Livepeer increased by 108%, reaching $140 million.

Launched in 2017, Livepeer emerged as the initial decentralized and open-source live video streaming solution. The value of its native token hit rock bottom at $0.42 during March 2020. Yet, the bull market in 2021 propelled LPT to a new peak price of $100.24 on November 9, 2021.

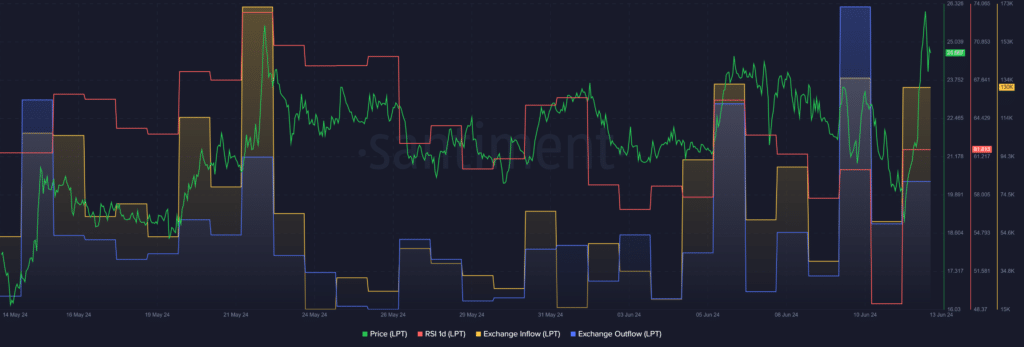

Based on Santiment’s data, there was a significant surge in the number of LPT tokens entering the exchange market during the last 24 hours, with a 115% increase from 60,638 to 130,250 coins. This influx suggests that certain investors, including large players or “whales,” are seeking to capitalize on short-term gains.

As a crypto investor, I’ve noticed an intriguing development with Livepeer tokens. According to the market intelligence data I follow, there has been a significant increase in outflows from the Livepeer exchange within the last 24 hours. This surge amounted to a 42% jump, with the token count moving from 74,984 coins to 106,630 tokens. It appears that some investors are making strategic moves towards long-term investment strategies by taking their Livepeer holdings off the exchange and holding onto them.

According to Santiment’s analysis, Livepeer’s Relative Strength Index (RSI), which is part of the Living Price Time series, increased from 48 to 61 within a day. This implies that Livepeer is currently exhibiting slightly overbought conditions based on this technical indicator.

Due to heightened trading activity, greater exchange flows, and Relative Strength Index (RSI) involvement, LPT‘s price could experience significant fluctuations.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-06-13 12:10