As a researcher with experience in cryptocurrency markets, I’m keeping a close eye on Convex Finance (CVX) after its impressive rally over the past day. With a current price of $4.28 and a market cap of $415 million, CVX is now the 155th-largest digital currency.

Over the past day, the value of Convex Finance (CVX) has experienced a significant surge. However, current market sentiment indicates that some traders are anticipating a decline in its price.

In the previous 24 hours, CVX has experienced a significant increase of 100% and is currently priced at $4.28. Notably, this value matches the price point from late March when the wider cryptocurrency market underwent a brief bullish trend.

Additionally, CVX‘s market capitalization soared to a staggering $415 million, positioning it as the 155th largest digital currency. Impressively, its daily trading volume experienced an astounding 2,800% increase, breaking through the $150 million threshold.

The data indicates that the Convex Finance decentralized finance platform has experienced a 1% increase in the total value locked within it, reaching a current figure of approximately $1.31 billion.

As a convex finance analyst, I can explain that instead of directly providing liquidity on Curve Finance and earning trading fees with tokens, convex finance enables users to stake their tokens on its platform and receive cvxCRV tokens as rewards.

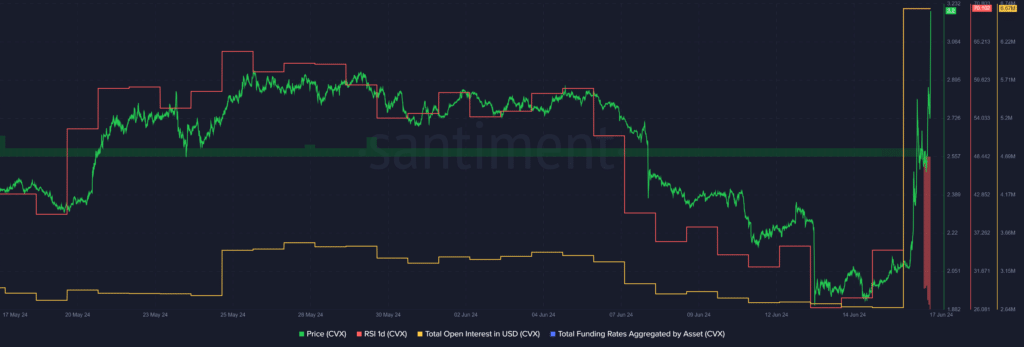

Based on the data I’ve analyzed from Santiment, there has been a significant surge of 151% in open interest for CVX within the last 24 hours. This indicates that traders are actively seeking to capitalize on the asset’s sudden price fluctuations, ultimately resulting in heightened volatility.

According to the data obtained from our market intelligence tool, the cumulative funding rate for CVX has shifted dramatically in the last 24 hours, plummeting from a meager 0.01% to a substantial negative 0.17%. The graph indicates that investors are presently wagering on a decline in CVX’s price.

As a researcher studying market trends, I’ve noticed an intriguing development regarding CVX‘s relative strength index (RSI) based on Santiment’s data. Within the past 24 hours, the RSI has significantly increased from 34 to 70. This upward shift indicates that CVX is currently overbought. Furthermore, such a rapid surge raises suspicion of potential whale manipulation in the market.

CVX is currently a highly volatile asset due to the sudden increases in its open interest and RSI.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-06-17 09:44