This text discusses the comparative performance of Solana and Ethereum based on various metrics such as net inflows, DEX volumes, stablecoin transfer volumes, revenue, and decentralization. According to the data presented, Solana has shown significant growth and outperformed Ethereum in several areas.

As a Solana analyst, I’ve noticed that the platform has been subject to significant skepticism in the crypto community. Critics often paint a picture of Solana as a centralized network prone to frequent outages. However, my analysis of the data and progress within the Solana ecosystem tells a different story. In this article, I aim to dispel these misconceptions by delving deeply into Solana’s key metrics.

Despite the common belief that paints Solana in a negative light, this blockchain platform demonstrates impressive growth and innovation in various aspects. The escalating transaction volumes of stablecoins on its network and the larger decentralized exchange (DEX) volumes compared to Ethereum are evidence of Solana’s expanding usefulness. Moreover, its superior data processing capabilities and resilience, as shown by its technical throughput, add to its allure. Lastly, the surge in new addresses and daily active users indicates increasing confidence and adoption within the broader crypto community.

As a crypto investor, I believe that delving into the following metrics offers a well-rounded and fact-based argument for why Solana is an underestimated gem in the crypto market come June 2024:

Table of Contents

Centralization

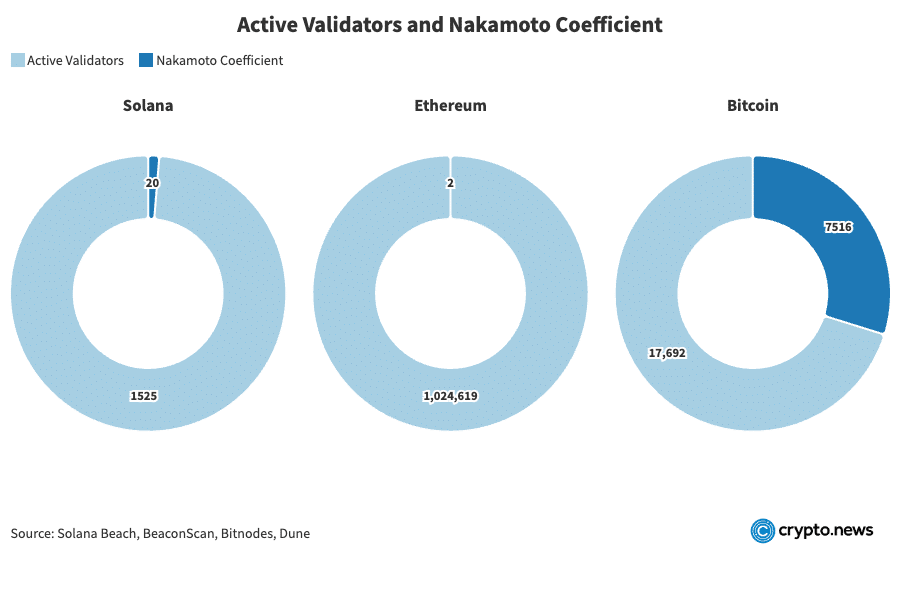

The intricacy of decentralization in a blockchain network is multifaceted and goes beyond being assessed through a solitary metric. A comprehensive examination of which network genuinely embodies decentralization by considering every intricate detail would warrant an entire article. Consequently, we will concentrate on the Nakamoto coefficient as a benchmark for evaluation. The Nakamoto coefficient signifies the least number of entities in a network that must conspire to disrupt the system. In the case of proof-of-stake networks such as Solana and Ethereum, holding around 33% of the stake carries significant influence, while for proof-of-work networks like Bitcoin, controlling more than half (51%) is crucial.

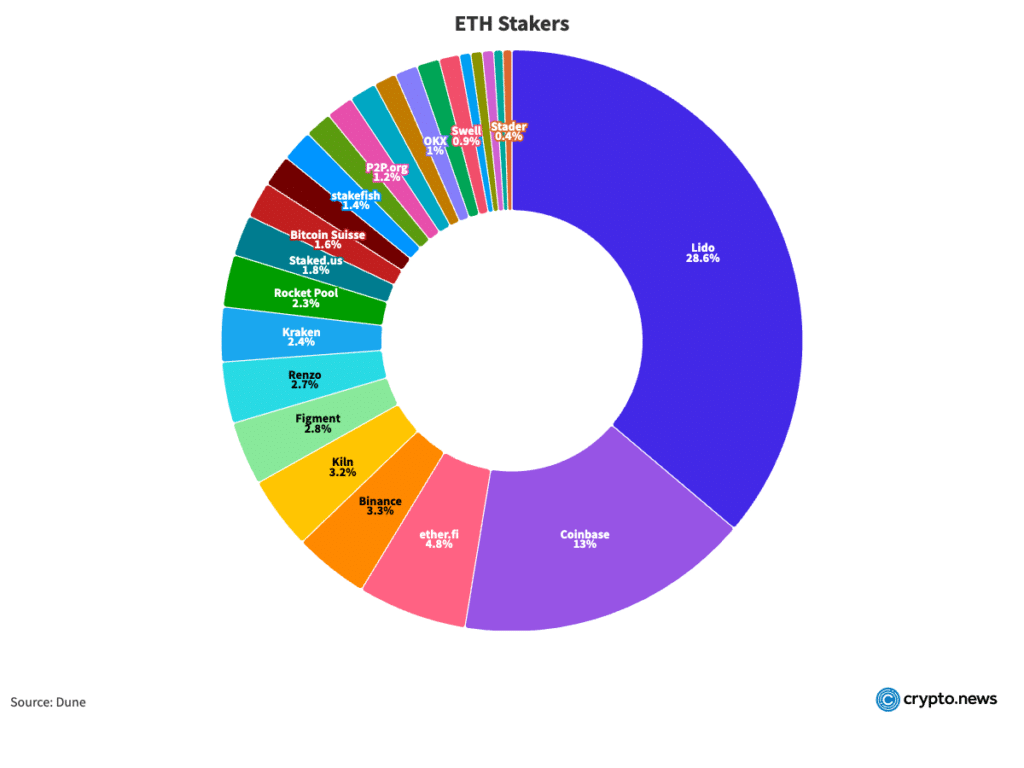

Starting from June 20, 2024, I have identified 1,525 active validators in the Solana network. Among these, twenty validators hold more than one-third (33%) of the stake. In contrast, Ethereum boasts an impressive number of 1,024,619 active validators. However, it’s important to note that two entities are responsible for more than 33% of Etherean staked Ether. It is essential to consider that a single entity may control multiple validator nodes, which could potentially misrepresent the actual level of decentralization in the Ethereum network.

Based on Dune analysis, Lido and Coinbase collectively own over a third of Ethereum’s staking market share. With each node requiring 32 ETH for validation, this translates to approximately 432,389 potential validators under their control. This significant control by two entities poses a threat to Ethereum’s decentralized ethos.

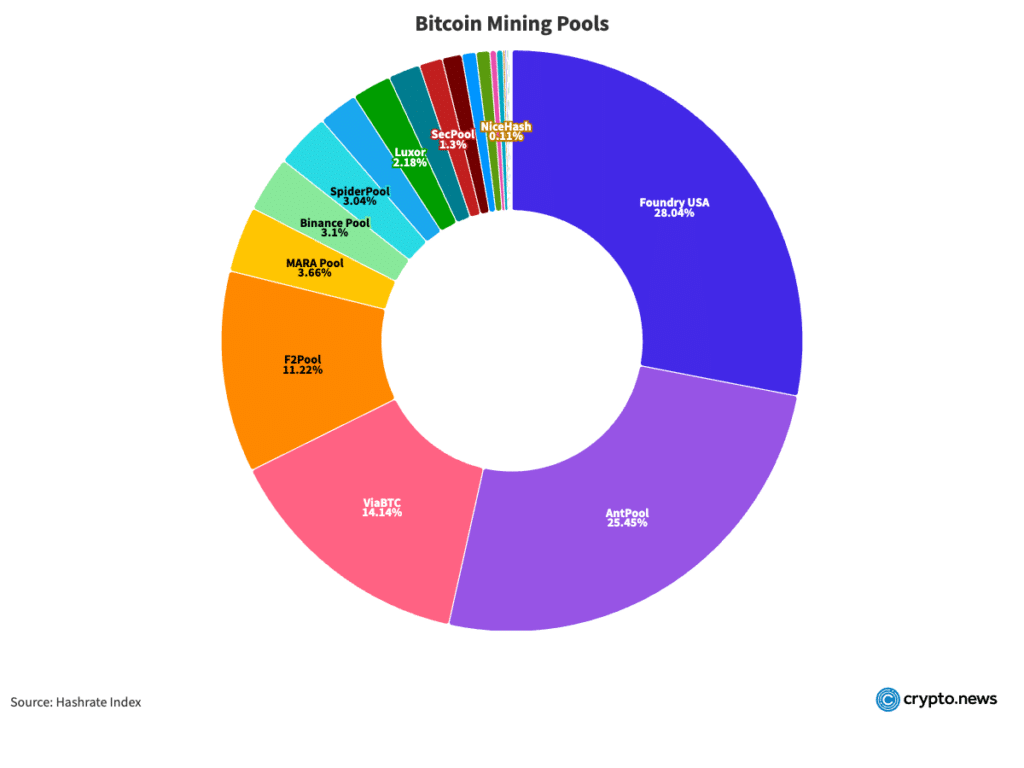

Approximately 17,692 unpruned full nodes on the Bitcoin network are currently in operation, out of which around 7,516 have the potential to significantly impact the network’s functionality. Regrettably, no data is available concerning the individual hashrates of these nodes. The figure of 7,516 was derived by applying the Peer Index (PIX) methodology. The PIX score, which ranges from 0.0 to 10.0 and updates every 24 hours based on a node’s characteristics and network statistics, was utilized in this analysis, with nodes having a PIX value of 5 or higher being taken into account.

As a bitcoin analyst, I would argue that evaluating its decentralization based on hashrate distribution is crucial. At present, two dominant mining pools, Foundry USA and Antpool, collectively account for over half (51%) of the entire network’s hashrate.

These pools do not function as controllers within the network despite being groups of individual miners. Instead, mining pools serve as platforms where miners combine their processing power to heighten their probabilities of cracking blocks and receiving rewards. If a pool exhibits malicious behavior, miners possess the freedom to transfer their operations to alternative pools, thereby preserving the network’s decentralized structure.

As a researcher studying the decentralization of various blockchain networks, I recognize that this complex concept cannot be fully captured by a single metric. However, I find the Nakamoto coefficient to be a valuable tool for comparison. Concerning Solana’s position in this regard, its Nakamoto coefficient reveals that 20 validators control over 33% of the stake. This figure is lower than Ethereum’s, where just two entities wield more than 33% of the stake. While Solana may not be as decentralized as Bitcoin, it still maintains a considerable degree of decentralization that significantly contributes to its security and reliability.

Stability

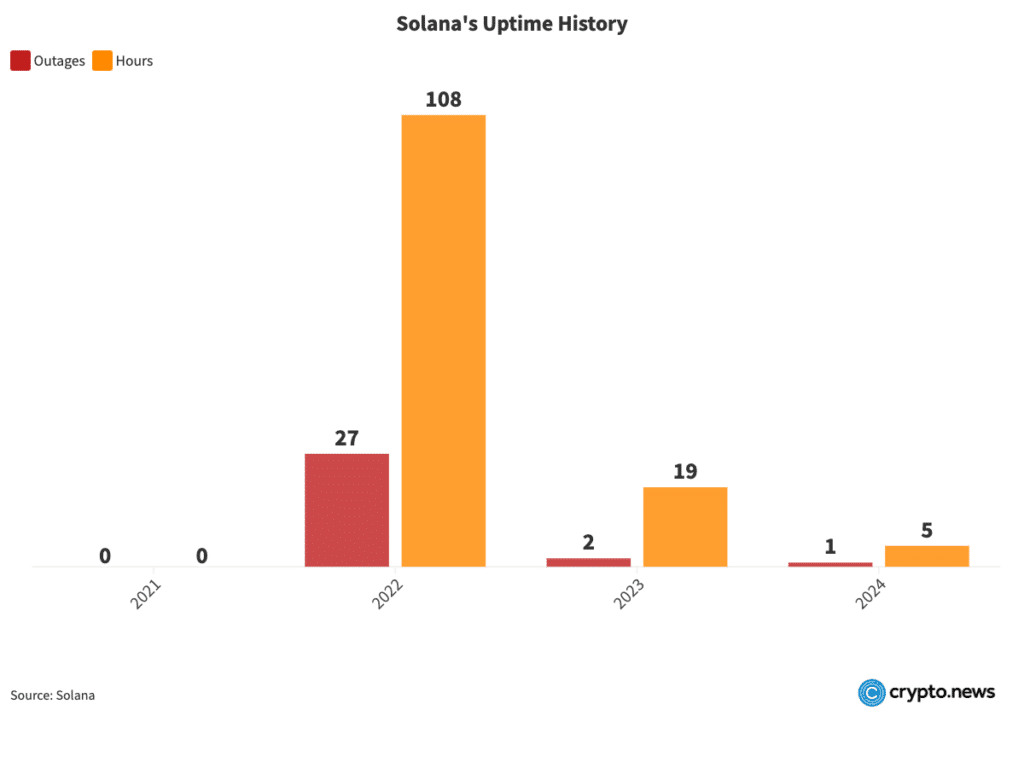

Although some have raised concerns about Solana’s network stability due to past outages, a more in-depth analysis of its uptime record paints a different picture. While there have been occasional disruptions, Solana’s network remains stable the majority of the time.

In the year 2021, Solana’s network operated without any interruptions or downtime. Conversely, in the year 2022, there were a total of 27 outages which amounted to 108 hours of disrupted service. Fortunately, the situation improved significantly in the year 2023, with merely two outages and a combined duration of just 19 hours. As we move into the year 2024, up until June 19, the network experienced only one brief interruption lasting five hours. These statistics offer an insight into the network’s performance but do not tell the entire story.

In terms of uptime, these disruptions make up a minuscule percentage of the entire operating time. For example, during the year 2022, even with 27 instances of outages, the network remained operational for approximately 99.47% of the year. Likewise, the 19 hours of downtime in 2023 and 5 hours in 2024 up to mid-June translate to insignificant interruptions against the backdrop of generally reliable performance.

One potential way of rephrasing this: Solana’s design, with a focus on quick processing and affordability, makes it highly appealing for substantial usage. Yet, the swell of activity can result in network congestion and instability. For illustration, Solana generates a block every 0.4 seconds, significantly faster than most other blockchains. Consequently, when block creation temporarily ceases for an hour or two, the interruption seems more pronounced. Nevertheless, even Bitcoin experiences such downtime; for instance, it took over two hours to mine block 689301 after block 689300.

As an analyst, I would describe Solana’s approach as follows: By continuously pushing the limits of its capabilities, Solana encounters and tackles real-world challenges that theoretical models and simulations may not anticipate. This method mirrors SpaceX’s iterative process of learning from setbacks to drive swift innovation. While some skeptics consider Solana’s past outages as a disadvantage, this rigorous testing and issue resolution phase significantly bolsters its competitive edge.

Solana by the Numbers

Daily active wallets

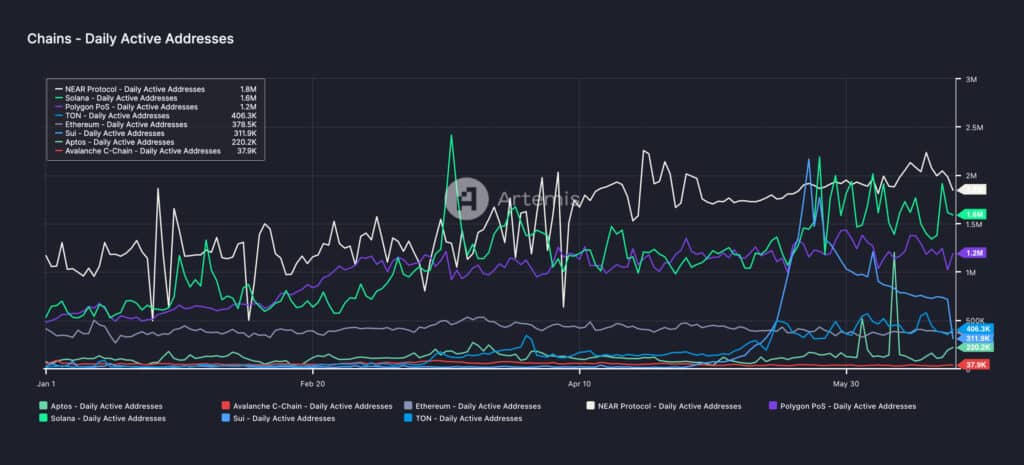

Approximately 1.6 million Solana wallets are in use every day, marking a substantial difference compared to Ethereum’s 367,000 daily active users.

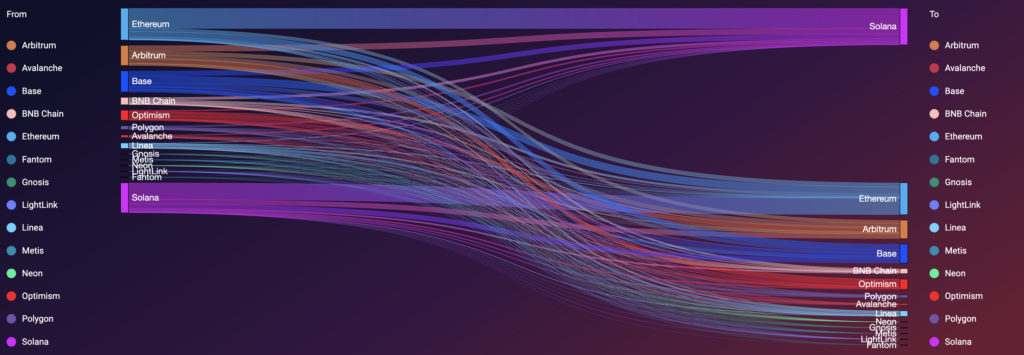

Inflows and outflows

From April 2023 to June 2024, there were $801.73 million in investments (inflows) into Solana, while $654.21 million were taken out (outflows). On the other hand, Ethereum experienced $694.17 million in investments and identical outflows of $694.1 million during this period. Consequently, Solana had a net investment of roughly $150 million, while Ethereum saw a negligible net gain of around $70,000.

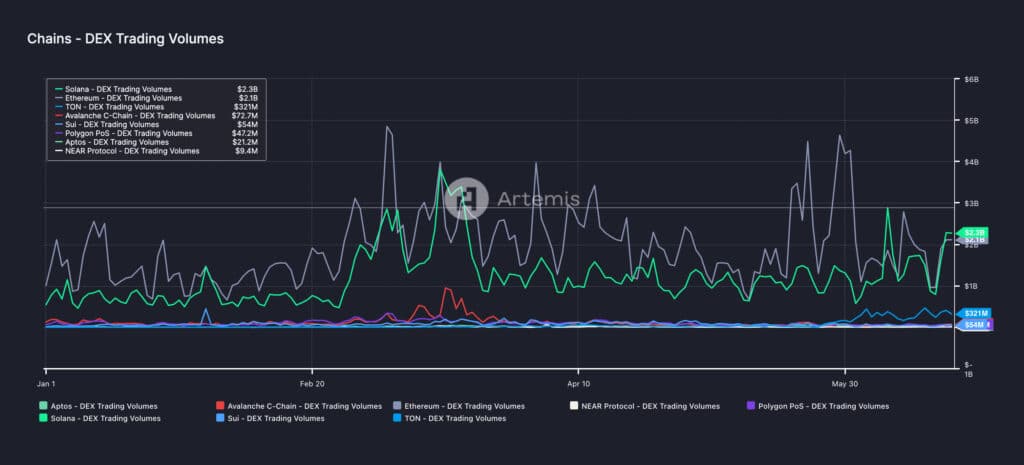

DEX volumes

When it comes to Decentralized Exchange (DEX) trading volume, Solana has been impressively holding its own against Ethereum. On multiple occasions, Solana’s trading volumes have matched or even surpassed those of Ethereum. This is noteworthy given that Solana’s market capitalization stands at approximately $63 billion, significantly less than Ethereum’s $430 billion. Furthermore, Solana’s native token has only been in existence for four years – compared to Ethereum’s nine-year tenure in the crypto market. The fact that Solana can challenge Ethereum in terms of DEX trading volumes, despite being newer and smaller, speaks volumes about its potential growth.

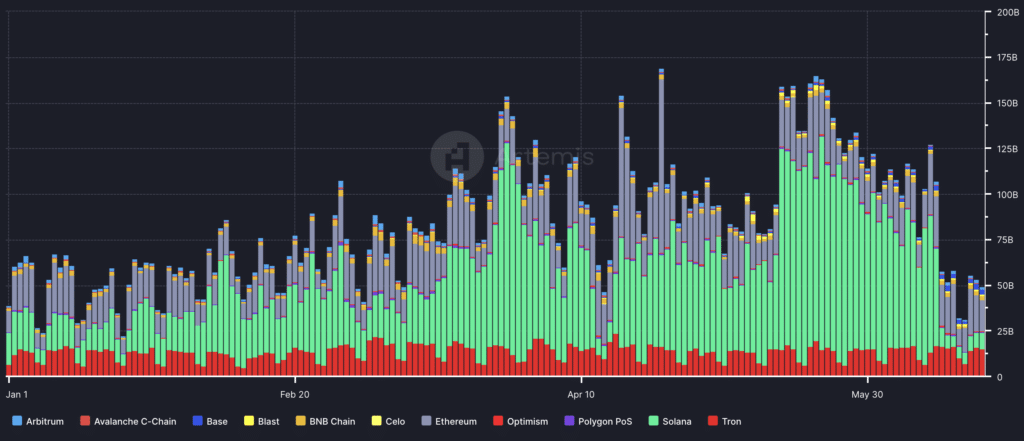

Stablecoin transfer volumes

As a crypto investor, I’ve noticed that Solana stands out for its impressive stablecoin transfer volumes. The reason behind this is its lightning-fast transaction speeds and ultra-low fees. These features make it an irresistible choice for users looking to move large amounts of stablecoins around efficiently. Moreover, the network’s capability to process a high number of transactions without any hiccups adds fuel to the fire. Lastly, Solana’s dedication to scalability and user-friendly experience is another significant factor that cements its position as the go-to platform for stablecoin transfers.

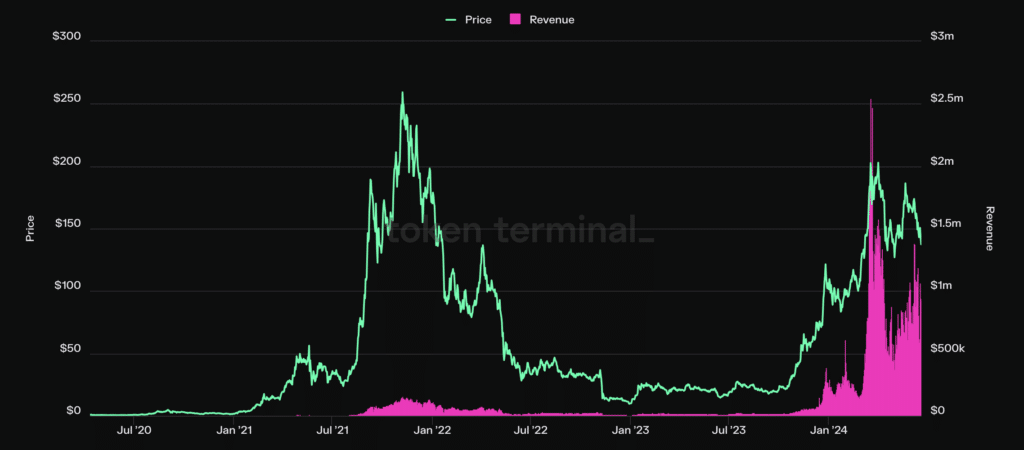

Revenue

In the middle of 2024, Solana’s earnings reached half of Ethereum’s earnings, marking a significant milestone in its history. Previously, during the busiest periods in 2021 and 2022, Solana generated less than 1% of Ethereum’s earnings. At the start of 2024, this percentage was around 10%. The substantial rise in Solana’s earning ratio versus Ethereum signifies a surge in its utilization and economic activity on the network.

Conclusion

As an analyst, I’ve examined the criticism that Solana functions as a centralized and unreliable network. However, upon closer inspection of the data, this narrative does not hold up. Solana boasts impressive technical capabilities and is experiencing increasing adoption, indicating significant progress and resilience.

The criticism surrounding network stability of Solana has lessened, as it now boasts impressive uptime and ongoing advancements. Solana’s commitment to delivering top performance and scalability can sometimes lead to instability, but this instability also fosters rapid innovation and resilience, much like the iterative development process prevalent in other advanced technology sectors.

As a researcher studying the cryptocurrency landscape, I’ve observed some intriguing metrics that suggest Solana’s growing significance in this ecosystem. Daily active wallets, inflows and outflows, decentralized exchange volumes, and revenue are all on the rise for this network. Although it boasts a smaller market cap and is relatively young compared to other players, its capacity to process high transaction volumes at affordable costs positions Solana as a serious contender against Ethereum.

As a analyst, I can assert that my assessment of Solana’s progress and expansion reveals a robust and evolving platform that not only defies industry norms but also redefines benchmarks. By surpassing previous criticisms and proving its worth, Solana has solidified its position as a valuable investment in the market.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-20 20:35